Understanding tax obligations is an essential skill for university students, as it can help them manage their finances effectively and avoid any legal issues. When it comes to taxes, students often have unique considerations due to their age, income sources, and financial independence. This guide aims to provide an overview of the key elements university students need to know about taxes, including the types of income they may earn, tax deductions and credits available to students, and the resources and tools they can use to navigate the tax filing process. By familiarizing themselves with these aspects, students can ensure they are compliant with tax laws and make informed decisions about their financial future.

What You'll Learn

- Tax Filing Basics: Understanding tax forms and deductions for students

- Income and Deductions: Tracking earnings and eligible expenses for tax relief

- Student Loan Tax Benefits: Exploring tax breaks for loan payments and interest

- Tax Credits for Education: Learning about credits for tuition and fees

- Tax Planning for Graduates: Strategies to manage taxes post-graduation and beyond

Tax Filing Basics: Understanding tax forms and deductions for students

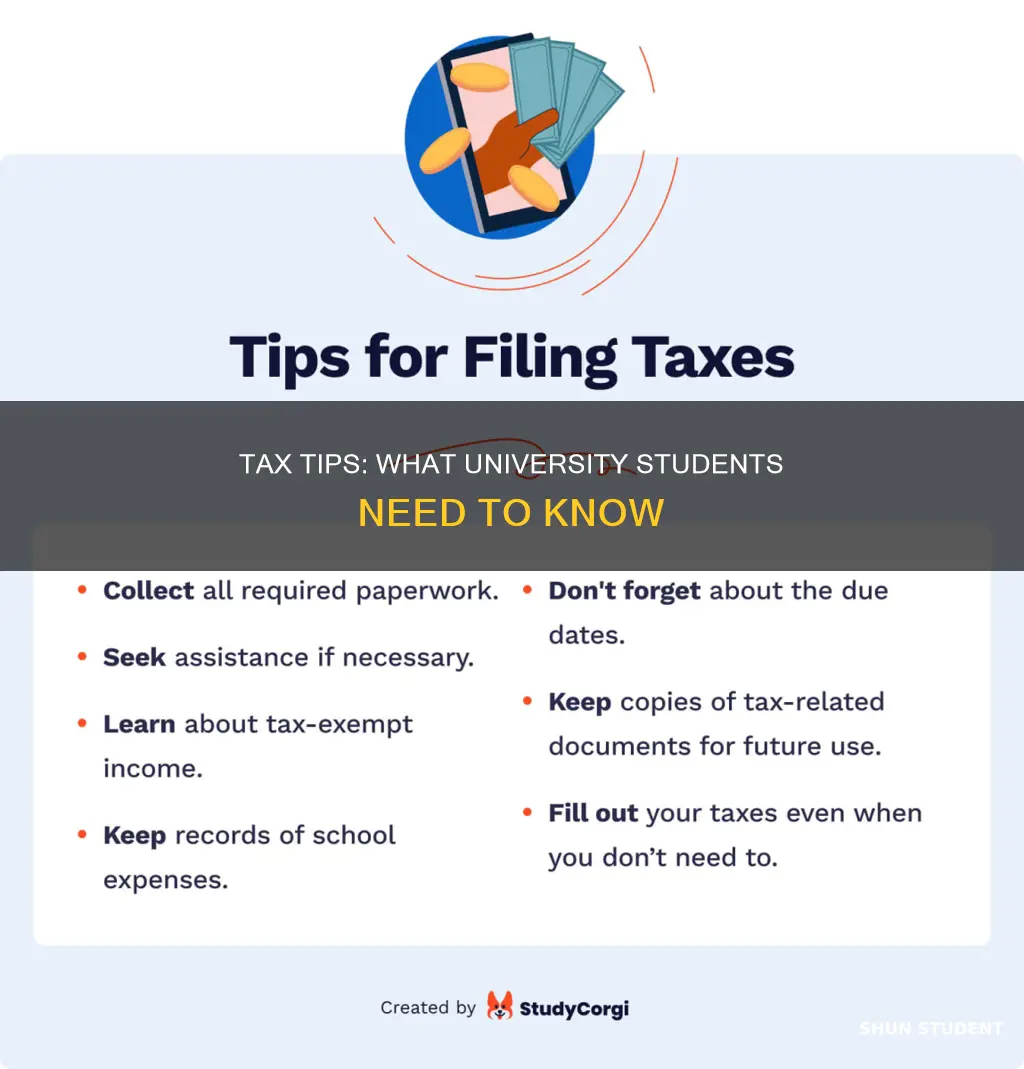

Tax filing can be a daunting task for university students, especially those who are new to the process. Understanding the basics of tax forms and deductions is essential to ensure you are not only compliant with the law but also maximizing any potential refunds. Here's a guide to help students navigate the world of taxes:

