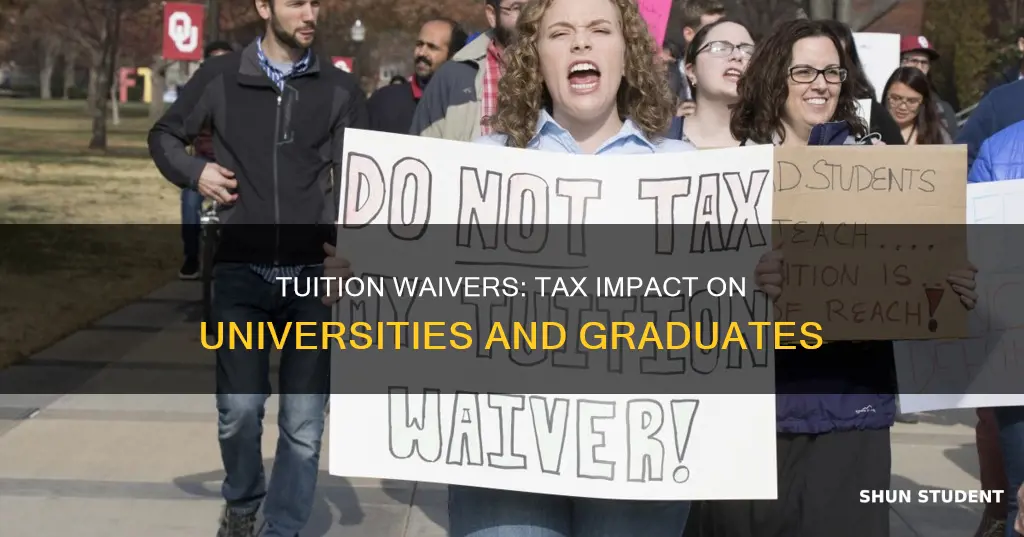

Graduate students at universities across the United States can receive tuition waivers, which reduce their tax liability. These waivers are typically offered in exchange for teaching or research activities and can significantly reduce the financial burden on graduate students. However, the tax treatment of these waivers has been a subject of debate, with a controversial provision in the GOP tax bill proposing to tax them as income. This provision was met with protests from graduate students and even some Republican lawmakers, who argued that it would impose a significant financial burden on students who are already struggling financially. Ultimately, the provision was removed from the final version of the tax bill, and graduate students' tuition waivers remain untaxed. Understanding the tax implications of tuition waivers is crucial for universities and graduate students alike, as it directly impacts their financial planning and overall affordability of higher education.

| Characteristics | Values |

|---|---|

| Graduate tuition waiver threshold | $5,250 per calendar year |

| Graduate tuition waiver tax rate | 25% federal income tax, plus 7.65% for Social Security and Medicare Tax |

| Tax exemption | Teaching or research activities, job-related education, or graduate assistantships |

What You'll Learn

- Graduate tuition waivers are taxable unless exempt under the Internal Revenue Code

- Tuition waivers are considered taxable income if they exceed $5,250 per year

- Tuition waivers for graduate students who teach or conduct research are exempt from taxation

- Tuition waivers for non-job-related graduate classes are taxed at a higher rate than those for job-related classes

- Universities are required by law to withhold taxes on tuition waivers that exceed the tax-exempt amount

Graduate tuition waivers are taxable unless exempt under the Internal Revenue Code

Graduate tuition waivers are generally taxable, but there are some exemptions outlined under the Internal Revenue Code (IRC). Under IRC Section 127, employees enrolled in graduate-level classes who receive tuition benefits or waivers must include the amount exceeding $5,250 in a calendar year as taxable income. This means that if the total tuition waiver for the year is $5,250 or less, it is exempt from taxation.

There are, however, some exceptions to this rule. According to IRC Section 117(d), graduate students engaged in teaching or research activities may be exempt from taxation on tuition waivers. This exemption is applicable to individuals with roles such as Teaching Assistants (TAs) or Research Assistants (RAs). Additionally, employees whose education is considered job-related under IRC Section 132(j) may also be exempt. In this case, they must complete an "Employee Graduate Level Job-Related Education Certification" form to claim the exemption.

