Many colleges and universities offer health insurance plans as part of their student services, providing coverage tailored to the unique needs of their student population. These plans often include comprehensive medical, dental, and vision care, ensuring students have access to essential healthcare services during their academic journey. With a focus on promoting student well-being, these institutions aim to alleviate financial burdens and provide peace of mind, allowing students to focus on their education and personal growth. Understanding the options available and the benefits of these insurance plans is crucial for students to make informed decisions about their healthcare coverage.

What You'll Learn

- Health Insurance Coverage: Colleges offer various health insurance plans to students

- Plan Options: Students can choose from different insurance providers and coverage levels

- Enrollment Process: The university facilitates student enrollment in health insurance programs

- Financial Aid: Financial aid packages may include health insurance as a benefit

- Student Well-being: Insurance ensures students' access to healthcare services for a healthy campus life

Health Insurance Coverage: Colleges offer various health insurance plans to students

Many colleges and universities provide health insurance coverage as part of their student services, recognizing the importance of ensuring students' well-being. These institutions often offer comprehensive health insurance plans tailored to the unique needs of their student population. The primary goal is to provide financial protection and access to quality healthcare for students, addressing potential health concerns and promoting a healthy campus environment.

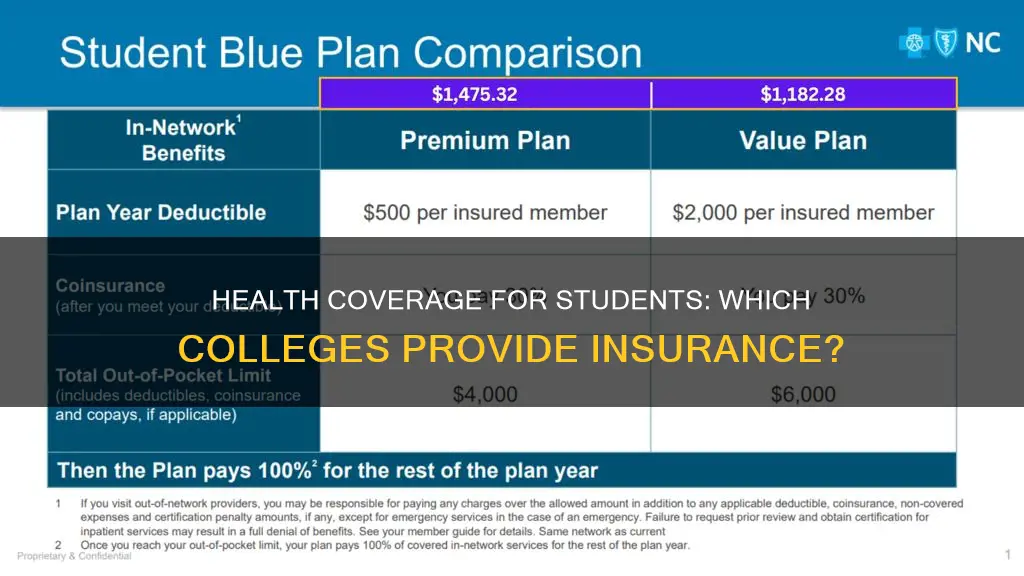

When considering health insurance options, students should be aware of the different types of coverage available. Colleges typically offer two main types of plans: comprehensive health insurance and limited coverage plans. Comprehensive plans provide extensive medical coverage, including doctor visits, hospitalization, prescription drugs, mental health services, and emergency care. These plans are designed to cater to a wide range of health needs and ensure students receive the necessary care without incurring substantial out-of-pocket expenses. On the other hand, limited coverage plans may offer basic medical services and often come with higher deductibles, requiring students to pay more upfront before the insurance coverage kicks in.

The benefits of having health insurance through a college or university are significant. Firstly, it provides financial security by covering medical expenses, which can be substantial without insurance. Students can access a network of healthcare providers, ensuring they receive timely and appropriate treatment. Additionally, many plans include mental health services, recognizing the importance of emotional well-being alongside physical health. This comprehensive approach to healthcare allows students to focus on their academic pursuits without the added stress of financial burdens related to medical issues.

Furthermore, college health insurance plans often offer convenience and accessibility. Students can typically access healthcare services through on-campus clinics or affiliated medical facilities, making it easier to receive prompt care. These plans may also provide coverage for off-campus medical visits, ensuring students can continue their treatment even when they are away from the university. The convenience of having a single insurance provider for all medical needs can significantly streamline the healthcare experience for students.

