The process of applying to universities in the United States often involves a significant financial commitment, and one aspect that can be a source of confusion for prospective students and their families is the concept of commission in the admission process. In this context, the term commission typically refers to a fee or payment made by a student or their family to a third-party service or individual for assistance with the application process. This practice has sparked debates and raised concerns among students and educational institutions alike. Understanding the intricacies of these commissions and their impact on the admission process is crucial for anyone navigating the complex landscape of US higher education.

What You'll Learn

Tuition Costs: Financial aid, scholarships, and grants

When considering the financial aspects of attending a university in the USA, understanding the various options for funding your education is crucial. The cost of tuition can vary significantly between institutions and programs, and many students rely on financial aid, scholarships, and grants to make their education more affordable. Here's an overview of these essential financial support mechanisms:

Financial Aid: This term encompasses a wide range of support provided by the federal government, state governments, and educational institutions. Financial aid is designed to assist students with the costs of education, including tuition, fees, room, and board. It is typically need-based, meaning it is awarded based on the financial circumstances of the student and their family. Federal financial aid programs include the Free Application for Federal Student Aid (FAFSA), which determines eligibility for grants, work-study programs, and loans. Many universities also have their own financial aid packages, which may include scholarships, grants, and work-study opportunities. It is essential to complete the FAFSA early to maximize the chances of receiving federal aid, as some states and institutions have their own aid programs with earlier application deadlines.

Scholarships: These are awards given to students based on various criteria, such as academic achievement, leadership potential, community involvement, or specific talents. Scholarships can be highly competitive and often require a detailed application process, including essays, letters of recommendation, and sometimes interviews. They can cover a significant portion of tuition and sometimes even include a stipend for living expenses. Many scholarships are merit-based, rewarding students for their academic excellence, while others are need-based or targeted at specific groups, such as underrepresented minorities or students with particular interests or backgrounds. Students should research and apply for scholarships early, as they often have strict deadlines and limited availability.

Grants: Similar to financial aid, grants are forms of financial assistance that do not need to be repaid. They are typically awarded based on financial need, academic merit, or specific criteria related to the field of study. Federal grants, such as the Pell Grant, are available to eligible students and can provide a substantial amount of financial support. Many states and private organizations also offer grants, often with a focus on particular areas of study or demographic groups. Grants are an excellent way to supplement other financial aid and can help students avoid accumulating significant debt during their studies.

When applying for financial aid, scholarships, and grants, students should carefully review the requirements and deadlines of each program. Many institutions and organizations have specific criteria and application processes, and being aware of these details can significantly increase the chances of receiving financial support. Additionally, students should be proactive in seeking out opportunities, as the competition for these funds can be intense.

On-Campus Living at UNC: How Many Students?

You may want to see also

Tuition Waivers: Policies and eligibility criteria

Tuition waivers are a financial aid strategy employed by many US universities to attract and support students. These waivers can significantly reduce the financial burden on students, making higher education more accessible. The policies and eligibility criteria for tuition waivers can vary widely between institutions, and understanding these can be crucial for students seeking financial relief.

Understanding Tuition Waivers:

Tuition waivers are essentially a form of financial assistance that exempts students from paying a portion or all of their tuition fees. This aid is often targeted at specific groups of students, such as those with exceptional academic achievements, unique talents, or those facing financial hardships. The primary goal is to encourage and support students who might otherwise be unable to afford the high costs of higher education.

Eligibility Criteria:

Eligibility for tuition waivers is typically based on several factors, and the criteria can be quite diverse:

- Academic Excellence: Many universities offer waivers to students with outstanding academic records, such as high GPAs, impressive standardized test scores, or a history of significant achievements in their field of study.

- Extracurricular Excellence: Students who demonstrate exceptional skills or achievements in sports, arts, community service, or leadership roles may be eligible for waivers. This approach recognizes the value of well-rounded individuals who can contribute to the university's community.

- Financial Need: Some institutions provide waivers based on financial assessments, targeting students from low-income families or those facing economic challenges. This ensures that education remains accessible to those who need it most.

