Funding a university education without relying on student finance can be a challenging but rewarding endeavor. Many students opt for alternative funding methods to cover their tuition fees and living expenses, and there are several strategies to consider. One approach is to explore scholarships, grants, and bursaries, which can significantly reduce the financial burden. Students can also consider work-study programs, part-time jobs, or even starting a small business to generate income. Additionally, many universities offer bursaries and scholarships specifically for international students or those from disadvantaged backgrounds. Another strategy is to look into personal savings, family contributions, or even crowdfunding. By combining these methods, students can find creative ways to fund their education and achieve their academic goals without solely relying on student finance.

What You'll Learn

- Scholarships: Research and apply for grants, awards, and merit-based aid

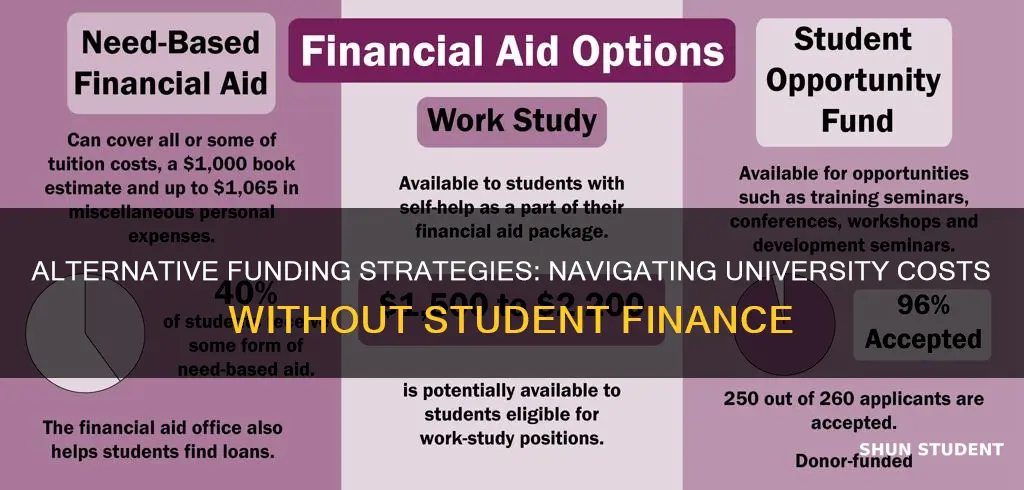

- Work-Study Programs: Utilize on-campus jobs or part-time employment to cover expenses

- Part-Time Work: Balance studies with part-time jobs to earn income

- Crowdfunding: Launch online campaigns to raise funds from a wide audience

- Personal Savings: Use personal savings, investments, or family support

Scholarships: Research and apply for grants, awards, and merit-based aid

Funding your university education without relying on student finance is an achievable goal, and scholarships are a fantastic way to make this happen. The process involves a bit of research and dedication, but the rewards can be life-changing. Here's a step-by-step guide to help you navigate the world of scholarships and secure the financial support you need.

Start by identifying the various types of scholarships available. These can be broadly categorized into three main groups: merit-based, need-based, and achievement-based. Merit-based scholarships are awarded to students based on their academic achievements, talents, or potential. Need-based scholarships, on the other hand, consider financial circumstances and are often provided by the university or external organizations to support students in need. Achievement-based scholarships recognize and reward specific accomplishments, such as sports excellence, community service, or leadership skills. Understanding these categories will help you tailor your search and increase your chances of success.

The next step is to become a scholarship detective. Utilize online resources, university websites, and dedicated scholarship search engines to find relevant opportunities. Many organizations and institutions offer scholarships to support students with diverse backgrounds and interests. You can also reach out to your university's financial aid office or student support services, as they often have lists of available scholarships and can provide guidance on the application process. Don't underestimate the power of networking; alumni networks, community groups, and local businesses may have scholarship programs to support students from their area.

When you've compiled a list of potential scholarships, carefully review the application criteria and requirements. Each scholarship will have its own unique set of guidelines, and it's essential to understand what is expected of you. Pay attention to deadlines, as these can vary widely, and ensure you allow enough time for the application process. Some scholarships may require essays, letters of recommendation, or specific projects, so be prepared to showcase your skills and experiences effectively.

Applying for scholarships requires a strategic approach. Start early to give yourself ample time to gather the necessary documents and prepare a compelling application. Tailor your applications to each scholarship, highlighting how your skills and experiences align with their criteria. Be honest and authentic in your writing, and don't be afraid to showcase your unique strengths. Remember, scholarships are a form of recognition and an opportunity to stand out.

In summary, scholarships are a powerful tool for funding your university education without student finance. By conducting thorough research, understanding the different types of scholarships, and applying strategically, you can increase your chances of success. Stay organized, meet deadlines, and don't underestimate the impact of a well-crafted application. With persistence and a bit of luck, you'll find yourself on the path to securing the financial support you need for your higher education journey.

