Transferring to a new university can be an exciting step, but it often comes with financial considerations. Understanding the various payment options available to transfer students is crucial for managing the costs associated with this significant academic transition. This guide will explore the different ways transfer students can fund their education, including scholarships, grants, work-study programs, and financial aid, providing a comprehensive overview to help students navigate the financial aspects of their university transfer.

What You'll Learn

- Financial Aid: Understand grants, scholarships, and work-study programs

- Tuition Payment Plans: Explore options for spreading costs over time

- Scholarships for Transfers: Research specific awards for incoming students

- State Aid and Grants: Apply for state-funded opportunities and grants

- Private Loans: Compare interest rates and repayment terms for personal loans

Financial Aid: Understand grants, scholarships, and work-study programs

When it comes to financing your university transfer, understanding the various financial aid options is crucial. Financial aid can significantly reduce the financial burden and make your transition to a new institution smoother. Here's a breakdown of grants, scholarships, and work-study programs:

Grants: These are forms of financial aid that do not require repayment. They are often need-based and aim to support students who demonstrate financial hardship. Grants can be federal, state, or institution-specific. Federal grants, such as the Pell Grant, are available to eligible students and can provide a substantial amount of funding. State grants are typically awarded to residents of a particular state and may have specific eligibility criteria. Many universities also offer institutional grants to attract and support talented students. It's important to research and apply for grants early in the financial aid process, as they often have strict deadlines.

