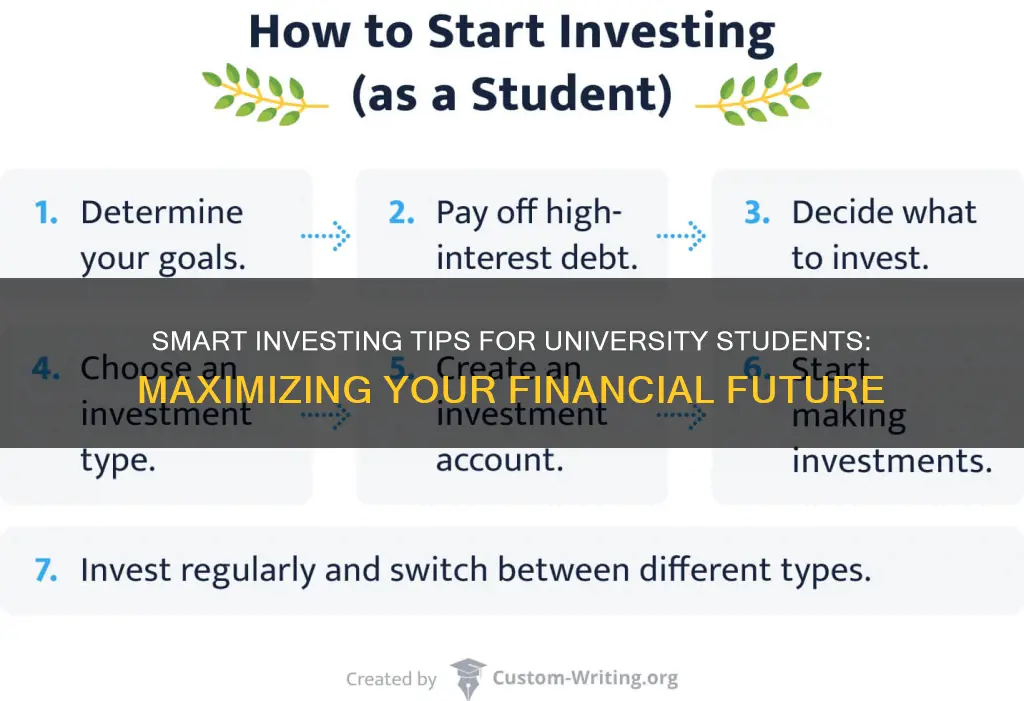

Investing as a university student can be a great way to start building wealth and financial literacy early on. With limited income and a focus on education, it might seem challenging to begin investing, but there are several strategies that can help. This guide will explore various investment options, including stocks, bonds, mutual funds, and ETFs, and provide tips on how to get started with a small budget. It will also discuss the importance of setting financial goals, understanding risk tolerance, and creating a long-term investment plan. By the end of this article, you'll have a clearer understanding of how to make informed investment decisions and potentially grow your wealth while pursuing your academic goals.

What You'll Learn

- Budgeting Basics: Create a monthly budget to allocate funds for investments

- Low-Risk Options: Explore beginner-friendly investments like index funds or ETFs

- App-Based Investing: Utilize user-friendly apps for easy and accessible investing

- Long-Term Goals: Define financial goals and invest accordingly for future success

- Stay Informed: Keep updated on market trends and news for informed decisions

Budgeting Basics: Create a monthly budget to allocate funds for investments

Budgeting is a crucial skill for any university student looking to manage their finances effectively and make informed investment decisions. Creating a monthly budget is the first step towards achieving financial independence and building wealth. Here's a breakdown of how to approach this process:

Step 1: Identify Your Income and Expenses

Start by understanding your financial situation. Calculate your total monthly income, which may include any part-time job earnings, scholarships, grants, or allowances from family. Then, make a comprehensive list of all your expenses. These can be categorized into fixed costs (e.g., tuition fees, accommodation, internet) and variable expenses (groceries, entertainment, transportation). Being thorough in this step is essential to gain a clear picture of your financial flow.

