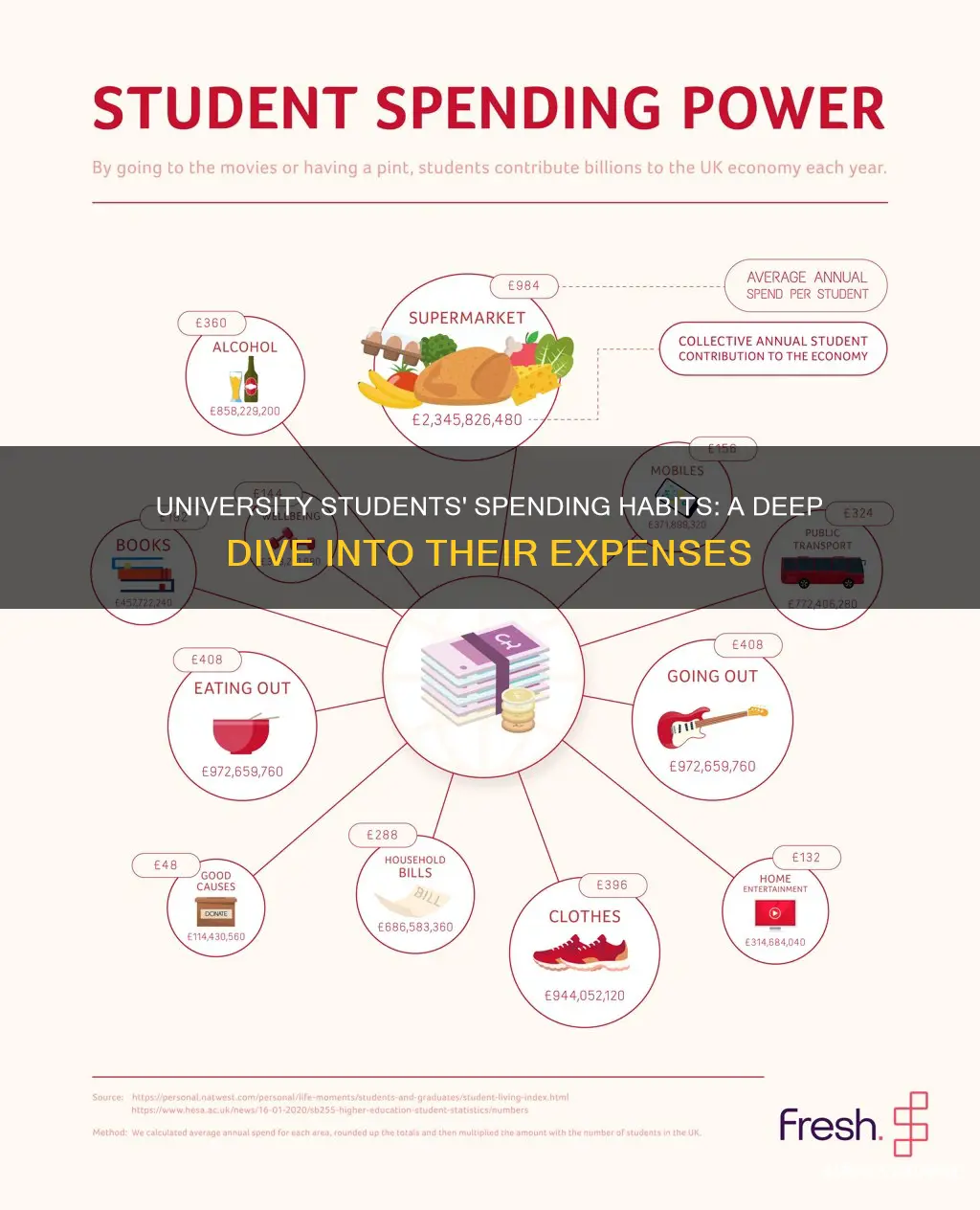

University students often face financial challenges as they navigate the transition to adulthood and independence. Understanding their spending habits is crucial for both students and institutions to provide appropriate support and resources. This paragraph aims to explore the various expenses that university students typically encounter, ranging from essential costs like tuition and accommodation to everyday necessities and leisure activities. By examining these aspects, we can gain insight into the financial landscape of students and potentially identify areas where guidance and assistance can be offered to enhance their overall well-being and academic success.