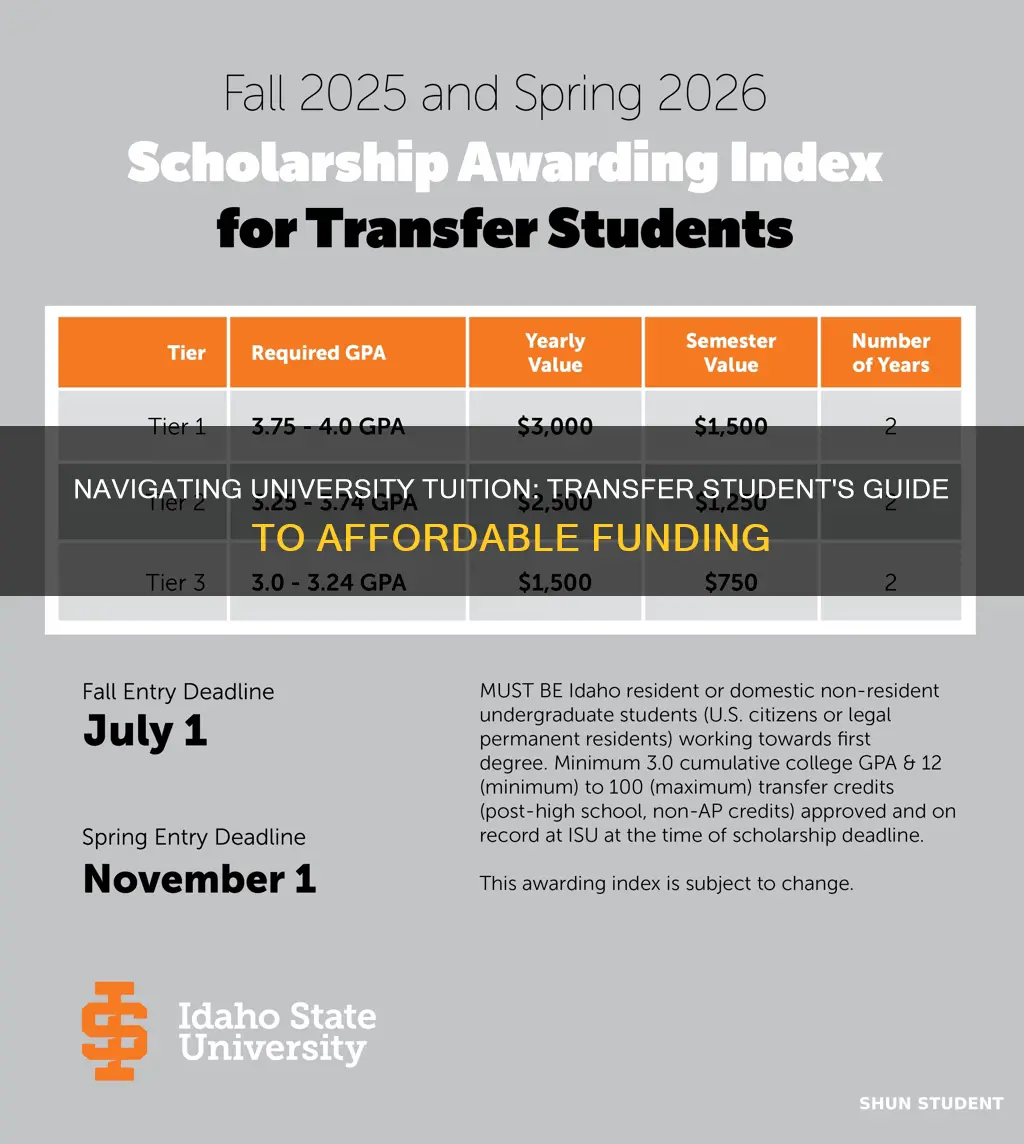

Scholarships: Similar to grants, scholarships are financial awards that do not need to be repaid. They are often merit-based, recognizing academic achievements, leadership qualities, community involvement, or other exceptional qualities. Scholarships can vary in amount and may be renewable if certain conditions are met. Some scholarships are specific to certain fields of study, while others are open to a wide range of disciplines. Transfer students should explore both institutional and external scholarship opportunities. Many organizations, businesses, and community groups offer scholarships to support students' educational pursuits.

Work-Study Programs: These programs provide part-time employment opportunities for students with financial need. The earnings from these jobs can help cover educational expenses. Work-study positions are often on-campus jobs, such as working in the library, dining hall, or administrative offices. The federal government funds work-study programs, and they are designed to provide a flexible way to earn money while maintaining a balance between work and studies. The amount you can earn through work-study is typically limited, ensuring that your academic commitments remain a priority.

Understanding and applying for these financial aid options can significantly contribute to your financial stability during the transfer process. It is essential to start the application process early, as many grants and scholarships have specific deadlines. Additionally, maintaining a good academic standing and actively seeking out relevant scholarships can increase your chances of receiving financial assistance. Remember, financial aid is a vital resource to ensure that your transfer to a new university is financially manageable and successful.

Transferring to Ross University: What You Need to Know

You may want to see also

Tuition Payment Plans: Explore options for spreading costs over time

When considering how to finance your university transfer, exploring tuition payment plans can be a strategic approach to manage the financial burden effectively. These plans are designed to provide flexibility and support for students, especially those transitioning from one educational institution to another. Here's an overview of the options available:

Understanding Tuition Payment Plans:

Tuition payment plans are structured arrangements that allow students to spread the cost of their education over a more extended period. This approach is particularly beneficial for transfer students who might face unexpected financial challenges during their transition. By opting for a payment plan, you can avoid the pressure of paying the entire tuition fee upfront, which can be a significant financial strain.

Options for Payment Plans:

- Installment Payments: This is a common method where students can choose to pay their tuition in multiple installments throughout the academic year. Typically, these payments are spread over several months, making it more manageable. Many universities offer this option, allowing students to set up a payment schedule that aligns with their financial capabilities.

- Monthly or Quarterly Payments: Some institutions provide the flexibility to pay tuition on a monthly or quarterly basis. This option is ideal for students who prefer a more consistent payment structure. By paying regularly, you can ensure that the financial commitment is distributed evenly, making it easier to budget and plan.

- Deferred Payment: In certain circumstances, students might be eligible for deferred payment plans. This option allows you to postpone tuition payments until after the semester or academic year. It can be a valuable resource for students who need time to secure funding or arrange financial support. However, it's essential to understand the terms and conditions, as there may be associated fees or interest.

Benefits of Payment Plans:

- Financial Relief: Payment plans provide a sense of financial security by breaking down the tuition cost into smaller, more manageable chunks. This approach can reduce the initial financial burden, allowing students to focus on their academic goals.

- Flexibility: With various payment options available, students can choose a plan that suits their financial situation and preferences. This flexibility ensures that paying for university becomes a more accessible and less stressful process.

- Improved Creditworthiness: Making timely payments as per the agreed plan can positively impact your credit history. This is especially beneficial for students building their credit profile, as it demonstrates financial responsibility.

Steps to Enroll in a Payment Plan:

- Check University Policies: Begin by reviewing the payment policies of your chosen university. Each institution may have specific guidelines and requirements for payment plans, including eligibility criteria and application processes.