University Essentials: Your Ultimate Packing Checklist for Freshers

You may want to see also

Work-Study Programs: Utilize on-campus jobs or part-time employment to cover expenses

Work-study programs are an excellent way to fund your university education without relying on traditional student finance. These programs offer part-time employment opportunities specifically designed for students, providing a steady income to cover educational expenses. Here's how you can make the most of work-study programs:

Many universities offer on-campus work-study positions, which can be a great way to gain practical experience and earn an income. These jobs often include roles such as research assistants, administrative support, library assistants, or even tutoring. The beauty of these positions is that they are tailored to students' needs and schedules, allowing you to work around your academic commitments. You can explore various options within your university's work-study program, ensuring you find a role that suits your skills and interests.

To access these opportunities, start by checking your university's website or the dedicated work-study office. They will provide information on available positions, application processes, and eligibility criteria. Often, you'll need to complete an application form and provide relevant academic records. Be proactive and regularly check for updates, as new positions may become available throughout the year.

When applying, highlight your relevant skills and experiences. Even if you don't have extensive work experience, emphasize your academic abilities and any relevant projects or assignments you've completed. Demonstrating a strong work ethic and a willingness to learn will make you a strong candidate.

Remember, work-study programs offer more than just financial support. They provide valuable networking opportunities and a chance to build connections within your university community. You can meet fellow students, interact with professors, and gain insights into various fields of study. This can be particularly beneficial for gaining a better understanding of your chosen subject and making informed decisions about your academic path.

Additionally, these part-time jobs can teach you valuable skills such as time management, communication, and problem-solving. Balancing work and study can be challenging, but it will prepare you for the demands of the professional world.

In summary, work-study programs are a fantastic resource for students seeking financial independence during their university journey. By exploring on-campus job opportunities, you can gain practical experience, earn an income, and develop essential skills. So, take advantage of these programs, and make your university experience both financially sustainable and enriching.

Graduate Housing Options: Exploring UW's Campus and Beyond

You may want to see also

Part-Time Work: Balance studies with part-time jobs to earn income

Part-time work is an excellent strategy to fund your university education without relying on student finance. It allows you to earn an income while maintaining a manageable workload, ensuring your studies remain a priority. Here's how you can effectively balance part-time employment with your academic pursuits:

Identify Suitable Job Opportunities: Begin by exploring various part-time job options that align with your interests, skills, and availability. Consider roles in retail, hospitality, or customer service, as these industries often offer flexible hours, which can accommodate your university schedule. Look for local businesses, cafes, or restaurants that might provide part-time positions. Online platforms and job boards can also be valuable resources for finding suitable opportunities.

Create a Schedule: Develop a well-organized schedule that allocates specific time slots for your part-time job and dedicated study periods. Ensure that your work hours do not interfere with your classes, assignments, or exam preparation. A balanced approach will help you stay on top of your academic responsibilities while earning an income. For instance, you might work in the evenings or on weekends, allowing you to focus on your studies during the day.

Prioritize and Manage Time: Effective time management is crucial. Prioritize your academic tasks and allocate time accordingly. During your study sessions, concentrate on completing assignments, reviewing lecture notes, and preparing for exams. When working, give your full attention to your job, ensuring you meet deadlines and deliver quality work. This approach will help you maintain a healthy work-life balance and reduce stress.

Explore On-Campus Opportunities: Many universities offer on-campus part-time jobs, such as library assistants, research assistants, or administrative roles. These positions often provide a more flexible schedule and can be an excellent way to gain relevant experience while studying. Check with your university's careers service or student support department to discover available opportunities tailored to your field of study.

Consider Seasonal Work: Depending on your location and interests, you might find seasonal work opportunities. For example, retail stores often hire additional staff during holiday seasons. This type of work can provide a more extended period of income and allow you to save up for specific periods. Just ensure that your seasonal job doesn't become a full-time commitment, as it should complement your university life.

By embracing part-time work, you can take control of your finances and gain valuable experience while pursuing your degree. Remember to stay organized, manage your time effectively, and maintain a healthy balance between work and study to have a successful and fulfilling university experience.

Waiving GMAT for PhD Students: University of Cincinnati's Policy

You may want to see also

Crowdfunding: Launch online campaigns to raise funds from a wide audience

Crowdfunding has become an increasingly popular and effective method for students to fund their university education without relying on traditional student finance. This approach allows you to tap into a vast network of potential supporters and can be a great way to cover tuition fees, living expenses, or even specific project costs. Here's a step-by-step guide on how to launch a successful crowdfunding campaign:

Choose a Platform: There are numerous crowdfunding platforms available, each with its own unique features and audience. Popular options include GoFundMe, Kickstarter, and Indiegogo. Research and select a platform that aligns with your goals and the nature of your project. For educational funding, platforms that cater to personal causes or projects are ideal.

