Unemployment benefits are financial payments offered by the government to people who have lost their jobs through no fault of their own. These benefits are designed to help people cover basic living expenses while they search for new employment. While the requirements to obtain these benefits vary from state to state, generally, one must meet specific work and wage requirements and be actively looking for work. This poses a challenge for international students, who may find it difficult to balance the demands of their studies with the requirements for obtaining unemployment benefits.

Can international students apply for unemployment?

| Characteristics | Values |

|---|---|

| Eligibility | It depends on the state. Generally, eligibility requires being available for work and actively looking for work. |

| Full-time students | May find it more challenging to qualify due to the requirement for full-time work. |

| Part-time students | May find it easier to demonstrate their availability for work. |

| Work-study income | May be considered part of earnings. |

| Additional benefits | May be available through state-specific programs, such as California Training Benefits or the 599 Program in New York. |

| Federal loans | Students with federal loans may be eligible for in-school deferment of loan payments. |

| SNAP benefits | Available if working 25 hours/week or through a work-study program as part of financial aid. |

What You'll Learn

International students' eligibility for unemployment benefits

Firstly, unemployment benefits are financial payments provided by the government to individuals who have lost their jobs through no fault of their own. These benefits help cover basic living expenses while recipients search for new employment. To qualify for these benefits, individuals typically need to meet specific eligibility requirements, such as having a certain amount of work history and being actively available for work.

For students, the eligibility for unemployment benefits becomes more complex and varies depending on the state. Full-time students may find it challenging to qualify as they are often considered unavailable for full-time work, a common requirement for unemployment benefits. On the other hand, part-time students or those enrolled in night classes may have an easier time demonstrating their availability for work. Additionally, some states may require students to provide their school schedules to verify their availability.

