Many students at Devry University and beyond face the challenge of overwhelming student loan debt, which can be a significant barrier to financial freedom and future goals. Easing the burden of student loan debt is a complex process that requires a strategic approach. This guide will explore various methods and strategies to help students and graduates navigate the path to debt relief, offering insights into loan forgiveness programs, repayment plans, and financial management techniques tailored to the unique circumstances of Devry University alumni.

What You'll Learn

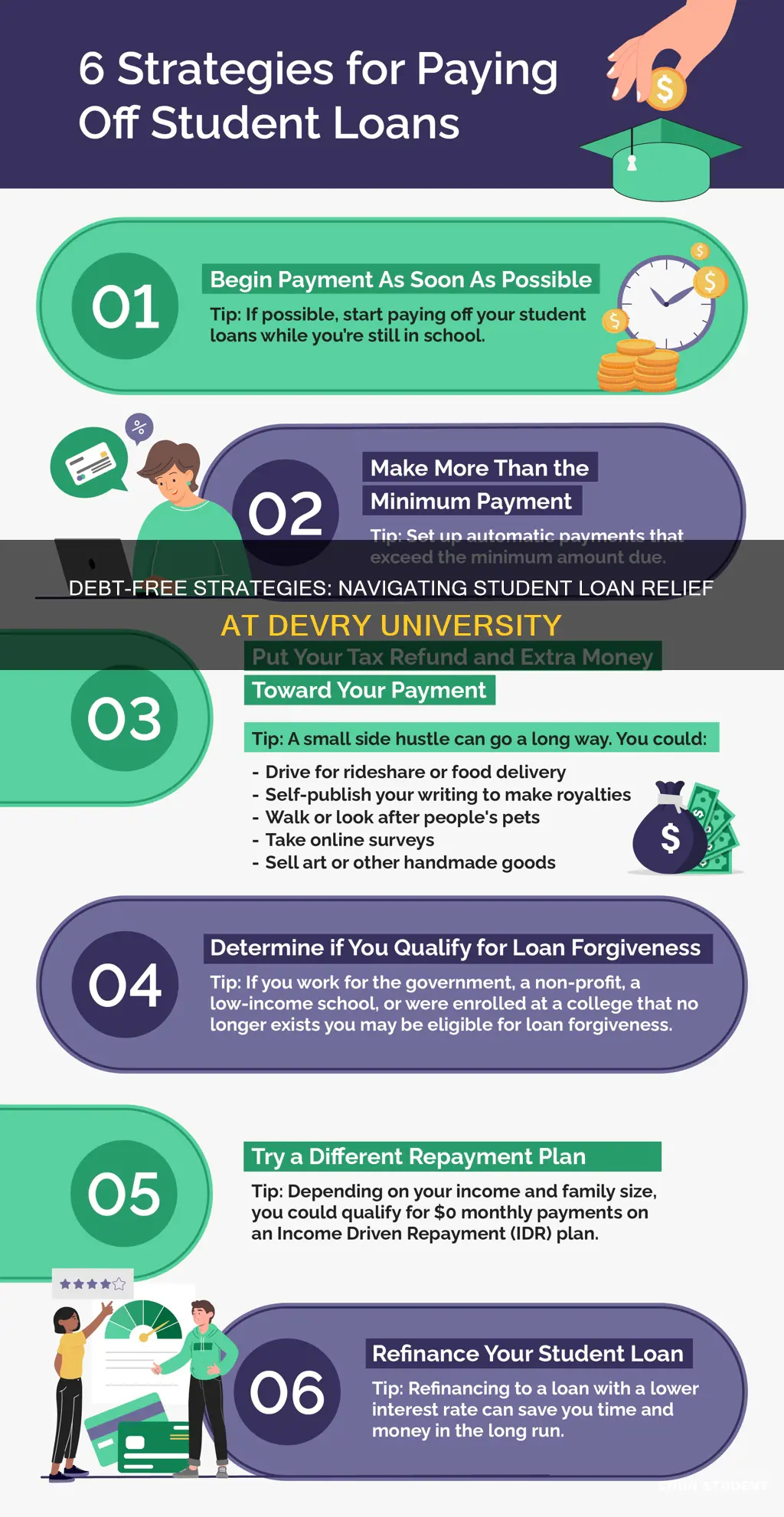

- Loan Consolidation: Combine multiple loans into one, often with lower interest rates

- Income-Driven Repayment Plans: Pay a percentage of income towards debt, adjusting for income and family size