Define Your Goal: Clearly outline the purpose of your campaign. Are you raising funds for tuition, living costs, or a specific university project? Be specific about the amount you need and how it will be utilized. For example, you might aim to cover a semester's worth of tuition fees or fund a research trip. A well-defined goal will attract the right supporters and provide a clear direction for your campaign.

Create a Compelling Story: Craft a narrative that resonates with your audience. Share your educational journey, the challenges you face, and the impact this funding will have on your studies or a particular project. Personal stories and experiences can evoke emotions and encourage people to contribute. Include relevant details such as your university, the course you're studying, and any unique aspects of your educational path.

Engage and Interact: Crowdfunding is not just about posting a campaign; it's an ongoing process of engagement. Regularly update your supporters with progress, milestones, and any interesting developments related to your goal. Respond to comments and messages, showing appreciation and addressing concerns. Building a community around your campaign will create a sense of involvement and encourage word-of-mouth promotion.

Utilize Social Media: Leverage the power of social media to reach a wider audience. Share your campaign on various platforms, including Twitter, Instagram, and Facebook. Create engaging posts, use relevant hashtags, and consider running targeted ads to boost visibility. Social media allows you to connect with people who might not typically engage with crowdfunding, increasing your chances of success.

Offer Rewards and Incentives: Consider providing small rewards or incentives to donors to show your appreciation. This could be a simple 'thank you' message, a digital certificate, or even a small gift related to your project. For example, if you're raising funds for a film project, you could offer a 'thank you' credit in the film or a small merchandise item. Rewards can motivate people to contribute and create a sense of exclusivity.

By following these steps and maintaining a consistent and engaging approach, you can effectively utilize crowdfunding to fund your university education. It's a powerful tool that allows you to connect with people who share your passion and can provide the financial support you need.

Graduate Class Rings: A Right for University of Texas Students?

You may want to see also

Personal Savings: Use personal savings, investments, or family support

Personal savings can be a significant source of funding for your university education, especially if you're looking to avoid student finance. Here's how you can utilize your personal resources effectively:

Start by assessing your financial situation. Calculate your total savings, including any money you've set aside for specific goals or emergency funds. This initial evaluation will give you a clear picture of your available resources. Consider any investments you've made, such as stocks, bonds, or mutual funds. These can be a valuable asset, and you might be able to use the proceeds or dividends to cover your university expenses. If you have a supportive family, they could be a potential source of financial aid. Discuss your university plans with them and explore the possibility of receiving financial contributions or loans. This could be a one-time gift or a structured repayment plan, ensuring you have the necessary funds for your studies.

When utilizing personal savings, it's essential to be strategic. Prioritize your expenses and identify areas where you can cut back. This might include reducing non-essential spending on entertainment, dining out, or luxury items. By redirecting these funds towards your education, you can significantly contribute to your university fees and living expenses. Additionally, consider any part-time work opportunities that align with your studies. Balancing work and education can be challenging, but it provides a practical way to earn money and fund your education simultaneously.

If you have a substantial amount of savings or investments, you might consider taking out a personal loan specifically for your university education. This option allows you to access the funds needed for tuition and living costs, with the advantage of potentially lower interest rates compared to other loan types. However, it's crucial to carefully consider the terms and conditions of any loan, ensuring you understand the repayment obligations and potential risks.

In summary, personal savings, investments, and family support are powerful tools when exploring ways to fund your university education without relying on student finance. By being proactive, strategic, and open to various funding options, you can take control of your financial journey and achieve your academic goals.

University of Delaware: Student Commute Insights Revealed

You may want to see also

Frequently asked questions

Yes, many universities and organizations offer scholarships specifically for international students. These scholarships can be merit-based, need-based, or targeted at specific fields of study. Research and apply for scholarships early in your application process, as they often have strict deadlines.

Absolutely! Many students choose to work part-time during term time and full-time during holidays to fund their university education. This approach allows you to earn while learning and can significantly reduce the reliance on student loans. Look for on-campus jobs, local businesses, or online freelance opportunities.

Private student loans can be an alternative to government-backed loans, but they often come with higher interest rates. Shop around and compare different lenders to find the best terms and interest rates that suit your financial situation. Remember to borrow only what you need and explore repayment plans.

Grants and bursaries are financial awards that do not need to be repaid. Many universities, charities, and government bodies offer these to support students in various ways. Keep an eye out for local community grants, university-specific bursaries, and national programs that cater to specific demographics or interests.

Absolutely! Many students fund their university education through personal savings, family contributions, or both. If you have a financial cushion or supportive family members, this can be a viable option. However, ensure that you have a clear plan and consider the potential impact on your long-term financial goals.