Furthermore, the taxation of tuition waivers can vary depending on whether the classes are considered job-related or not. For instance, at the University of Washington, employees taking graduate-level, non-job-related classes are entitled to a tuition waiver of up to $5,250 per year without tax withholding. On the other hand, there is no tax withheld for graduate-level job-related classes.

It is important to note that the tax treatment of tuition waivers may differ based on the specific university and their interpretation of the IRC. Additionally, the information provided here may not cover all possible scenarios, and it is always advisable to consult with a tax professional or the relevant university offices for the most accurate and up-to-date information.

Michigan State University's Student Clearinghouse Partnership Explained

You may want to see also

Tuition waivers are considered taxable income if they exceed $5,250 per year

Tuition waivers are generally taxable unless they are exempt under the Internal Revenue Code (IRC). Under IRC Section 127, employees enrolled in graduate-level classes who receive tuition benefits or waivers must include the amount exceeding $5,250 per calendar year in their taxable income. This means that if the tuition waiver is $5,250 or less, it is not considered taxable income. However, if the waiver amount exceeds this threshold, only the amount above $5,250 is taxed.

There are a few exceptions to this rule. Firstly, graduate students engaged in teaching or research activities may be exempt under IRC Section 117(d). For example, Texas A&M University considers positions such as Graduate Assistant Teaching (GAT), Graduate Assistant Lecturer (GAL), and Graduate Assistant Researcher (GAR) as exempt from taxation. Secondly, employees whose education is considered job-related under IRC Section 132(j) may also be exempt. To claim this exemption, employees must complete and submit a specific form to the Tax Compliance and Reporting department for evaluation.

The University of Washington's tax plan, based on IRC Section 127, also allows for a tuition waiver of up to $5,250 per year without tax withholding. Any amount exceeding this limit is subject to federal income tax and Social Security and Medicare Tax. The University monitors tuition waiver status through information submitted to the Registrar's office by employees each quarter to determine if the limit has been exceeded.

It is important to note that tuition waivers for graduate assistantships or pre-professional graduate assistantships may also be taxed differently. For example, Teaching Assistantship (TA) and Research Assistantship (RA) waivers are generally not taxed, per IRS regulations. However, it is always advisable to consult with a qualified tax advisor or the relevant university offices to understand the specific tax implications of tuition waivers for your particular situation.

International Students at Georgia Southern University: A Growing Community

You may want to see also

Tuition waivers for graduate students who teach or conduct research are exempt from taxation

Graduate teaching and research assistants are exempt from paying taxes on tuition waivers of up to $5,250 per calendar year (January to December) under the Internal Revenue Code (IRC) §127. This exemption applies to graduate students who teach or conduct research and are considered employees of the university.

According to the IRC §117, tuition and fee waivers above $5,250 are exempt from taxation for individuals conducting teaching or research activities. Universities typically consider graduate teaching assistants (TAs) and research assistants (RAs) as students involved in classroom instruction, tutoring, grading, developing instructional materials, and other teaching or research-related tasks.

The University of Washington, for instance, offers a tuition waiver of up to $5,250 per year without tax withholding for employees taking graduate-level, non-job-related classes. Amounts exceeding this limit are subject to federal income tax and Social Security and Medicare Tax. On the other hand, no tax is withheld for graduate-level job-related classes or any undergraduate-level classes.

It is important to note that graduate service assistants who do not meet the teaching or research requirement, meaning they do not hold a position with at least 50% research or teaching hours, are taxed differently. While they do not qualify for the full exemption, the IRS allows them to receive up to $5,250 in tuition remission tax-free each calendar year. Any amount exceeding this limit is considered taxable income.