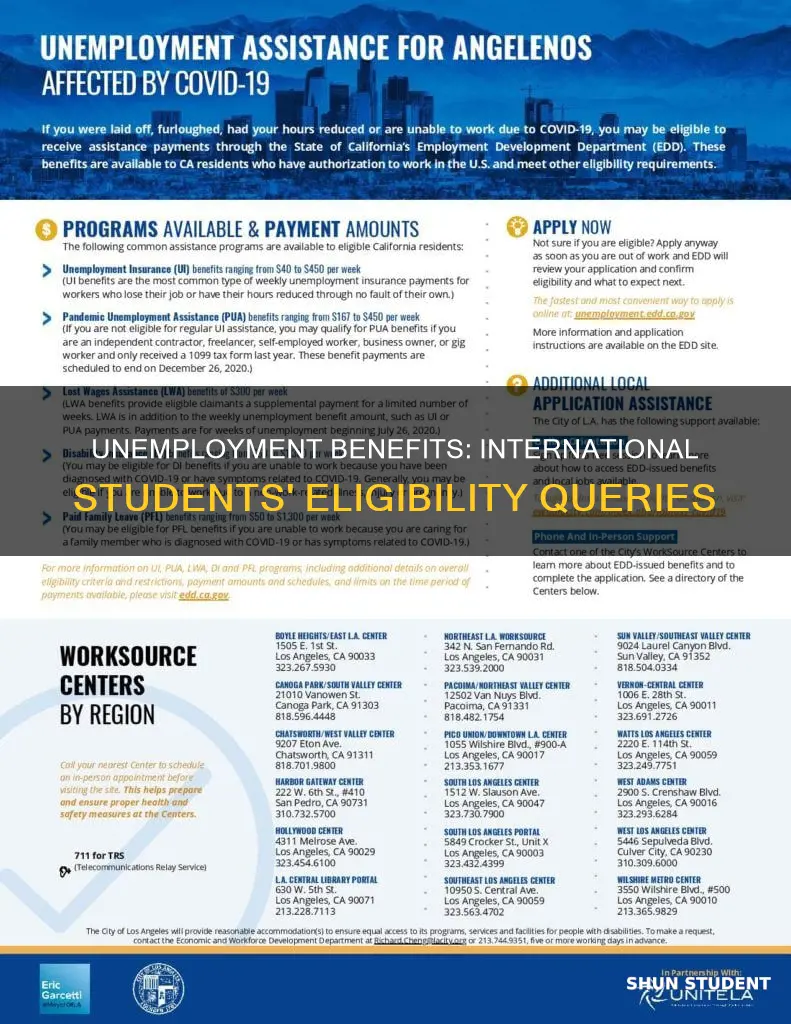

In certain states, specific programs or waivers exist to accommodate students. For example, in California, currently enrolled students can be eligible for unemployment benefits as long as they are physically able to work, available, actively seeking employment, and willing to accept a job. Similarly, in Virginia, students can receive benefits if their school schedule allows them to take a daytime job, such as by attending night or weekend classes.

It is important to note that unemployment benefits are typically funded through taxes paid by employers, and not all students who have lost their jobs will qualify. Students may need to explore other options to manage their finances while unemployed, such as enrolling in vocational training programs that provide an income or reviewing their spending and budget to cut down on expenses.

To determine their eligibility, international students should refer to the specific requirements and programs offered by their state. They should also ensure they have the necessary documentation, such as proof of employment, earnings, and availability, when applying for unemployment benefits.

Pursuing Graduate Studies Abroad: New Zealand's Opportunities

You may want to see also

Work and wage requirements

International students in the United States on F-1 visas may be eligible for off-campus employment under the Special Student Relief program in the event of unforeseen economic hardship. This includes circumstances such as natural disasters, wars, military conflicts, and financial crises. To qualify, students must have been enrolled for at least one academic year, maintained good academic standing, and experienced a loss of financial aid or on-campus employment through no fault of their own.

Additionally, international students on F-1 visas can apply for post-completion optional practical training upon graduation. This allows them to gain work experience related to their field of study. The off-campus employment authorization is valid for one year or until the completion of the program, whichever comes first. To engage in optional practical training, students must obtain a Form I-20, "Certificate of Eligibility for Nonimmigrant Student Status," from their Designated School Official (DSO).

In terms of unemployment benefits, foreign workers in the United States may be eligible if they meet certain work and wage requirements. These requirements vary by state, but generally, individuals must have worked a minimum number of hours or earned a certain amount of wages during a specified "base period." Each state administers its unemployment insurance program, but all follow federal guidelines. To receive benefits, individuals must file a claim with the unemployment insurance program in the state where they worked.

It is important to note that not all foreign workers are eligible for unemployment benefits. In some states, such as Illinois, benefits are restricted to US citizens or lawful permanent residents. However, certain visa holders, such as those with an H-4 EAD, may qualify for unemployment benefits as they are authorized to work for any US employer. In the case of temporary or nonimmigrant workers, it is essential to maintain valid work authorization during employment and throughout the period of receiving benefits.

H1B Visas: A Pathway for International Students in the US

You may want to see also

State-specific eligibility criteria

Eligibility criteria for unemployment benefits vary from state to state in the USA. Each state administers a separate unemployment insurance program within the guidelines established by federal law. While there is no federal unemployment program, the Federal-State Unemployment Insurance Program provides unemployment benefits to eligible workers.

In most cases, you should file for unemployment in the state where you worked, not where you live. If you worked in multiple states, the state unemployment insurance agency where you live can provide information about how to file a claim with other states.

To qualify for unemployment benefits, many states require that you earned at least a certain amount within the last 12-24 months. In most states, you must have separated from your last job due to a lack of available work. You must also meet the work and wage requirements of your state, such as wages earned or time worked during a "base period." This period is usually the first four out of the last five completed calendar quarters before filing your claim.

If you are an F-1 visa holder, you are generally not eligible for state unemployment benefits because you are required to be engaged in employment directly related to your field of study. However, there are some reports of F-1 visa holders being eligible for unemployment benefits if they meet the other requirements. For example, one source mentions that they were deemed financially eligible for unemployment benefits in Pennsylvania.

Work Opportunities for International Students at Mathnasium

You may want to see also

Unemployment benefits for part-time students

In the US, unemployment insurance is a benefit paid for by federal and state governments, and full-time students are typically disqualified from receiving it. However, part-time students may be eligible for unemployment benefits if they meet certain conditions. For example, in California, students restricting their availability to part-time work due to school attendance may be eligible for unemployment benefits if they are actively seeking and willing to accept work and are in a labour market with a reasonable demand for their part-time services.