What You'll Learn

- Textbooks and Course Materials: Students often buy or rent textbooks, notes, and other resources

- Social Activities: Parties, events, and outings with friends are common expenses

- Transportation: Commuting to campus, attending off-campus classes, or traveling for study abroad

- Food and Dining: Meals, snacks, and beverages at campus cafes or restaurants

- Entertainment: Streaming services, video games, concerts, and other leisure activities

Textbooks and Course Materials: Students often buy or rent textbooks, notes, and other resources

University students often face a significant financial burden when it comes to their education, and one of the most substantial expenses is the cost of textbooks and course materials. These resources are essential for academic success, providing the foundation for understanding complex subjects and keeping students informed about the latest developments in their fields. The high price tags on these materials can be a challenge, especially for those on a tight budget.

Textbooks, in particular, are a staple in a student's life. They are the primary source of information for most courses and are often required to be purchased or rented from the institution's bookstore or online platforms. These books are typically written by renowned authors and experts in their respective fields, ensuring a high level of academic rigor. However, the cost can be staggering, with some textbooks retailing for over $200, and in certain specialized fields, even more. Students often have no choice but to invest in these expensive resources, as they are essential for their studies.

Renting textbooks has become a popular alternative to buying, especially for students who want to save money or those who are uncertain about the long-term value of a particular course. Many universities now offer digital rental options, allowing students to access the content online for a limited period. This approach is environmentally friendly and often more cost-effective, as it eliminates the need for physical storage and reduces the risk of the book becoming outdated. However, it's important to note that digital rentals may not always provide the same level of engagement and interaction as physical textbooks, and some students prefer the traditional reading experience.

In addition to textbooks, students also incur expenses for other course materials, such as lecture notes, study guides, and laboratory manuals. These resources are often provided by the instructors or required readings, and they can be equally costly. For instance, a comprehensive study guide for a challenging exam might retail for around $50, while a set of detailed lecture notes could cost even more. Students often have to make difficult choices, deciding between purchasing these materials or allocating their funds to other essential expenses.

To manage these financial challenges, students can explore various strategies. Some may opt for second-hand textbooks, which are often significantly cheaper and can be purchased from online marketplaces or campus resale shops. Others might consider creating study groups to share resources and costs. Additionally, many universities now offer open-educational resources, providing free or low-cost digital alternatives to traditional textbooks, which can be a valuable option for budget-conscious students.

Addressing Student Homelessness: University Strategies and Support

You may want to see also

Social Activities: Parties, events, and outings with friends are common expenses

University life is a vibrant and social experience, and for many students, a significant portion of their budget goes towards social activities and gatherings with friends. These events are an essential part of the university journey, offering a break from academic pressures and a chance to build lifelong friendships.

One of the most prominent expenses in this category is attending parties. University parties can range from small gatherings in student accommodation to large-scale events organized by societies or sports teams. Students often contribute to the cost of party supplies, drinks, and snacks, and many host their own events to showcase their creativity and hospitality. These parties provide an opportunity to bond with peers, celebrate milestones, and create lasting memories.

Events and outings are another significant expense for students. These can include society events like concerts, film screenings, or cultural festivals, which often require tickets or entry fees. Students may also organize group trips to nearby cities or attractions, sharing travel costs and accommodation expenses. Outings could be as simple as a weekend getaway to explore a new town or a day trip to a nearby beach or national park. These activities foster a sense of community and provide a break from the routine of campus life.

Social events and outings often involve food and entertainment, which can be costly. Students may organize potluck-style dinners or BBQs, where everyone contributes a dish, or they might opt for eating out at local restaurants or cafes. Entertainment expenses could include movie nights, game tournaments, or even simple card games and board games. These activities encourage teamwork and friendly competition, strengthening the bond between friends.

