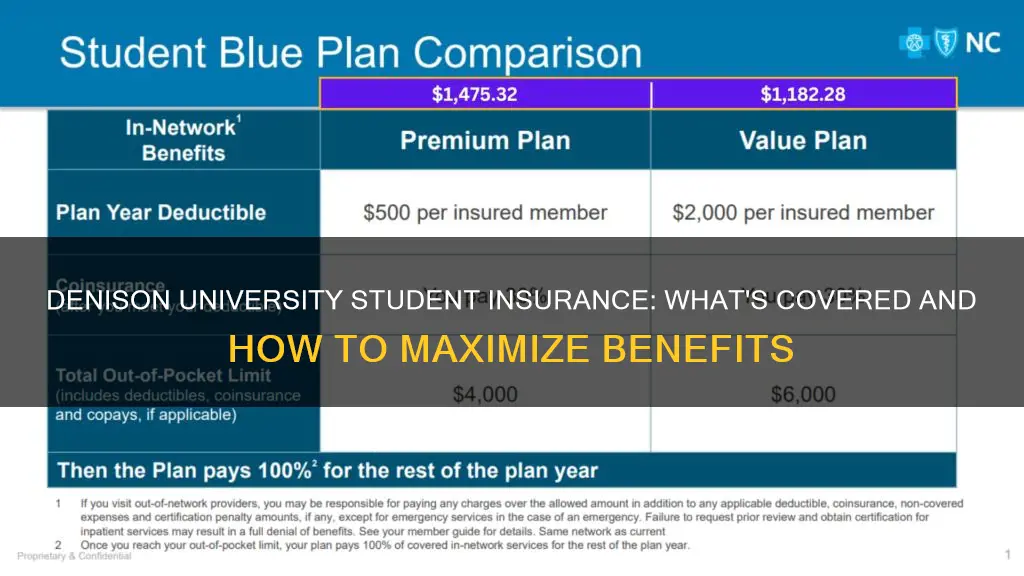

Denison University Student Insurance is a comprehensive coverage plan designed to provide financial protection and peace of mind to students enrolled at the university. This insurance policy is tailored to meet the unique needs of the student population, offering a range of benefits that can help cover various medical and personal expenses. From emergency room visits to prescription medications, the plan aims to ensure that students receive the necessary care and support during their academic journey. Understanding the specific coverage details is essential for students to make informed decisions about their healthcare and overall well-being while at Denison University.

What You'll Learn

- Medical Expenses: Coverage for doctor visits, surgeries, and hospital stays

- Prescription Drugs: Assistance with medication costs and refills

- Mental Health Services: Therapy, counseling, and psychiatric care

- Emergency Room Visits: Treatment for sudden illnesses or injuries

- Vision and Dental Care: Eye exams, glasses, and dental treatments

Medical Expenses: Coverage for doctor visits, surgeries, and hospital stays

Denison University's student insurance plan provides comprehensive coverage for various medical expenses, ensuring that students receive the necessary care without incurring substantial financial burdens. One of the primary focuses of this insurance is to cover the costs associated with doctor visits, surgeries, and hospital stays, which are essential aspects of maintaining a student's health and well-being.

When it comes to doctor visits, the insurance typically covers routine check-ups, consultations, and treatments. This includes visits to primary care physicians, specialists, and even urgent care centers. The coverage often extends to a wide range of medical services, such as diagnostic tests, vaccinations, and prescription medications. Students can seek medical attention for various health concerns, from minor injuries to chronic conditions, without worrying about excessive out-of-pocket expenses.

Surgery is another critical area covered by the student insurance. Whether it's a routine procedure or a complex operation, the plan aims to provide financial protection for students. This coverage includes pre-operative and post-operative care, ensuring that students receive the necessary support before and after the surgery. It covers a broad spectrum of surgical procedures, from minor surgeries like appendectomies to more complex interventions such as joint replacements or heart surgeries. The insurance policy will outline specific surgical procedures covered and any associated costs.

Hospital stays are also an essential component of medical coverage. The insurance plan typically covers expenses related to inpatient care, including room and board, nursing services, and various medical treatments. This coverage ensures that students receive the necessary care in a hospital setting, whether it's a short-term stay for observation or a longer-term admission for treatment. The insurance may also provide coverage for specialized hospital units, such as intensive care units, and offer financial protection for the duration of the hospital stay.