Overall, tuition waivers for graduate students who teach or conduct research are exempt from taxation up to a certain limit, as specified by the Internal Revenue Code. It is recommended to refer to the specific university's policies and seek advice from a qualified tax advisor to understand the tax implications of tuition waivers fully.

International Students Thriving at Liberty University

You may want to see also

Tuition waivers for non-job-related graduate classes are taxed at a higher rate than those for job-related classes

Tuition waivers for graduate-level classes are taxable unless exempt under the Internal Revenue Code. Under the Internal Revenue Code (IRC) Section 127, employees enrolled in graduate-level classes who receive tuition benefits or waivers must include the amount of tuition waivers that exceed $5,250 in a calendar year in their income.

There are, however, some exceptions to graduate tuition waivers being taxed. One exception is if the total value of all graduate tuition waivers received in a calendar year does not exceed $5,250. This amount is exempt from income. Another exception is for graduate students engaged in teaching or research activities, who are exempt under IRC Section 117(d). Additionally, employees whose education is considered job-related under IRC Section 132(j) as a working condition fringe benefit are also exempt from taxation.

For tuition waivers that exceed the $5,250 threshold, the tax implications can vary depending on whether the classes are job-related or non-job-related. At the University of Washington, for example, employees taking graduate-level, non-job-related classes are entitled to a tuition waiver of up to $5,250 in a year without tax withholding. However, amounts exceeding this limit are subject to a 25% federal income tax, plus 7.65% for Social Security and Medicare Tax. On the other hand, there is no tax withheld for graduate-level job-related classes.

Therefore, while tuition waivers for both job-related and non-job-related graduate classes can be taxed if they exceed the $5,250 threshold, the specific tax rates and implications may differ based on the nature of the classes and the applicable tax laws and regulations. It is important to review the specific rules and regulations pertaining to tuition waivers and taxation to understand the tax treatment in a particular situation.

Jewish Student Population at the University of Georgia

You may want to see also

Universities are required by law to withhold taxes on tuition waivers that exceed the tax-exempt amount

In the United States, tuition waivers for graduate students are taxable unless they are exempt under the Internal Revenue Code (IRC). Under IRC Section 127, employees enrolled in graduate-level classes who receive tuition benefits or waivers must include in their income the amount of tuition waivers that exceed $5,250 in a calendar year. This means that universities are required to withhold taxes on tuition waivers that exceed this tax-exempt amount.

The University of Washington, for example, follows IRC Section 127, entitling employees taking graduate-level, non-job-related classes to a tuition waiver of up to $5,250 in a year without tax withholding. Amounts exceeding this limit are subject to federal income tax and Social Security and Medicare Tax. The University monitors tuition waiver status through information submitted to the Registrar's office each quarter to determine if any employees have exceeded the waiver limit.

There are, however, certain exceptions to graduate tuition waivers being taxed. Texas A&M University, for instance, considers graduate students engaged in teaching or research to be exempt under IRC Section 117(d). Additionally, employees whose education is considered job-related under IRC Section 132(j) may also be exempt.

It is important to note that universities are required by law to withhold taxes on tuition waivers that exceed the tax-exempt amount specified by the IRC. This results in the excess amount being treated as additional taxable income for the university employee.

Seoul National University: Open to International Students?

You may want to see also

Frequently asked questions

Graduate students who receive tuition waivers are not taxed, per IRS regulations. However, there are certain conditions that may apply. For example, at the University of Washington, an employee taking graduate-level, non-job-related classes is entitled to a tuition waiver of up to $5,250 per year without tax withholding. Amounts exceeding this limit are subject to a 25% federal income tax, plus 7.65% for Social Security and Medicare Tax.

No, each university has its own policies and procedures regarding tuition waivers and their tax implications. It's important to review the specific guidelines provided by your university's financial aid or student fiscal services department.

Yes, according to the Internal Revenue Code (IRC) §117, tuition and fee waivers above $5,250 for individuals conducting teaching or research activities are exempt from taxation. This exemption applies to both Teaching Assistants (TAs) and Research Assistants (RAs).