- Special Circumstances: Certain universities may consider unique personal circumstances, such as medical conditions, family responsibilities, or other extenuating factors, to determine eligibility.

- Departmental or University-Specific Awards: Some waivers are granted at the discretion of individual academic departments or the university administration, often based on specific criteria relevant to the department's focus or the university's mission.

Application Process:

The application process for tuition waivers can vary. Some institutions may require students to submit additional documentation or essays to support their application, while others might use a standard application form. It is essential to carefully review the university's guidelines and deadlines to ensure a timely and accurate submission.

Impact and Benefits:

Tuition waivers can have a profound impact on students' lives, allowing them to focus on their studies without the constant worry of financial strain. This financial relief can lead to improved academic performance, increased student engagement, and a more diverse and vibrant campus community.

Tarleton State University: Unveiling Student Population Insights

You may want to see also

Financial Aid Packages: Scholarships, grants, and work-study programs

Financial aid packages are a crucial aspect of the financial planning process for students, especially when considering the high costs associated with attending a university in the United States. These packages encompass various forms of financial assistance, including scholarships, grants, and work-study programs, each designed to support students in their educational pursuits. Understanding these options is essential for students aiming to secure the necessary funds to cover their educational expenses.

Scholarships are one of the most common and sought-after forms of financial aid. They are typically awarded based on academic merit, extracurricular achievements, leadership qualities, or other specific criteria set by the university or external organizations. Merit-based scholarships often require students to meet certain GPA or standardized test score requirements. These scholarships can significantly reduce the financial burden of tuition fees and sometimes cover additional expenses like room and board. Many universities also offer need-based scholarships, which take into account a student's financial situation and may be available to those who don't necessarily excel academically but still demonstrate a commitment to their studies.

Grants, on the other hand, are typically need-based financial aid provided to students to cover educational expenses. They are often awarded to students who demonstrate financial need, as determined by the university's financial aid office. Grants do not require repayment, which makes them an attractive option for students. These funds can be used for various purposes, including tuition, fees, books, and even living expenses. Federal grants, such as the Pell Grant, are available to eligible students and can provide substantial financial support. State grants and institutional grants are also common, with each offering unique benefits and eligibility criteria.

Work-study programs are another essential component of financial aid packages. These programs provide part-time employment opportunities for students, allowing them to earn money to contribute to their educational expenses. The work can vary, from on-campus jobs assisting professors or administrative staff to off-campus positions in the local community. Work-study positions often offer a flexible schedule, allowing students to balance their studies and work commitments. Earnings from these jobs can be used to cover tuition, fees, and even living costs, providing a practical solution for managing financial responsibilities during university.

When applying for financial aid, students should carefully review the requirements and deadlines set by their chosen universities. Each institution has its own financial aid office, which can provide detailed information on the available packages and the application process. It is advisable to start the application process early, as some scholarships and grants have limited funding and may be awarded on a first-come, first-served basis. Additionally, students should be prepared to provide comprehensive financial information, including tax returns, bank statements, and other relevant documents, to ensure a smooth and successful application.

Rivier University: Acceptance with a D Grade

You may want to see also

Tuition Payment Plans: Installment options and fees

Tuition payment plans are a crucial aspect of managing the financial burden of higher education, especially for students and their families. Many universities in the USA offer installment payment options to make tuition fees more manageable and accessible. These plans allow students to spread the cost of tuition over several months, often with additional fees and interest.

When considering installment payment plans, it's essential to understand the terms and conditions set by the university. Typically, these plans require students to pay a certain percentage of the total tuition upfront, with the remaining balance due in subsequent installments. The number of installments can vary, but it often ranges from 3 to 12 months, depending on the university's policies. For example, a student might pay 20% of the tuition as a down payment and then make monthly payments for the remaining 80% over the next few months.

One of the key advantages of installment payment plans is the flexibility they provide. Students can choose a plan that suits their financial situation and preferences. Some universities offer interest-free plans, while others may charge a small interest fee on the remaining balance. It is crucial to review the interest rates and fees associated with each plan to make an informed decision. Additionally, students should be aware of any late payment penalties and the consequences of missing installment payments, as these can impact their financial standing and, in some cases, their ability to continue their studies.