In summary, Denison University's student insurance plan offers extensive coverage for medical expenses, particularly focusing on doctor visits, surgeries, and hospital stays. This comprehensive approach ensures that students have access to quality healthcare services without facing financial barriers. It is crucial for students to understand the specific details of their insurance policy, including any exclusions or limitations, to make informed decisions regarding their medical care.

Exploring Towson University's Student Population

You may want to see also

Prescription Drugs: Assistance with medication costs and refills

Denison University's student insurance plan offers comprehensive coverage for prescription drugs, ensuring that students have access to essential medications without incurring significant financial burdens. The insurance policy is designed to provide assistance with medication costs and refills, offering a safety net for students who require regular prescriptions.

When it comes to medication costs, the insurance plan typically covers a significant portion of the expenses associated with filling prescriptions. This coverage can vary depending on the specific plan and the student's individual needs. In general, the plan aims to reduce the financial impact of prescription drugs by negotiating discounted rates with pharmacies and pharmaceutical companies. Students can present their insurance card or ID at the pharmacy to access these discounted prices, ensuring that essential medications are affordable and accessible.

Assistance with medication refills is another crucial aspect of the coverage. Many students rely on regular refills of their prescriptions to manage chronic conditions or maintain their health. The insurance plan streamlines the refill process by providing a network of preferred pharmacies that facilitate quick and convenient refills. Students can usually obtain refills without incurring additional costs, ensuring they have a continuous supply of their necessary medications. This aspect of the coverage is particularly beneficial for students who may have difficulty accessing transportation or who prefer the convenience of local pharmacies.

In addition to cost assistance, the insurance plan may also offer support services related to prescription drugs. This could include access to a dedicated pharmacy team that provides guidance on medication management, potential side effects, and interactions. Such services can empower students to make informed decisions about their prescriptions and overall health. Furthermore, the plan might offer resources for students to explore generic alternatives, which can be more cost-effective without compromising on quality.

It is important for students to review the specific details of their insurance plan, as coverage for prescription drugs can vary. Understanding the terms and conditions, including any exclusions or limitations, will enable students to navigate the system effectively and make the most of the available benefits. By doing so, students can ensure they receive the necessary medications and support while also managing their healthcare expenses efficiently.

Exploring Lipscomb University's Student Population and Campus Life

You may want to see also

Mental Health Services: Therapy, counseling, and psychiatric care

Denison University's student insurance plan offers comprehensive coverage for mental health services, recognizing the importance of supporting students' overall well-being. The insurance aims to provide access to various therapeutic and counseling options to address a wide range of mental health concerns.

Therapy and counseling services are a cornerstone of the mental health coverage. Students can access individual therapy sessions with licensed mental health professionals. These sessions can help students navigate personal challenges, manage stress, and work through various mental health issues. The insurance typically covers a certain number of sessions per semester or year, ensuring students can receive ongoing support when needed. Group therapy sessions may also be available, providing a supportive environment for students to share experiences and learn from peers.

In addition to traditional therapy, the insurance may include coverage for psychiatric care. This involves assessments and consultations with psychiatrists or psychiatric nurse practitioners. These professionals can diagnose and treat mental health disorders, often prescribing medication when appropriate. The coverage might include initial evaluations, medication management, and regular check-ins to monitor progress and adjust treatment plans as necessary.

Denison University's student insurance often provides a dedicated mental health team or a network of providers. This team can offer a range of services, including crisis intervention, referrals to specialized care, and ongoing support. They may also provide educational resources and workshops to promote mental well-being and help students understand the importance of self-care.

It is essential for students to familiarize themselves with the specific details of their insurance coverage, including any co-pays, deductibles, or limitations. Understanding these aspects will ensure that students can access the mental health services they need without unexpected financial burdens. The university's student health services or the insurance provider's website can offer detailed information regarding coverage and utilization.

Business Students at the University of Florida: How Many?

You may want to see also

Emergency Room Visits: Treatment for sudden illnesses or injuries

When it comes to emergency room visits, understanding the coverage provided by your student insurance plan at Denison University is crucial for navigating unexpected medical situations effectively. Student insurance plans typically offer comprehensive coverage for emergency care, ensuring that you receive the necessary treatment without incurring substantial out-of-pocket expenses.