- Loan Forgiveness Programs: Certain programs forgive debt for teachers, public servants, and other eligible borrowers

- Debt Settlement: Negotiate with lenders to reduce the total debt owed

- Loan Refinancing: Replace existing loans with new ones, often at lower interest rates

Loan Consolidation: Combine multiple loans into one, often with lower interest rates

Loan consolidation is a strategic approach to managing and potentially reducing the burden of student loan debt. It involves combining multiple student loans into a single loan, which can offer several benefits, especially for those attending or attending Devry University. Here's a detailed guide on how this process can help:

When you have multiple student loans from various lenders, each with its own interest rate and repayment terms, managing them can become complex and stressful. Loan consolidation provides a solution by simplifying the process. You can consolidate your federal student loans, private loans, or a mix of both into a single loan. This means you'll have one monthly payment instead of multiple ones, making it easier to keep track of your finances. The key advantage is often the potential for lower interest rates, which can significantly reduce the overall cost of your debt.

The process typically involves finding a lender or using a federal loan consolidation program. Private lenders often offer consolidation loans, and their rates can be competitive. They may provide fixed or variable interest rates, and the terms can be tailored to your needs. Alternatively, the U.S. Department of Education offers federal consolidation loans, which can be an attractive option due to their lower interest rates and flexible repayment plans. These plans often include income-driven repayment options, where monthly payments are adjusted based on your income, making it more manageable for graduates with varying financial situations.

One of the most significant advantages of loan consolidation is the potential for a lower interest rate. Lenders often offer lower rates for consolidated loans because they combine multiple debts into one, reducing the risk for the lender. Lower interest rates mean less money spent on interest over the life of the loan, allowing you to pay back less overall. This is especially beneficial for Devry University graduates who may have accumulated debt from various sources during their studies.

Additionally, loan consolidation can provide a structured repayment plan. You can choose between various repayment options, such as standard, graduated, or extended repayment plans. These plans determine your monthly payment amount and duration. Standard plans have consistent payments over a set period, while graduated plans start with lower payments and increase over time. Extended plans offer longer repayment periods, which can result in lower monthly payments but may increase the total interest paid.

In summary, loan consolidation is a powerful tool for managing and potentially erasing the burden of student loan debt. It simplifies the repayment process, offers lower interest rates, and provides flexibility in repayment options. For Devry University graduates or any student loan borrower, exploring consolidation options can be a strategic step towards financial relief and a more secure future. It is advisable to research and compare different lenders and programs to find the best fit for your specific financial situation.

Unveiling the Hottest Spots: Where UCSF Students Hang Out

You may want to see also

Income-Driven Repayment Plans: Pay a percentage of income towards debt, adjusting for income and family size

Income-Driven Repayment (IDR) plans are a crucial strategy for managing student loan debt, especially for those attending or have attended Devry University. These plans are designed to make repayment more manageable by linking your monthly payments to your income and family size. Here's a detailed guide on how to utilize IDR plans effectively:

Understanding the Basics:

Income-Driven Repayment plans are a group of repayment options offered by the federal government to help borrowers manage their student loan debt. The key principle is that your monthly payment is calculated as a percentage of your discretionary income, which is the amount of income left after subtracting a basic living allowance. This ensures that your payments are affordable and tailored to your financial situation.

Eligibility and Benefits:

To be eligible for an IDR plan, you must have a federal student loan and be enrolled in a repayment program. Devry University graduates often qualify for these plans, especially if they are struggling with high monthly payments. The primary advantage is that it can significantly reduce your monthly payments, making debt repayment more sustainable. Additionally, interest may not accrue on your loans while you are in certain IDR plans, which can save you money in the long run.

Types of IDR Plans:

There are several types of IDR plans available:

- Income-Based Repayment (IBR): This plan calculates your payment based on 10% of your discretionary income. Any remaining balance is typically forgiven after 20 or 25 years, depending on your loan type.

- Income-Contingent Repayment (ICR): ICR plans use a similar approach but set payments at a higher percentage of income, ensuring that the loan is repaid within a 12-year period.

- Pay As You Earn (PAYE): PAYE sets payments at 10% of discretionary income, with remaining balances forgiven after 20 years.

- Revised Pay As You Earn (REPAYE): This plan is similar to PAYE but uses a more complex formula, allowing for lower payments and potential forgiveness after 20 years.