Understanding Tax Forms:

The first step in tax filing is recognizing the different forms you might need to complete. For students, the most common forms include IRS Form 1040, which is the standard tax return form for individuals. This form requires you to report your income, expenses, and any deductions you qualify for. Additionally, you may need to complete Schedule 1 (Additional Income and Adjustments to Income) and Schedule D (Sales and Other Income) if you have various sources of income or specific business-related expenses. It's important to note that some students might also need to file Form 8819, 'Parent's Tax Credit for Dependent Care Expenses,' if they qualify for certain tax credits.

Income Reporting:

University students should be aware of the various sources of income that need to be reported. This includes scholarships, grants, and any part-time job earnings. Income from tutoring, freelance work, or summer jobs also needs to be declared. It is crucial to report all income accurately, as this will determine the amount of tax owed or the potential refund. Students should keep records of all income-generating activities and provide supporting documents when filing their taxes.

Deductions and Credits:

Tax deductions and credits can significantly reduce the tax liability for students. Common deductions include tuition and fees, textbooks, and other educational expenses. Students can also claim student loan interest as a deduction, which can be a significant benefit. Additionally, there are specific tax credits available for students, such as the American Opportunity Tax Credit, which provides a credit for qualified higher education expenses. These credits can directly reduce the amount of tax owed, so it's essential to understand which expenses qualify for these benefits.

Filing Process:

When filing taxes, students should consider using tax preparation software or seeking assistance from a tax professional, especially if it's their first time. These tools can guide you through the process, ensuring accuracy and helping you identify all eligible deductions. The IRS also provides free resources and tools, such as the IRS Free File program, which offers free tax preparation and e-filing for eligible taxpayers. This can simplify the process and ensure students meet all the necessary requirements.

Understanding tax forms and deductions is a crucial step in becoming financially responsible as a university student. By taking the time to learn about these basics, students can ensure they are meeting their tax obligations and potentially saving money through deductions and credits. It is always a good idea to stay informed and seek professional advice if needed to navigate the complexities of tax filing.

Columbia University Library Access for Non-Students

You may want to see also

Income and Deductions: Tracking earnings and eligible expenses for tax relief

When it comes to taxes, university students often have unique financial situations that require careful consideration. Understanding income and deductions is crucial for maximizing tax benefits and ensuring compliance with tax laws. Here's a guide on how to track earnings and eligible expenses for tax relief:

Income Tracking:

University students may have various sources of income, including part-time jobs, freelance work, or even summer employment. It's essential to keep detailed records of all income earned. Start by gathering pay stubs, bank statements, and any other relevant documents that show your earnings. Organize this information by the source of income, such as wages from a part-time job, freelance fees, or scholarship payments. Maintaining a record of the amount, date, and purpose of each income source will make the tax filing process smoother.

Deductions and Expenses:

Tax deductions can significantly reduce your taxable income, so it's vital to identify and track eligible expenses. University students can claim deductions for various expenses related to their education and daily living. Common deductions include tuition fees, textbooks, and course-related supplies. Additionally, students can deduct expenses like transportation costs (if using a vehicle for school), internet and phone bills, and even a portion of their rent or mortgage if they have a shared living arrangement with classmates. Keep receipts and records for these expenses, as they will be essential for claiming deductions during tax season.

To make the process more manageable, consider using digital tools or spreadsheets to categorize and track your income and expenses. You can set up different categories for each source of income and subcategories for various deductions. This organized approach will make it easier to identify eligible expenses and calculate the potential tax savings.

Furthermore, it's important to stay informed about tax laws and regulations specific to student taxpayers. The IRS provides resources and guidelines tailored to students, offering insights into the tax implications of different financial situations. Understanding these rules will help you make informed decisions and ensure you take advantage of all applicable deductions.

In summary, tracking income and deductions is a critical aspect of tax preparation for university students. By maintaining organized records of earnings and eligible expenses, students can accurately report their income and claim valuable deductions. This proactive approach will contribute to a smoother tax filing process and potentially result in significant tax savings.