- Contact Financial Aid Office: Reach out to the university's financial aid or student services department to gather information and understand the available options. They can provide guidance on the best payment plan for your needs.

- Complete Necessary Forms: Follow the university's instructions to apply for the payment plan. This might involve filling out an application form and providing relevant financial information.

- Set Up Payment Schedule: Once approved, work with the university to establish a payment schedule that suits your financial situation. Ensure you understand the due dates and any associated fees or penalties.

By exploring tuition payment plans, transfer students can approach their university education with a more manageable financial strategy. It empowers students to take control of their expenses and focus on their academic journey without the added stress of immediate financial burdens. Remember, each university may have its own policies, so it's essential to research and understand the options available to make an informed decision.

Master University Writing: Tips for Engaging, Effective Essays

You may want to see also

Scholarships for Transfers: Research specific awards for incoming students

When it comes to financing a university transfer, scholarships can be a significant source of financial aid. Many institutions and organizations offer specific awards to incoming transfer students, recognizing their unique experiences and contributions. Here's a guide on how to research and find these scholarships:

Understand Transfer Student Status: As a transfer student, you bring valuable academic credits and experiences to the table. Many scholarships are designed to support students like you, who have demonstrated a commitment to education and often have a unique perspective. Understanding this aspect of your application can help you identify relevant scholarship opportunities.

Explore University Resources: Start by checking your chosen university's website for scholarship information. Many institutions have dedicated pages or offices that provide financial aid and scholarship opportunities specifically for transfer students. These resources often include internal scholarships, merit-based awards, and even partnerships with external organizations. Contact the financial aid office to inquire about available options and any upcoming scholarship deadlines.

Search Online Databases: Utilize online scholarship search engines and databases to find a comprehensive list of awards. Websites like Fastweb, Cappex, and Scholarship.com allow you to filter scholarships based on criteria such as academic performance, field of study, and transfer student status. These platforms often provide detailed information about each scholarship, including eligibility requirements, application processes, and deadlines.

Look for Transfer-Specific Awards: Some organizations and foundations offer scholarships exclusively for transfer students. Research local community foundations, alumni associations, and non-profit organizations that support education. These entities often have awards to recognize and support the unique challenges and achievements of transfer students. Their websites or social media pages may provide application guidelines and criteria.

Network and Ask for Recommendations: Don't underestimate the power of networking. Reach out to academic advisors, professors, or alumni from your previous institution. They may have insights into scholarships that are not widely advertised. Additionally, consider joining transfer student organizations or online communities where you can connect with current students who might share valuable scholarship leads.

Remember, the key is to be proactive in your research and application process. Start early, as scholarship deadlines can be competitive and vary across institutions. By exploring these avenues, you can uncover a range of scholarships tailored to transfer students, helping to alleviate the financial burden of your university transition.

GPA Requirements for Transfer Students: What Universities Really Care About

You may want to see also

State Aid and Grants: Apply for state-funded opportunities and grants

When it comes to financing your university transfer, exploring state aid and grants can be a valuable strategy. Many states offer financial assistance programs specifically tailored to transfer students, recognizing the unique challenges and contributions of these students to the higher education system. Here's a comprehensive guide on how to navigate this process:

Research State-Specific Opportunities: The first step is to identify the financial aid options available in your state. Each state has its own higher education agency or department that administers various grant and scholarship programs. Start by visiting the official website of your state's education department or a similar relevant agency. These websites often provide detailed information about the aid available, including eligibility criteria, application processes, and deadlines. Look for programs specifically designed for transfer students, as these may have unique requirements and benefits.

Understand the Application Process: State aid and grants typically have specific application procedures. Pay close attention to the instructions provided on the official websites. The application process may involve filling out online forms, submitting required documents, and meeting certain deadlines. Ensure you have all the necessary information and documents ready before starting the application. This might include your academic records, proof of residency, and any other supporting materials requested by the state agency.

Explore Different Types of State Aid: State-funded opportunities for transfer students can vary widely. Some common forms of state aid include:

- State Scholarships: These are merit-based or need-based scholarships awarded to transfer students based on academic achievements, community involvement, or financial need.

- Tuition Reimbursement Programs: Certain states offer programs that reimburse transfer students for a portion of their tuition fees, especially if they are attending a public institution.