Step 2: Allocate Funds for Basic Needs

Prioritize your spending by allocating funds for essential expenses first. Ensure you have enough to cover your rent, utilities, textbooks, and any other mandatory costs. This step is critical to avoid falling into debt due to unforeseen circumstances.

Step 3: Create a Realistic Budget

Now, it's time to distribute the remaining funds. A common strategy is the 50/30/20 rule, where 50% is allocated for needs, 30% for wants, and 20% for savings and investments. Adjust this ratio based on your personal preferences and financial goals. For instance, if you have a part-time job, you might allocate more funds for investments and savings.

Step 4: Track Your Spending

Regularly monitor your expenses to ensure you stay within your budget. There are numerous budgeting apps and spreadsheets available that can help you track spending and identify areas where you might be overspending. This practice will also help you become more mindful of your financial habits.

Step 5: Invest with Care

With a monthly budget in place, you can now consider investing. Start small and invest a portion of your disposable income. Research various investment options suitable for students, such as stocks, bonds, mutual funds, or even fractional shares. Diversifying your portfolio is a smart strategy to minimize risk. Remember, investing is a long-term game, and it's essential to educate yourself about the market and seek professional advice if needed.

Creating a monthly budget is an empowering step towards financial freedom during your university years and beyond. It provides a structured approach to managing your money, ensuring that your hard-earned funds are utilized efficiently for both immediate needs and long-term financial goals.

Asian Students: The Growing Presence in Universities

You may want to see also

Low-Risk Options: Explore beginner-friendly investments like index funds or ETFs

When it comes to investing as a university student, it's important to start with low-risk options that can help you build a solid foundation for your financial future. One of the best beginner-friendly investments is index funds or Exchange-Traded Funds (ETFs). These are great choices for those who want to dip their toes into the world of investing without taking on excessive risk.

Index funds and ETFs are designed to mirror the performance of a specific market index, such as the S&P 500 or the NASDAQ-100. By investing in these funds, you're essentially buying a small piece of each company included in the index. This diversification is a key advantage, as it reduces the impact of any single stock's performance on your overall investment. For example, if you invest in an S&P 500 index fund, your money will be spread across 500 of the largest U.S. companies, making it a relatively safe way to participate in the stock market.

One of the biggest advantages of index funds and ETFs is their low cost. These funds typically have lower expense ratios compared to actively managed funds, meaning you pay less in fees. This is particularly beneficial for students who may have limited funds to invest. Additionally, these investments are highly liquid, meaning you can easily buy or sell them on the stock market, providing flexibility for your investment strategy.

To get started, you can open a brokerage account with a platform that offers commission-free trading of ETFs and index funds. Many online brokerages cater to beginners and provide user-friendly interfaces, making it easy to navigate the investment process. You can start by researching different index funds and ETFs that align with your investment goals and risk tolerance. Diversification is key, so consider spreading your investments across various sectors and asset classes.

Remember, investing is a long-term game, and it's essential to educate yourself about the markets and the companies you're investing in. While index funds and ETFs offer low risk, they still carry some inherent market risk. Stay informed, monitor your investments regularly, and be prepared to adjust your strategy as you gain more experience and knowledge. Starting with low-risk options like these can provide a solid foundation for building your investment portfolio and achieving your financial goals.

International Students at Howard University: Who Gets Accepted?

You may want to see also

App-Based Investing: Utilize user-friendly apps for easy and accessible investing

Investing as a university student can be a great way to start building your financial future, but it's important to approach it with a strategy that fits your limited time and resources. One of the most accessible and user-friendly methods to begin investing is through app-based investing platforms. These apps have revolutionized the way people invest by making the process simple, efficient, and often free.

The beauty of app-based investing is its convenience. With just a few taps on your smartphone, you can open an account, deposit funds, and start investing in a matter of minutes. Many of these apps offer a wide range of investment options, including stocks, bonds, mutual funds, and even cryptocurrencies. They often provide a personalized dashboard, making it easy to track your investments and stay informed about market trends. For instance, apps like Robinhood, Acorns, and Stash allow you to invest small amounts of money regularly, which is particularly beneficial for those with limited capital.