Enrolling in an IDR Plan:

The process typically involves contacting your loan servicer and requesting an IDR plan. You will need to provide information about your income, family size, and other financial details. Once enrolled, your payments will be adjusted accordingly, and you can benefit from the reduced monthly payments and potential loan forgiveness.

Adjustments and Flexibility:

One of the strengths of IDR plans is their flexibility. You can adjust your plan periodically to reflect changes in your income or family size. This ensures that your payments remain manageable even if your financial situation improves or changes. It's essential to review and update your information regularly to take full advantage of this feature.

By enrolling in an Income-Driven Repayment plan, Devry University graduates can gain better control over their student loan debt. These plans provide a structured approach to repayment, ensuring that your monthly payments are tailored to your income and circumstances. Remember, it's a powerful tool to help you manage your debt effectively and work towards financial stability.

Mason Student Population: How Many Pack Patriots?

You may want to see also

Loan Forgiveness Programs: Certain programs forgive debt for teachers, public servants, and other eligible borrowers

Loan forgiveness programs are a crucial avenue for individuals burdened by student loan debt, especially those who have dedicated their careers to public service or teaching. These programs offer a pathway to financial relief and a fresh start for borrowers who meet specific criteria. Here's an overview of how these programs work and who is eligible:

Understanding Loan Forgiveness:

Loan forgiveness is a process where a portion or all of your student loan debt is canceled, providing much-needed financial relief. Several factors determine eligibility, including the type of loan, borrower's occupation, and the specific program's requirements. For instance, the Public Service Loan Forgiveness (PSLF) program is designed to assist borrowers who work in eligible public service jobs.

Eligibility for Teachers and Public Servants:

- Teachers in Low-Income Areas: Educators working in low-income areas or under specific teaching contracts may qualify for loan forgiveness programs. These programs aim to encourage and retain teachers in underserved communities.

- Public Service Employees: Individuals employed by government agencies, non-profit organizations, or certain private sector lenders serving low-income communities can explore loan forgiveness options. The PSLF program, mentioned earlier, is a prime example, offering debt relief for those in public service careers.

- Military Service: Active-duty military personnel and veterans may also be eligible for loan forgiveness programs, providing support for their educational expenses.

Application Process:

Borrowers interested in loan forgiveness should start by reviewing the specific program requirements. Each program has its own set of guidelines and eligibility criteria. For instance, the PSLF program requires borrowers to make 120 qualifying monthly payments while working full-time for a qualifying employer. It's essential to understand the commitment and ensure your employment aligns with the program's criteria.

Benefits and Considerations:

Loan forgiveness can significantly reduce financial burden and stress, allowing borrowers to focus on their careers and personal well-being. However, it's important to note that some programs may require borrowers to waive their right to certain benefits or may impact future tax liabilities. Borrowers should carefully consider the implications and seek professional advice if needed.

In summary, loan forgiveness programs provide a unique opportunity for teachers and public servants to manage their student loan debt. By understanding the specific requirements and eligibility criteria, borrowers can take advantage of these initiatives and work towards a more financially stable future.

Uncover Why Middlesex University is a Top Choice for International Students

You may want to see also

Debt Settlement: Negotiate with lenders to reduce the total debt owed

Debt settlement is a strategy that can help individuals burdened by overwhelming student loan debt, especially those who attended institutions like Devry University. It involves negotiating with lenders to reduce the total debt owed, providing a potential pathway to financial relief. Here's a step-by-step guide on how to approach this process:

Understand Your Debt: Begin by gathering comprehensive information about your student loans. Identify the lenders, the total amount owed, interest rates, and any existing repayment plans. This knowledge is crucial as it forms the basis of your negotiation strategy. For Devry University graduates, this might include loans from federal or private lenders, each with its own terms and conditions.

Assess Your Financial Situation: Evaluate your current financial circumstances. Calculate your income, expenses, and available assets. This assessment will help determine how much you can realistically contribute to debt reduction. It's essential to be honest about your financial capabilities to set realistic expectations for the negotiation process.

Contact Your Lenders: Reach out to your student loan lenders and express your intention to explore debt settlement options. Many lenders have specialized departments or programs dedicated to working with borrowers in financial distress. Be prepared to provide detailed financial information and explain your situation. Lenders often prefer to negotiate directly with borrowers, so being proactive can be advantageous.

Negotiate and Propose a Settlement: During the negotiation, propose a settlement amount that you believe is feasible given your financial assessment. This amount should be less than the total debt owed, as lenders typically expect a discount. Be prepared to justify your proposal by highlighting your financial constraints and the potential long-term benefits of reducing the debt burden. Lenders may offer various settlement options, such as a lump-sum payment or a reduced monthly payment for a set period.