Managing these social expenses is an art. Many students create group budgets to ensure everyone contributes fairly, and they may also look for discounts or free events to keep costs down. Some universities offer student discounts or event subsidies, making these social activities more accessible and affordable. Balancing the desire for social engagement with financial responsibility is a skill that students learn and develop throughout their university years.

Should Universities Share the Risk of Student Debt?

You may want to see also

Transportation: Commuting to campus, attending off-campus classes, or traveling for study abroad

University students often have various transportation needs that contribute significantly to their overall expenses. One of the primary costs is commuting to campus, which can vary depending on the student's location and the mode of transportation. For those living close to their university, walking or cycling is a common and cost-effective option. However, for students who live further away, public transportation becomes a necessity. Monthly or semester passes for buses, trains, or subways can be a significant expense, especially for those in urban areas with high public transport costs. Some students might also opt for carpooling or ride-sharing services, which can be more affordable but may require a small contribution from each rider.

Attending off-campus classes or study sessions can also incur transportation costs. Students might need to travel to libraries, laboratories, or other facilities located away from the main campus. This could involve using personal vehicles, which would include fuel, maintenance, and parking expenses. Alternatively, they might rely on public transportation or, in some cases, arrange for a designated driver, which can be a convenient but potentially costly arrangement.

For students participating in study abroad programs, transportation costs can be substantial. International travel expenses, including flights or other modes of transportation, can be a significant one-time cost. Once abroad, students may need to navigate new transportation systems, which could involve learning the local public transport network or even purchasing a local transport pass. Additionally, off-campus trips for cultural experiences or field studies will require further travel arrangements, potentially including international train or bus travel, which can be expensive.

Managing these transportation expenses is crucial for university students. Many institutions offer student discounts for public transportation, and some provide access to campus shuttle services or bike-sharing programs. Students can also consider carpooling with classmates or roommates to split fuel and parking costs. With careful planning and awareness of available resources, students can better manage their transportation expenses and ensure they have the necessary funds for other essential university-related costs.

Exploring Central Michigan University's Student Population

You may want to see also

Food and Dining: Meals, snacks, and beverages at campus cafes or restaurants

University students often have a limited budget, and their spending habits reflect their need for affordable and convenient options. When it comes to food and dining, campus cafes and restaurants cater to a variety of student preferences and financial constraints. Here's an overview of how students allocate their funds in this area:

Meal Choices: University students typically opt for a mix of on-campus dining options. Many students take advantage of the campus cafeteria or food court, where they can find a variety of meals at reasonable prices. These venues often offer a selection of soups, salads, sandwiches, and hot dishes, allowing students to customize their meals according to their taste and dietary needs. The affordability of these options makes them a popular choice for those on a tight budget.

Snack Options: Snacking is an essential part of a student's daily routine, providing energy and sustenance between classes. Campus cafes usually stock a range of snacks, including chips, cookies, nuts, and fruit. Some students also bring their own snacks, such as homemade granola bars or trail mix, to save money. The availability of these convenient snack options ensures that students can maintain their energy levels throughout their busy schedules.

Beverage Selection: Drinks play a significant role in a student's daily expenditure. Campus cafes often provide a wide array of beverages, including coffee, tea, soft drinks, and sometimes even specialty drinks like smoothies or juices. Students may opt for cheaper alternatives like tap water or refillable water bottles to save money. Additionally, some universities offer discounted or free coffee or tea options for students, making it an affordable way to stay hydrated and energized.

Budget-Friendly Strategies: To make the most of their limited budgets, students employ various strategies. Many opt for buying in bulk, taking advantage of discounts for larger purchases. Some students also utilize student discounts offered by campus restaurants or cafes. Another popular approach is to plan meals and snacks in advance, creating a weekly menu to avoid unnecessary spending. This strategic approach ensures that students can enjoy a variety of food options while managing their finances effectively.