In summary, colleges and universities play a vital role in supporting students' health and well-being by offering various health insurance plans. These plans provide comprehensive coverage, financial protection, and access to quality healthcare services. Students should carefully review the options available and choose a plan that best suits their individual needs, ensuring they are adequately protected during their academic journey. Understanding the details of these insurance plans is essential to making informed decisions regarding one's health and financial security.

UVU's Student Population: A Comprehensive Overview

You may want to see also

Plan Options: Students can choose from different insurance providers and coverage levels

When it comes to health insurance for students, colleges and universities often provide a range of options to cater to the diverse needs of their student body. This approach ensures that students can select a plan that best suits their individual circumstances and preferences. Here's an overview of the plan options available:

Insurance Providers: Colleges typically partner with reputable insurance companies to offer health coverage to students. These providers are carefully selected based on their reputation, financial stability, and ability to cater to the specific needs of a student population. Students can choose from a list of approved insurance providers, each with its own unique features and benefits. For instance, one provider might offer comprehensive coverage with a wide network of healthcare providers, while another may specialize in student-specific plans with lower premiums.

Coverage Levels: The coverage options available can vary significantly. Students can opt for different tiers of insurance, each with its own set of benefits and costs. Basic plans might cover essential health services, such as doctor visits, emergency care, and prescription drugs, but may have higher deductibles. More comprehensive plans could include additional benefits like mental health services, vision and dental care, and even international travel insurance. Students can assess their personal and family medical history, expected healthcare needs, and budget to determine the level of coverage that aligns with their requirements.

The process of selecting a plan often involves comparing the coverage details, network providers, and associated costs. Students can review the benefits of each plan, including any exclusions or limitations, to make an informed decision. This transparency empowers students to choose a plan that provides adequate protection without unnecessary expenses.

Furthermore, colleges may offer a range of plan types, such as individual student plans, family coverage, or dependent student plans, allowing students to customize their insurance based on their family situation. This flexibility ensures that students can find a plan that fits their unique circumstances.

In summary, by offering a variety of insurance providers and coverage levels, colleges and universities enable students to take control of their health insurance choices. This approach promotes informed decision-making, ensuring that students can access the necessary healthcare services while managing their financial responsibilities effectively.

Pace University: Out-of-State Students Statistics and Insights

You may want to see also

Enrollment Process: The university facilitates student enrollment in health insurance programs

The enrollment process for health insurance at universities is a streamlined and essential step for all students, ensuring they have access to adequate healthcare coverage during their academic journey. Here's an overview of how the university simplifies this process:

When students first enroll in their chosen university, they are provided with comprehensive information regarding health insurance options. This initial step is crucial as it introduces students to the available coverage and the importance of having health insurance. The university's financial aid or student services office typically handles this information dissemination. They offer detailed brochures, online resources, or even host informational sessions to explain the different insurance plans and their benefits. This ensures that students are well-informed about their healthcare options right from the start.

Enrollment in the health insurance program is often integrated into the overall registration process. Students can select their preferred insurance plan during the enrollment period, which is usually aligned with the initial stages of the academic year. The university's administration has made this process convenient by providing a single platform or portal where students can access and manage their insurance details. This centralized system allows students to review various insurance providers, compare coverage options, and make informed choices. The university may also offer assistance during this period, providing guidance to students who require help navigating the enrollment system.

In some cases, the university might partner with specific insurance companies to offer tailored health insurance plans for students. These partnerships ensure that the coverage is customized to meet the unique needs of the student population. By working closely with insurance providers, the university can negotiate rates and benefits that cater to the student's demographic. This collaboration simplifies the enrollment process, as students can directly access and enroll in these university-endorsed plans through the designated portal.

Furthermore, the university's commitment to facilitating enrollment extends beyond the initial academic year. They often provide ongoing support and resources to ensure students can manage their insurance coverage throughout their studies. This includes assistance with any changes in insurance plans, updates on coverage options, and guidance on utilizing the insurance benefits effectively. The university's dedication to student welfare is evident in their efforts to simplify the enrollment process, making it accessible and efficient.

In summary, the university plays a pivotal role in ensuring students' access to health insurance by streamlining the enrollment process. Through comprehensive information dissemination, integrated enrollment systems, and potential partnerships with insurance providers, the university simplifies the selection and management of health insurance plans. This approach not only benefits students by providing essential healthcare coverage but also contributes to a more seamless and supportive academic experience.