These platforms typically have low or no minimum investment requirements, making it possible for students to invest even with a small budget. You can start by investing in fractional shares of stocks or exchange-traded funds (ETFs), which means you don't need to buy a whole share of a stock, making it affordable for beginners. Additionally, many app-based investing services offer automated investment features, such as round-up savings, where your purchases are rounded up to the nearest dollar, and the difference is invested. This feature encourages a habit of saving and investing without requiring much thought.

Another advantage is the educational aspect. Many of these apps provide resources and tutorials to help you understand the market and different investment strategies. They often offer insights and news feeds to keep you informed about the economy and specific industries. This can be an excellent way to learn about investing while also growing your portfolio. Furthermore, the social aspect of some investing apps allows you to connect with like-minded individuals, share investment ideas, and even compete with friends, making the learning process more engaging.

When using app-based investing platforms, it's crucial to set clear financial goals and understand your risk tolerance. Diversifying your investments is also key to managing risk. Remember, investing is a long-term strategy, and starting early can significantly impact your financial future. By utilizing these user-friendly apps, university students can take control of their finances, learn valuable lessons about the market, and potentially build a solid investment portfolio.

Transferring to Rice University: What You Need to Know

You may want to see also

Long-Term Goals: Define financial goals and invest accordingly for future success

Investing as a university student can be a powerful way to build a secure financial future, even with limited resources. It's crucial to define long-term goals and create a strategy that aligns with your aspirations. Here's a guide to help you navigate this journey:

- Set Clear Financial Goals: Begin by envisioning your future self. What do you want to achieve financially in the long run? Are you aiming to buy a home, start a business, or secure your retirement? Define these goals with precision. For instance, if your goal is to purchase a house in 10 years, calculate the down payment required and the potential monthly mortgage payments. This clarity will motivate you to invest wisely.

- Create a Timeline: University life can be demanding, so it's essential to create a realistic timeline for your investments. Break down your long-term goals into smaller, achievable milestones. For example, if your goal is to save for a house, you might aim to save a certain amount each month or semester. This approach ensures that your investments are not just dreams but tangible plans in motion.

- Educate Yourself on Investment Options: As a student, you have various investment avenues to explore. Start by researching different investment vehicles such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Understand the risks and potential returns associated with each. Consider consulting financial advisors or utilizing online resources specifically tailored for students to make informed decisions.

- Start with a Budget: Effective budgeting is the cornerstone of successful investing. Create a monthly budget that allocates a portion of your income or allowance towards investments. Explore ways to increase your income, such as taking on part-time work or utilizing scholarships and grants. By managing your finances wisely, you can consistently contribute to your investment accounts.

- Diversify Your Portfolio: Diversification is a key strategy to manage risk and maximize returns. Spread your investments across different asset classes and sectors. For instance, you could invest in a mix of stocks, bonds, and real estate investment trusts (REITs). Diversification ensures that your portfolio is not overly exposed to any single market or risk factor.

- Stay Informed and Adapt: Financial markets are dynamic, and staying informed is crucial. Regularly review your investment portfolio and make adjustments as needed. Keep up with economic news, market trends, and changes in tax laws that may impact your investments. Being proactive and adaptable will help you navigate market fluctuations and make informed decisions.

Remember, investing as a university student is about building a foundation for your financial future. It requires discipline, research, and a long-term perspective. By setting clear goals, educating yourself, and staying committed, you can embark on a journey towards financial success, even with limited resources.