Another important consideration is the availability of different payment plan options. Universities may offer various plans, such as monthly, bi-weekly, or even weekly payment schedules. Students can select the frequency that best fits their income and cash flow. For instance, a bi-weekly plan would involve making two payments per month, which might be more manageable for some students. It is advisable to compare different payment plan structures to find the most suitable one for individual needs.

In addition to the installment options, students should be aware of any associated fees. These may include processing fees, late payment fees, or even a fee for the payment plan itself. Understanding these additional costs is vital to ensure that students are not caught off guard by unexpected expenses. Some universities may also offer financial aid or scholarships to help offset the costs, so students should explore all available resources to support their education.

In summary, tuition payment plans with installment options are a valuable tool for students to manage their education expenses. By carefully reviewing the terms, interest rates, and associated fees, students can make informed decisions and choose a payment plan that suits their financial circumstances. It is essential to plan and budget accordingly to ensure a smooth and successful academic journey.

Rutgers University's Greek Life: A Look at the Numbers

You may want to see also

Admission Fees: Application, processing, and enrollment costs

When considering the financial aspects of applying to universities in the USA, it's important to understand the various fees associated with the admission process. These fees can vary significantly between institutions and even within the same university, depending on factors such as state residency, program type, and individual circumstances. Here's a breakdown of the common admission fees you might encounter:

Application Fees: This is the initial cost incurred when you submit your application to a university. It covers the administrative work involved in processing your application, including reviewing your academic records, test scores, and any other supporting documents. Application fees typically range from $50 to $100 per institution, but some schools offer waivers or discounted rates for certain applicants, such as those from low-income families or underrepresented groups. It's worth noting that some universities may charge different application fees for undergraduate and graduate programs, or for international and domestic students.

Processing and Handling Fees: In addition to the application fee, some universities may impose processing or handling fees. These fees are often associated with the additional work required to verify and assess your application. This could include tasks such as contacting your high school or previous educational institutions for transcripts, arranging for standardized test score reports, or conducting background checks. Processing fees can vary widely, and some institutions may include this cost in the overall application fee, while others may charge it separately.

Enrollment Deposits: Once you receive an offer of admission, you may be required to pay an enrollment deposit to secure your spot in the incoming class. This deposit is typically non-refundable and is usually applied towards your first semester's tuition and fees. The amount can vary, but it often ranges from $100 to $500 per institution. It's essential to carefully review the university's deposit policy, as some may require you to pay the deposit by a specific deadline, and failure to do so may result in the loss of your offer.