In the event of a sudden illness or injury, the emergency room (ER) is often the first point of contact for medical attention. These visits can range from minor injuries like sprains and cuts to more severe conditions such as allergic reactions, infections, or traumatic injuries. During these visits, healthcare professionals will assess your condition, provide necessary treatments, and stabilize your health.

Denison University's student insurance policy usually covers a wide range of emergency room services. This includes diagnostic tests, such as X-rays, blood work, and imaging scans, which are essential for determining the cause of your symptoms. Treatment may involve medications, intravenous fluids, wound care, or even surgical procedures in critical cases. The insurance plan aims to cover these services to ensure you receive timely and appropriate care.

It's important to note that the level of coverage and any potential out-of-pocket costs can vary depending on the specific insurance provider and the plan's details. Some plans might have a deductible or co-payment for emergency room visits, while others may cover the entire cost. Understanding your insurance policy's terms and conditions is vital to ensure you receive the maximum benefits during emergencies.

In summary, emergency room visits for sudden illnesses or injuries are typically well-covered by Denison University's student insurance plans. The focus is on providing essential medical care and managing your condition effectively. Being aware of your insurance coverage and any associated costs will enable you to make informed decisions and seek the necessary treatment without undue financial burden.

Shippensburg University's Student Population: How Many Attend?

You may want to see also

Vision and Dental Care: Eye exams, glasses, and dental treatments

Denison University's student insurance plan provides comprehensive coverage for vision and dental care, ensuring that students can maintain their eye and oral health without incurring significant financial burdens. Here's a breakdown of what is typically covered:

Eye Exams: Regular eye examinations are essential for maintaining good vision and detecting any potential eye health issues. The student insurance plan usually covers annual comprehensive eye exams, which may include visual acuity tests, refraction assessments, and checks for eye diseases like glaucoma or cataracts. These exams are often provided by on-campus optometrists or affiliated eye care professionals.

Glasses and Contact Lenses: If you require vision correction, the insurance plan will typically cover the cost of prescription eyeglasses or contact lenses. This coverage often includes a set amount for frames, lenses, or a combination of both. Some plans may also offer discounts or special rates for students purchasing glasses or contact lenses outside of the university's network.

Dental Services: Dental care is an essential aspect of overall health. The student insurance policy generally covers a range of dental treatments, including:

- Preventive Care: Regular dental check-ups, cleanings, and x-rays are usually covered to promote oral health and prevent dental issues.

- Restorative Dentistry: Fillings, root canals, and dental crowns are often included in the coverage to address dental problems and restore oral function.

- Orthodontics: Braces or other orthodontic treatments may be partially or fully covered, depending on the specific plan.

- Emergency Care: Unplanned dental visits for emergencies, such as toothaches or injuries, are typically covered.

It's important to note that the extent of coverage for vision and dental care can vary depending on the specific student insurance plan provided by Denison University. Students should carefully review their insurance documents or contact the university's student health services to understand the details of their coverage, including any exclusions or limitations. Additionally, students can often take advantage of on-campus dental and vision clinics, which may offer more affordable rates and convenient access to care.

Maryland University: Graduating Thousands of Students Annually

You may want to see also

Frequently asked questions

Student insurance is a comprehensive coverage plan designed to support the well-being of students by providing financial protection and access to healthcare services during their time at the university. It ensures that students can focus on their academic pursuits without the added stress of unexpected medical expenses.

Yes, the insurance policy typically covers medical expenses that arise from accidents or illnesses, even when the student is away from campus. This includes coverage for emergency room visits, doctor consultations, prescription medications, and hospitalization, among other medical services.

Like any insurance policy, there may be certain limitations and exclusions. For instance, pre-existing conditions might have specific waiting periods before coverage begins, and some elective procedures or cosmetic treatments may not be fully covered. It's essential to review the policy details to understand what is and isn't covered.

Students can access the insurance benefits by presenting their student ID or relevant documentation when seeking medical care. They should also be aware of the process for filing claims, which may involve providing receipts, medical reports, and other necessary documentation to the university's insurance office.

Denison University's student insurance plan might offer some level of customization, allowing students to choose specific coverage options that best suit their needs. This could include adding or removing certain benefits, such as vision care, dental coverage, or mental health services, to create a personalized insurance package.