Social Dining: Campus dining areas also serve as social hubs, where students gather to socialize and connect. Group meals and study sessions at cafes or restaurants are common, fostering a sense of community. Students often allocate a portion of their budget for these social dining experiences, creating a balance between their academic responsibilities and social life. This aspect of campus dining contributes to a well-rounded university experience.

University Science Class Sizes: How Many Students?

You may want to see also

Entertainment: Streaming services, video games, concerts, and other leisure activities

University students often have a limited budget, but they still seek ways to enjoy their leisure time and unwind after a long day of studying. Entertainment is a significant aspect of their spending, and there are several ways they like to spend their money on fun and relaxation.

Streaming services have become a popular choice for entertainment among students. With the rise of on-demand platforms like Netflix, Hulu, and Amazon Prime Video, they can access a vast library of movies, TV shows, and documentaries at their convenience. These services offer a cost-effective way to watch the latest releases and classic films, providing a personalized viewing experience. Many students also enjoy the flexibility of streaming, allowing them to watch content anytime, anywhere, as long as they have an internet connection. This accessibility has made streaming services a go-to option for entertainment, especially during the busy university schedule.

Video games are another significant entertainment expense for students. The gaming industry has seen tremendous growth, and with the advent of powerful gaming consoles and high-speed internet, students can now access a wide range of games. From action-packed adventures to relaxing puzzle games, the options are endless. Many students invest in gaming consoles, such as the PlayStation or Xbox, and also purchase games individually or through subscription services. Online multiplayer games have also gained popularity, allowing students to connect and play with friends remotely. The gaming community is vast, and students often attend gaming tournaments or events, which can be a significant expense, but one that provides an exciting social experience.

Concerts and live music events are a favorite pastime for many university students. Attending a live performance allows them to immerse themselves in the energy of the crowd and enjoy their favorite artists in person. Students often save up to buy concert tickets, which can be a substantial investment. They may also spend money on merchandise, such as band t-shirts or albums, to support their favorite musicians. The live music scene caters to various tastes, from pop and rock to indie and electronic genres, ensuring that students have ample opportunities to enjoy different types of music.

In addition to streaming, gaming, and concerts, university students also spend money on various other leisure activities. Some enjoy going to the cinema to watch the latest blockbusters, while others prefer spending time at the local gym or fitness studio to stay active. Outdoor activities like hiking, camping, or joining sports teams are also popular choices. Students may also allocate funds for social events, such as student club gatherings, parties, or trips, which provide a sense of community and shared experiences. These activities contribute to a well-rounded university life and often leave lasting memories.

Managing entertainment expenses is essential for students to maintain a healthy balance between their academic and social lives. Many students opt for budget-friendly options, such as free or low-cost events, student discounts, or sharing costs with friends. They may also prioritize their spending, ensuring that entertainment remains a significant part of their university experience without compromising their financial stability.

Presentations in University: Are They Inevitable?

You may want to see also

Frequently asked questions

University students often face a range of expenses, including tuition fees, accommodation costs, textbooks and course materials, transportation, and daily living expenses. These costs can vary depending on the student's location, the type of university, and individual circumstances.

The cost of attending university can vary significantly. Tuition fees alone can range from a few thousand to tens of thousands of dollars per year, depending on the country, institution, and program. Additionally, students may need to consider living expenses, which can include accommodation, food, utilities, and other personal costs.

Yes, there are several strategies students can employ to manage their finances. These include seeking financial aid and scholarships, utilizing student discounts, working part-time or full-time during the academic year, and exploring options for student loans or financial assistance programs provided by the university.

Accommodation expenses can be a significant portion of a student's budget. This includes rent or mortgage payments for off-campus housing, or on-campus residence fees. Other costs may include utilities (electricity, water, internet), maintenance, and any shared expenses with roommates or flatmates.

Effective money management is crucial for students. Strategies include creating a budget and sticking to it, tracking expenses, prioritizing needs over wants, saving for future expenses, and exploring ways to reduce unnecessary costs. Many universities also provide financial literacy resources and workshops to help students make informed financial decisions.