Exploring the Diverse Student Organizations at George Washington University

You may want to see also

Student Loan Tax Benefits: Exploring tax breaks for loan payments and interest

Student loan tax benefits can be a significant relief for many graduates and current students, offering a way to reduce the financial burden of their educational debt. Understanding these tax breaks is essential for anyone managing student loans, as it can lead to substantial savings over time. Here's an overview of the tax advantages related to student loan payments and interest:

Tax Deductions for Student Loan Payments:

One of the most well-known tax benefits for student loan borrowers is the ability to deduct a portion of their loan payments. This deduction is available to individuals who meet certain criteria, primarily that the loan was used for qualified higher education expenses. These expenses typically include tuition, fees, and other related costs incurred by the borrower or their dependent. The Internal Revenue Service (IRS) allows borrowers to claim the interest paid on the loan as a deduction, which can significantly reduce their taxable income. For instance, if a student pays $500 in interest on their loan, this amount can be deducted from their income, potentially lowering their tax liability.

Interest on Student Loans as a Deduction:

In addition to the principal loan payment, the interest accrued on student loans is also tax-deductible. This is particularly beneficial for borrowers who have substantial interest charges, which can accumulate over the life of the loan. By deducting the interest, students can lower their taxable income, thus reducing the amount of tax they owe. It's important to note that this deduction is available for both federal and private student loans, providing a broad range of borrowers with this tax benefit.

Standard Deduction vs. Itemized Deductions:

When claiming student loan tax benefits, borrowers have the option to either take the standard deduction or itemize their deductions. The standard deduction is a fixed amount that reduces taxable income, while itemized deductions allow borrowers to claim specific expenses, including student loan interest. For many students, the interest on their loans can be a significant itemized deduction, making it a more advantageous choice. However, it's essential to keep detailed records of loan payments and interest to ensure compliance with IRS regulations.

Eligibility and Limitations:

Eligibility for these tax benefits often depends on the type of loan and the borrower's financial situation. For instance, federal student loans typically offer more favorable terms and eligibility criteria compared to private loans. Additionally, there are income limits and phase-out rules for certain deductions, meaning that the benefits may decrease or disappear for high-income earners. It is crucial for students to review the IRS guidelines and consult tax professionals to ensure they are taking advantage of all applicable tax breaks.

In summary, student loan tax benefits provide a valuable opportunity for graduates and students to manage their debt more effectively. By understanding and utilizing these deductions, borrowers can significantly reduce their tax burden, making their financial journey post-graduation a little less challenging. Staying informed about tax laws and seeking professional advice can help students maximize their savings and better manage their student loan obligations.

University of Wisconsin Madison: Graduation Rates and Statistics

You may want to see also

Tax Credits for Education: Learning about credits for tuition and fees

Tax credits for education can be a valuable benefit for students, offering financial relief and support for their academic pursuits. These credits are specifically designed to help offset the costs associated with higher education, making it easier for students to manage their tuition fees and other educational expenses. Understanding the ins and outs of these tax credits is essential for students to maximize their financial benefits and ensure they are taking advantage of all available resources.

One of the primary tax credits for education is the American Opportunity Tax Credit (AOTC). This credit is available to students who are enrolled at least half-time in a qualified educational program, such as a degree or certificate program. The AOTC provides a dollar-for-dollar reduction of the student's taxable income, which can significantly lower their overall tax liability. It covers expenses like tuition, fees, and required books and supplies. Students can claim this credit for themselves or for a qualified dependent. The credit amount is generally limited to the student's first four years of post-secondary education, ensuring that it benefits those in their initial stages of higher learning.

Another important credit is the Lifetime Learning Credit (LLC), which is available to students and their dependents. Unlike the AOTC, the LLC is not limited to the first four years of study and can be claimed for any level of education, including graduate and professional programs. This credit provides a partial offset of qualified education expenses, up to a certain percentage of the student's income. The LLC is calculated as a percentage of the student's income, with a maximum credit amount set by the IRS. This credit is particularly beneficial for students pursuing advanced degrees or those who have been out of school for a while and are returning to further their education.

To claim these tax credits, students must complete and submit the appropriate tax forms, typically the Free Application for Federal Student Aid (FAFSA) or similar state-specific forms. These forms require detailed information about the student's financial situation, including income, assets, and educational expenses. It is crucial to provide accurate and up-to-date information to ensure eligibility for the credits. Students should also keep records of all educational expenses, as they may need this documentation to support their tax claims.