Exploring Student Population at University of Tennessee Chattanooga

You may want to see also

Financial Aid: Financial aid packages may include health insurance as a benefit

Financial aid packages offered by colleges and universities can be comprehensive, addressing various aspects of a student's well-being and academic journey. One of the essential benefits often included in these packages is health insurance. This is particularly important for students who may not have access to healthcare coverage through their families or other sources.

When considering higher education, it is crucial to understand the financial aid options available. Financial aid packages are designed to support students in their pursuit of education, and they can significantly contribute to a student's overall experience. These packages often include a range of benefits, with health insurance being a vital component. Many institutions recognize the importance of ensuring students' health and well-being, especially during their formative years.

Health insurance coverage provided through financial aid can offer peace of mind to students and their families. It ensures that students have access to necessary medical care, including routine check-ups, vaccinations, and treatment for illnesses or injuries. This coverage can be particularly valuable for students who may not have a primary care physician or who require specialized medical attention. By including health insurance in financial aid packages, colleges and universities demonstrate their commitment to the holistic development of their students.

The process of applying for financial aid often involves a detailed assessment of a student's financial situation and needs. During this process, students can discuss their healthcare requirements and explore the options available. Financial aid officers can guide students in understanding the different health insurance plans offered and help them choose the most suitable coverage. This personalized approach ensures that students receive the necessary support to make informed decisions about their health and well-being.

Furthermore, health insurance provided through financial aid can have long-term benefits for students. It can help establish a pattern of regular health check-ups and disease prevention, which is essential for maintaining overall health. Additionally, having health insurance can provide students with the confidence to pursue their academic goals without the added stress of financial burdens related to medical expenses. This aspect of financial aid contributes to a supportive and nurturing environment, fostering a positive and productive college experience.

University Students: Customers or Consumers?

You may want to see also

Student Well-being: Insurance ensures students' access to healthcare services for a healthy campus life

The importance of student well-being cannot be overstated, especially in the context of higher education. One crucial aspect of supporting students' overall health and happiness is providing access to quality healthcare services. Many colleges and universities recognize this need and offer health insurance as a vital component of their student support systems.

Health insurance for students ensures that they have the necessary coverage to access a wide range of medical services. This includes routine check-ups, vaccinations, and preventive care, which are essential for maintaining good health. With insurance, students can seek medical attention without the immediate financial burden, allowing them to focus on their academic pursuits and overall well-being. This is particularly important during the transition to university life, where students may experience increased stress, anxiety, and other health challenges.

Having health insurance can empower students to take charge of their health. It encourages them to seek timely medical advice and treatment, which can prevent minor issues from becoming major health concerns. For instance, regular dental check-ups can identify and address oral health problems early on, ensuring students maintain a healthy smile and overall oral hygiene. Similarly, access to mental health services through insurance can provide students with the support they need to manage stress, anxiety, and other mental health issues, promoting a healthier and more balanced campus environment.

Furthermore, student health insurance often covers a comprehensive range of services, including prescription drugs, hospitalization, and specialist referrals. This ensures that students can receive the necessary treatment for various medical conditions. For example, students with chronic illnesses or those requiring regular medications can have peace of mind knowing their prescriptions are covered. This aspect of insurance is especially beneficial for students from diverse backgrounds, ensuring they have equal opportunities to access healthcare without financial barriers.

In summary, offering health insurance to students is a proactive approach to student well-being. It enables students to take care of their health, access essential medical services, and manage any health-related issues that may arise during their university years. By prioritizing student health, colleges and universities contribute to a positive and supportive learning environment, fostering a generation of healthy and resilient individuals.

University of Florida: PharmD Grad Numbers Revealed

You may want to see also

Frequently asked questions

No, health insurance coverage for students varies widely among educational institutions. While many colleges and universities offer some form of health insurance, the extent and quality of coverage can differ significantly. It is essential for students to research and understand the insurance options provided by their chosen university.

Students should contact their institution's student services or financial aid office to gather information about the health insurance plans available. These offices can provide details on the coverage, costs, and any associated benefits, ensuring students make informed decisions regarding their healthcare.

When selecting a health insurance plan, students should consider factors such as coverage scope, network of healthcare providers, premiums, and any additional benefits like mental health support or prescription drug coverage. Comparing different plans and understanding their specific terms and conditions is crucial to finding the best fit for individual needs.

Yes, depending on the country and region, there might be government-funded health insurance programs specifically designed for students. These programs often provide essential healthcare coverage at a lower cost or even free of charge. Students can explore options like the Student Health Insurance Plan (SHIP) in the United States or similar initiatives in other countries to access affordable healthcare during their studies.