Consider Professional Assistance: If negotiating with lenders proves challenging, consider seeking professional help from credit counselors or debt settlement companies. These experts can provide guidance, negotiate on your behalf, and ensure your rights are protected. However, be cautious of potential fees and always review any agreements before finalizing them.

Remember, debt settlement is a complex process, and success depends on your financial situation and the lenders' policies. It may take multiple attempts and persistence to reach a favorable agreement. Staying informed and being proactive in managing your student loan debt can significantly impact your financial well-being.

Unveiling the Limits: What Student Data Can Universities Share

You may want to see also

Loan Refinancing: Replace existing loans with new ones, often at lower interest rates

Loan refinancing is a strategic approach to managing and potentially reducing the burden of student loan debt, especially for those attending or having attended Devry University. This process involves replacing one or more existing loans with a new loan, often at a lower interest rate, which can significantly impact the overall cost of your education. Here's a step-by-step guide to understanding and implementing loan refinancing:

Assess Your Current Loan Situation: Begin by gathering all the necessary information about your student loans. This includes loan amounts, interest rates, repayment terms, and the current lender. Understanding the specifics of each loan will help you make informed decisions during the refinancing process. For instance, you might have multiple federal or private loans with varying interest rates, and refinancing could allow you to consolidate these into a single, more manageable loan.

Research Refinancing Options: Explore different refinancing options available in the market. Many private lenders offer refinancing services, and some are specifically tailored for students. Compare interest rates, fees, and repayment terms from various lenders to find the most favorable offer. Online platforms and financial advisors can be valuable resources for researching and comparing refinancing options. Remember, the goal is to secure a lower interest rate, which will reduce the long-term cost of your loans.

Consider the Benefits of Lower Interest Rates: Lower interest rates are a significant advantage of refinancing. When you refinance, you essentially pay off your existing loans and take out a new one. If the new loan has a lower interest rate, your monthly payments will decrease, and you'll save money over the life of the loan. This can be particularly beneficial if you have multiple loans with varying interest rates, as refinancing can simplify your repayment process and potentially reduce the overall debt burden.

Understand the Impact on Credit Score: Refinancing your loans may have a temporary impact on your credit score. When you apply for a new loan, the lender will perform a hard inquiry on your credit report, which can slightly lower your score. However, if you have a strong credit history and a good credit score, the positive effects of lower interest rates and improved cash flow might outweigh this temporary dip. It's essential to assess your creditworthiness before refinancing to ensure you make an informed decision.

Explore Government Loan Programs: Depending on your country and eligibility, there might be government-backed loan programs that offer refinancing options. These programs often provide benefits such as lower interest rates, flexible repayment plans, and potential loan forgiveness. Researching and applying for such programs can be a strategic move to manage your student loan debt effectively. Devry University might also have resources or partnerships that facilitate loan refinancing for its alumni, so exploring these avenues could be beneficial.

Princeton's First Graduate: Unveiling the President's Identity

You may want to see also

Frequently asked questions

Managing student loan debt can be challenging, but there are several strategies to consider. Firstly, Devry University offers financial aid and scholarship opportunities that can help reduce the overall debt burden. Students can also explore income-driven repayment plans, which adjust monthly payments based on income and family size, making it more manageable. Additionally, loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program, can be an option for those working in eligible public service jobs.

The application process for loan forgiveness programs typically involves several steps. Start by reviewing the specific program requirements, as each program has its own criteria. You will need to complete and submit an application form, providing detailed information about your loans, employment, and income. Devry University's financial aid office can guide you through the process and ensure you have all the necessary documentation. It is essential to act promptly, as there may be time limits for application submission.

Yes, Devry University graduates may be eligible for various debt relief programs. These can include income-driven repayment plans, loan consolidation programs, and even debt forgiveness initiatives tailored for Devry alumni. Researching and reaching out to the university's alumni association or financial aid office can provide valuable information on available resources and support for managing student loan debt.

Negotiating student loan terms is a viable option and can be done through a process called loan negotiation or debt settlement. This involves contacting your loan servicer and discussing potential solutions to reduce the debt. You can explore options like loan consolidation, refinancing, or negotiating lower interest rates. It is crucial to understand the implications and potential risks associated with negotiation, and seeking guidance from a financial advisor or credit counselor can be beneficial.