In addition to these credits, students may also be eligible for other education-related tax benefits, such as the Tuition and Fee Deduction, which allows a deduction for certain expenses, and the Student Loan Interest Deduction, which can help reduce the tax burden of student loan payments. Understanding the specific rules and limitations of each credit is essential to ensure proper utilization. By exploring these options, students can make informed decisions about their tax strategies and potentially save a significant amount of money during their academic journey.

Northeastern University Student Health Care Services: A Guide to the Building

You may want to see also

Tax Planning for Graduates: Strategies to manage taxes post-graduation and beyond

Tax planning is an essential skill for graduates to navigate the complexities of the tax system and ensure they remain compliant with the law. As a recent graduate, the transition from student life to the working world can be daunting, especially when it comes to understanding and managing one's tax obligations. This guide aims to provide a comprehensive overview of tax planning strategies tailored specifically for graduates, offering practical advice to help them stay on top of their tax responsibilities.

One of the first steps graduates should take is to familiarize themselves with the tax filing requirements in their country or region. Many countries offer tax relief and incentives for recent graduates, such as reduced tax rates or tax credits for education expenses. For instance, in some jurisdictions, graduates may be eligible for a tax credit for student loan interest, which can significantly reduce their taxable income. Understanding these specific graduate-related tax benefits is crucial to maximizing tax savings.

Creating a comprehensive tax plan involves organizing your financial records and understanding your income sources. Graduates often have multiple streams of income, including part-time jobs, freelance work, or even summer internships. It is essential to keep track of all income earned during the year, as this will determine your tax bracket and eligibility for various deductions. Maintaining a well-organized system of receipts, bank statements, and pay stubs will make the tax preparation process much smoother.

A key strategy for graduates is to take advantage of tax-efficient savings and investment options. Many young professionals are eager to start investing, but they should be mindful of the tax implications. Contributing to a retirement account, such as a 401(k) or similar plan, can offer tax benefits and long-term savings advantages. Additionally, graduates can explore tax-efficient investment accounts, such as a Health Savings Account (HSA) or a Flexible Spending Account (FSA), which can help reduce taxable income and provide tax-free benefits for qualified medical expenses.

Furthermore, graduates should consider the timing of their tax planning. The end of the year is a critical period for tax preparation, as it allows for the deduction of certain expenses and the utilization of any remaining tax credits. It is advisable to review your tax situation periodically throughout the year to identify opportunities for tax savings. For example, if you anticipate a significant tax liability, you might consider making estimated tax payments to avoid penalties.

In conclusion, tax planning is a vital aspect of financial management for graduates. By understanding the specific tax benefits available to them, organizing their financial records, and utilizing tax-efficient savings strategies, graduates can effectively manage their tax obligations. Staying informed and proactive in tax planning will not only ensure compliance but also help graduates make the most of their hard-earned income.

St. Louis University Students' Housing Choices: A Comprehensive Guide

You may want to see also

Frequently asked questions

When filing your taxes as a university student, it's important to gather certain documents to ensure an accurate and smooth process. These may include your university transcript or any official documentation related to scholarships, grants, or financial aid received. Additionally, keep track of any income earned during your studies, such as part-time job wages, freelance work, or internship payments. Receipts and records of expenses related to your education, like tuition fees, books, and course materials, are also crucial.

Yes, many university-related expenses can be claimed as tax deductions or credits. Common eligible expenses include tuition fees, textbooks, laboratory fees, and other educational supplies. Some universities also offer tax-free scholarship programs, which can be reported on your tax return. It's advisable to consult a tax professional or use tax preparation software to ensure you're claiming the correct deductions and credits based on your specific circumstances.

University scholarships, including those for academic merit, sports, or community service, are typically tax-free if they meet certain criteria. However, if the scholarship is taxable, you'll need to report it as income. This usually includes any monetary awards, gifts, or grants provided by the university or external organizations. You can report this income on your tax return, and any applicable taxes will be calculated based on your overall income for the year.

Part-time students may have different tax considerations compared to full-time students. If you work part-time during your studies, you can claim student-related expenses as deductions, such as transportation costs to and from class, study materials, and a portion of your living expenses if you're not living with your parents. Additionally, any income earned from part-time work may be exempt from taxes if it falls below a certain threshold, but it's essential to keep records of your earnings and expenses to ensure accurate tax reporting.