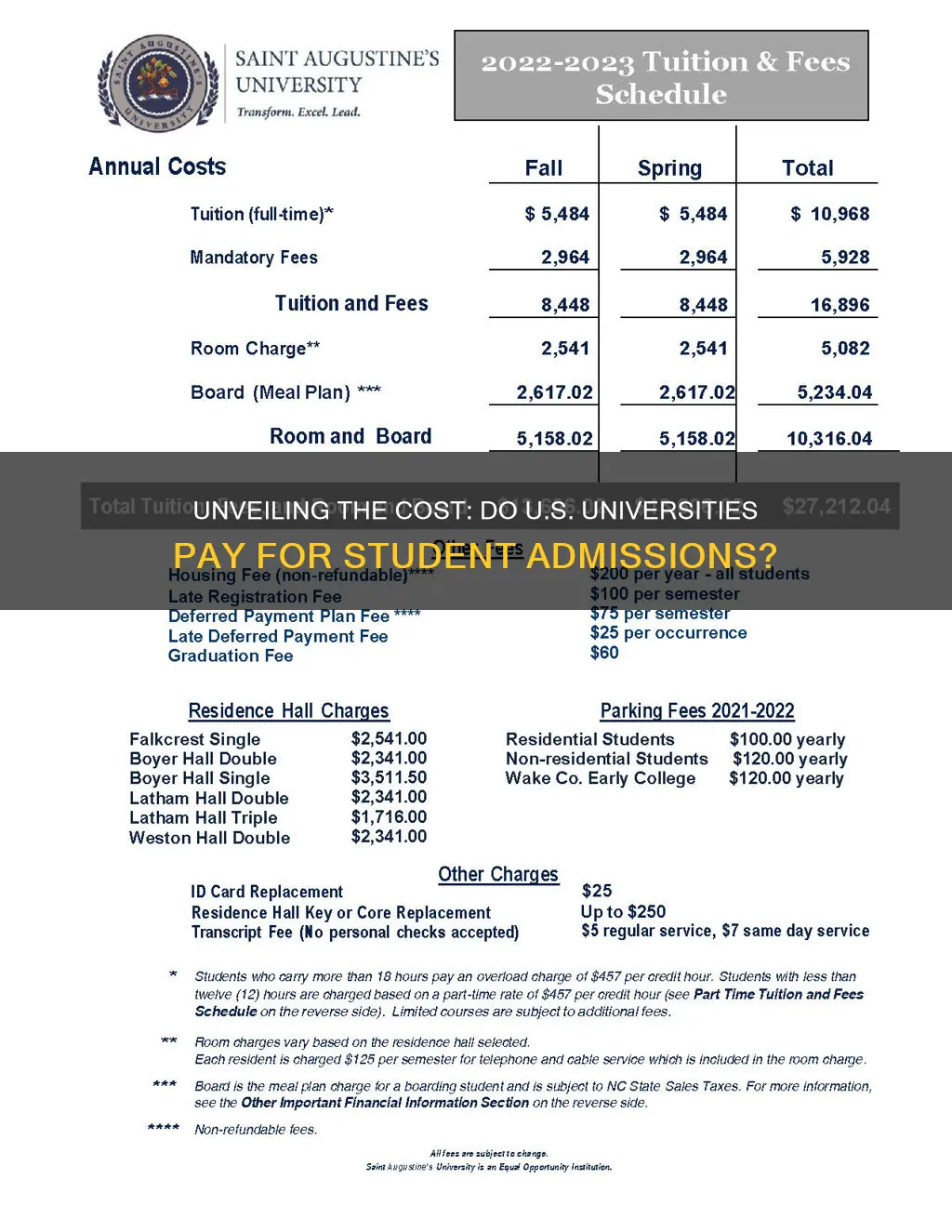

Tuition and Fee Structure: Admission fees are just a part of the overall financial commitment associated with attending a university. After the admission process, students must consider the actual tuition and fees for the chosen program. These costs can vary widely depending on the university, its location, and the specific degree or course. Public universities often have lower tuition rates for in-state residents compared to out-of-state or international students. Private institutions, on the other hand, may have higher tuition fees but also offer a wider range of financial aid options.

Understanding these admission fees is crucial for prospective students to plan their finances effectively. It's advisable to research and compare fees across different universities, as well as explore available financial aid and scholarship opportunities to make an informed decision about your educational journey in the USA.

Tyler University: Student Population and Campus Life

You may want to see also

Frequently asked questions

No, universities in the United States typically do not charge a commission for admitting students. The process of admissions is usually handled by dedicated staff and often involves a review of academic records, test scores, letters of recommendation, and personal statements. Some institutions may have associated fees for processing applications, but these are generally referred to as application fees or administrative charges, not commissions.

The admission process for international students can vary depending on the university and the student's country of origin. Many US universities have specific international student advisors or offices to assist with the application process. They provide guidance on required documents, such as proof of English language proficiency (e.g., TOEFL or IELTS scores), academic transcripts, and letters of recommendation. International students may also need to complete additional steps like obtaining a student visa and arranging health insurance.

While the admission process itself is generally straightforward, there can be some associated costs. Application fees are common and vary by university, typically ranging from $50 to $100. Some institutions may also charge a deposit fee to secure a spot in the incoming class, which is usually refundable if the student withdraws their application. Additionally, international students might need to pay for visa services and health insurance, which can vary in cost depending on the student's needs and the university's policies.