Each state in the US manages its own unemployment insurance program and sets its own eligibility rules, so state-specific requirements for students to claim unemployment benefits can vary. In general, college students typically struggle to qualify for unemployment insurance because they don't meet one or more of the three common eligibility criteria: they haven't earned enough money, they haven't worked long enough, or they are not available for full-time work due to their student status. However, during the coronavirus pandemic, Congress created the Pandemic Unemployment Assistance (PUA) program, which provided aid to students who lost their jobs due to Covid-19, including those who lost summer internships, part-time jobs, and work-study opportunities.

To apply for unemployment benefits, individuals typically need to file a claim through their state's unemployment insurance program and create a user account to receive payments. It is important to provide accurate and thorough information, and individuals may need to document their job search activities, such as submitting job applications and attending interviews. Failing to meet these requirements could result in a denial or reduction of benefits. If you are earning income, whether through part-time work or an allowance, it can affect your unemployment benefits. The amount you earn may reduce the benefit amount you receive, or in some cases, make you ineligible altogether.

To improve your chances of meeting unemployment requirements, consider applying for part-time or flexible jobs that align with your school schedule. During the process, clearly explain how you can work around your classes. It may be beneficial to look for on-campus job opportunities, as working on campus offers more flexible rules provided by USCIS. As an F-1 student, you can work for a maximum of 20 hours per week while school is in session, as long as your F-1 status stays valid. During breaks and holidays from school, you are allowed to work full-time on campus if you intend to continue your studies in the upcoming semester.

International Students: Leaving US on Pending Trial?

You may want to see also

Other financial options for international students

International students in the US have limited funding opportunities, and most cover their tuition fees and costs themselves. However, there are still some options for financial aid. Firstly, scholarships are available, although minimal, and most are reserved for graduate studies. Many colleges and universities offer scholarships or grants to talented international students, and some schools offer sports scholarships, while others provide academic or artistic scholarships. There are also private scholarships, and some are specifically for international students. Need-based scholarships are also awarded based on financial need, and some academic departments may have funds to assist international students with exceptional needs and/or talent.

Another option is to take out a loan. FAFSA (Free Application for Federal Student Aid) is a common form of financial aid for domestic US students, but it is restricted to specific categories of international students, such as those with a green card or those with certain visas. There are also international student loans available to individuals who meet certain criteria, but many require a cosigner.

Some students may be eligible for federal work-study programs, which can provide a source of income to help cover expenses. However, this type of work is usually part-time and on-campus, and the pay is typically not enough to finance a university education. It can serve as a supplement to other funds.

Your home country could also be a source of funding, either from organisations, companies, or your government. For example, Saudi Arabia has a program that provides full scholarships to Saudi students studying in the US. There are also international organisations, such as the Fulbright Commission, that grant aid to students worldwide.

Lastly, some states may have specific benefits or resources for students. For example, in Pennsylvania, students may qualify for SNAP (food stamps) if they work a certain number of hours per week or participate in a work-study program.

International Students: Getting Your ITIN Number Easily

You may want to see also

Frequently asked questions

It depends on the state. In California, international students could be eligible for unemployment benefits as long as they’re physically able to work and available, actively seeking, and willing to accept a job. In Virginia, international students can be eligible for unemployment benefits as long as school doesn't conflict with their ability to take a daytime job.

The requirements to apply for unemployment benefits vary depending on the state. However, some general requirements include having a certain amount of work history, being actively available for work, and being unemployed through no fault of your own.

To apply for unemployment benefits, you will typically need your Social Security number, details of your recent employment (employer’s name, address, and dates of employment), and proof of earnings, such as pay stubs or W-2 forms. Some states may also require your school schedule to verify your availability for work.

If you don't qualify for unemployment benefits as an international student, you may have other options to consider. For example, you could enter a vocational training program that pays while you're in school, allowing you to earn an income while learning new skills. Additionally, reviewing your finances and making adjustments to your budget can help you manage your expenses while you're out of work.