- Bridge Programs: These initiatives aim to support students transitioning from community colleges to four-year institutions, often providing financial assistance and academic support.

- Transfer Student Grants: Specifically designed for transfer students, these grants may have unique criteria and selection processes.

Meet Eligibility Criteria: Each state aid program has its own set of eligibility requirements. These criteria can include academic performance, residency status, enrollment status, and sometimes specific major or career goals. Carefully review the guidelines to ensure you meet all the necessary conditions. For example, some grants might prioritize students from underrepresented backgrounds or those pursuing fields with high job demand.

Complete and Submit Applications: Once you've identified the relevant state aid opportunities, it's time to apply. Follow the provided instructions, ensuring you submit all required documents and meet any specified deadlines. Be thorough and accurate in your application, as this will increase your chances of being selected for the financial assistance.

Exploring St. Peter's University Student Population

You may want to see also

Private Loans: Compare interest rates and repayment terms for personal loans

When considering private loans as a means to fund your university transfer, it's crucial to thoroughly compare the interest rates and repayment terms offered by different lenders. Private loans, often provided by banks, credit unions, or online lenders, can be a valuable source of financial aid, especially when federal student aid options are insufficient. Here's a step-by-step guide to navigating this process:

- Understand Interest Rates: Interest rates are a significant factor in private loans as they directly impact the total cost of borrowing. Fixed interest rates remain constant throughout the loan term, providing predictability in monthly payments. Variable interest rates, on the other hand, fluctuate with market conditions, which can lead to uncertainty in repayment amounts. Research current market rates and consider your financial stability over the long term. For instance, if you believe your income will increase significantly after graduation, a variable rate might be advantageous.

- Compare Repayment Terms: Lenders offer various repayment plans, and understanding these options is essential. Standard repayment plans require fixed monthly payments over a set period, typically ranging from 5 to 10 years. Graduated repayment plans start with lower monthly payments that gradually increase over time, which can be beneficial for recent graduates with limited income. Income-driven repayment plans tie your monthly payments to your income and employment status, often resulting in lower initial payments. Carefully evaluate your future financial prospects and choose a plan that aligns with your expected earnings and career trajectory.

- Loan Limits and Borrowing Capacity: Private loans often have higher borrowing limits compared to federal loans, allowing you to cover more significant expenses. However, it's essential to borrow only what you need. Exceeding your financial needs may lead to unnecessary interest payments and long-term debt. Lenders typically assess your creditworthiness and may consider your income, employment history, and existing debts to determine your borrowing capacity.

- Additional Fees and Charges: Beyond interest rates and repayment terms, be mindful of additional fees associated with private loans. These may include origination fees (a percentage of the loan amount charged by the lender), late payment fees, and prepayment penalties (if you pay off the loan early). Carefully review the loan agreement to understand all associated costs and ensure you're comfortable with them.

- Lender Reputation and Customer Service: Choose a reputable lender with a track record of fair lending practices and responsive customer service. Online reviews and ratings can provide valuable insights into a lender's reliability and customer satisfaction. Prompt and efficient customer support can be crucial if you encounter any issues or have questions about your loan.

By comparing interest rates, repayment terms, and associated fees, you can make an informed decision when selecting a private loan. Remember, the goal is to find a loan that suits your financial situation and provides manageable repayment options while covering your educational expenses.

Freiburg University's Student Application Numbers: An Overview

You may want to see also

Frequently asked questions

International students can explore various funding options to cover the costs of a university transfer. These may include scholarships specifically for international students, government grants, or private donations. Many universities also offer international student fees that can be paid in installments, and some institutions provide financial aid based on merit or need. It's essential to research and apply for these opportunities early in the application process.

Transfer students have several payment methods available. Many universities accept online bank transfers, credit/debit card payments, or electronic funds transfers. Some institutions might also offer installment plans, allowing students to pay in smaller, manageable amounts over a set period. It's advisable to check the university's financial services or student accounts department to understand the specific payment options and procedures.

Absolutely! Financial aid is available to transfer students and can significantly reduce the financial burden. This may include grants, scholarships, work-study programs, or loans. Transfer students should complete the financial aid application process, which often involves submitting the Free Application for Federal Student Aid (FAFSA) or a similar institutional form. The university's financial aid office can provide guidance on available options and help students navigate the application process.