Exploring Rowan University's Student Population

You may want to see also

Stay Informed: Keep updated on market trends and news for informed decisions

Staying informed is crucial when it comes to investing, especially as a university student with limited time and resources. The financial markets are dynamic and ever-changing, and keeping up with trends and news can provide valuable insights to make informed investment decisions. Here's a guide on how to stay updated and make the most of your investment journey:

- Utilize Online Resources: The internet is your best friend when it comes to staying informed. Numerous websites, blogs, and financial news platforms offer real-time market updates, analysis, and expert opinions. Start by identifying reputable sources such as Bloomberg, Reuters, CNBC, or financial-focused websites like Seeking Alpha and MarketWatch. These platforms provide comprehensive coverage of global markets, including stocks, bonds, commodities, and currencies. Set up custom alerts or newsletters to receive daily or weekly summaries of market-related news and trends.

- Follow Financial News Sources: Traditional media outlets like newspapers, magazines, and television networks also provide valuable financial news. Channels like CNN Business, BBC Business, or local business news channels can offer in-depth analysis and interviews with industry experts. Consider subscribing to reputable financial newspapers or magazines, which often provide long-form articles and insights. For example, the Wall Street Journal, Financial Times, or The Economist offer a wealth of financial knowledge and can keep you updated on market-moving events.

- Social Media and Financial Communities: Social media platforms have become powerful tools for financial education and news sharing. Twitter, for instance, is a hub for real-time market updates, with many financial journalists and analysts sharing their insights. Follow influential financial personalities, hedge fund managers, and investment analysts to gain access to their market perspectives. Additionally, joining online financial communities and forums can provide a platform to discuss market trends, ask questions, and learn from experienced investors.

- Market Research and Analysis: Develop a habit of regularly researching and analyzing market trends. Look beyond the headlines and delve into detailed reports and studies provided by financial institutions and research houses. These reports often offer in-depth analysis of specific sectors, industries, or market trends. Understanding the 'why' behind market movements can help you make more informed decisions. For example, if you're interested in investing in technology stocks, research reports from analysts covering the tech industry can provide valuable insights.

- Stay Updated on University Resources: Your university might also provide resources to help students navigate the world of investing. Many universities offer financial literacy programs, workshops, or investment clubs where students can learn and discuss market trends. These platforms can provide a supportive environment to enhance your financial knowledge and connect with like-minded individuals. Additionally, some universities have partnerships with financial institutions, offering exclusive resources and insights to students.

By staying informed and keeping up with market trends, you can make more confident investment decisions as a university student. Remember, investing is a long-term journey, and building a strong foundation of knowledge will serve you well in the future.

Morehouse University: White Students and Diversity

You may want to see also

Frequently asked questions

Investing as a student can be challenging due to financial constraints, but there are ways to get started. You can begin by setting aside a small amount of money each month, even if it's just $10 or $20. Consider investing in index funds or exchange-traded funds (ETFs) that track a broad market index, as these offer diversification and are generally low-cost. Many investment platforms and apps cater to students, offering fractional shares and low-minimum investment options.

There are several investment avenues that students can explore. Firstly, consider opening a high-yield savings account, which can provide a small return on your money while keeping it easily accessible. Another option is to invest in yourself by allocating funds for education, certifications, or skills development, which can have long-term financial benefits. Additionally, peer-to-peer lending platforms allow students to lend money to others and earn interest.

When selecting an investment platform, consider factors like fees, user-friendliness, and the range of investment options available. Many platforms offer free or low-cost trading, especially for students. Look for apps or websites that provide educational resources and tools to help you make informed decisions. Some popular choices include Robinhood, Acorns, and Betterment, each offering unique features tailored to different investment goals.

Investing always carries some level of risk, and students should be aware of potential pitfalls. It's important to understand the difference between short-term and long-term investments. Short-term investments might be more volatile and could result in losses if the market fluctuates. As a student, it's crucial to have a realistic understanding of your financial situation and only invest what you can afford to lose. Diversification is key to managing risk, so consider spreading your investments across different asset classes.

Staying informed is essential for successful investing. Utilize online resources, financial news, and educational content to keep up with market trends and learn about different investment strategies. Consider following reputable financial advisors or influencers who can provide insights and guidance. Additionally, many investment platforms offer research tools and analysis to help you make informed choices. Regularly reviewing and rebalancing your portfolio can also ensure it aligns with your financial goals.