Dropping out of university can have significant financial implications for students, especially those who have already invested time and money into their education. The decision to leave a course prematurely can impact not only the immediate financial burden but also long-term career prospects and earning potential. This paragraph will explore the financial consequences of dropping out, including the loss of financial aid, potential debt accumulation, and the challenges of re-entering the job market or pursuing further education. It will also discuss strategies for managing these financial impacts and making informed decisions about one's academic and professional future.

What You'll Learn

- Financial Aid: Dropouts may lose access to scholarships, grants, and loans, impacting future financial aid

- Tuition Costs: Dropping out can lead to wasted tuition fees, especially if you've already paid for the semester

- Student Loans: Defaulting on loans is a risk, with potential consequences like late fees and a damaged credit score

- Employment: A degree can enhance job prospects; without one, finding employment may be more challenging

- Career Progression: Dropping out can delay career goals, affecting long-term professional success and earning potential

Financial Aid: Dropouts may lose access to scholarships, grants, and loans, impacting future financial aid

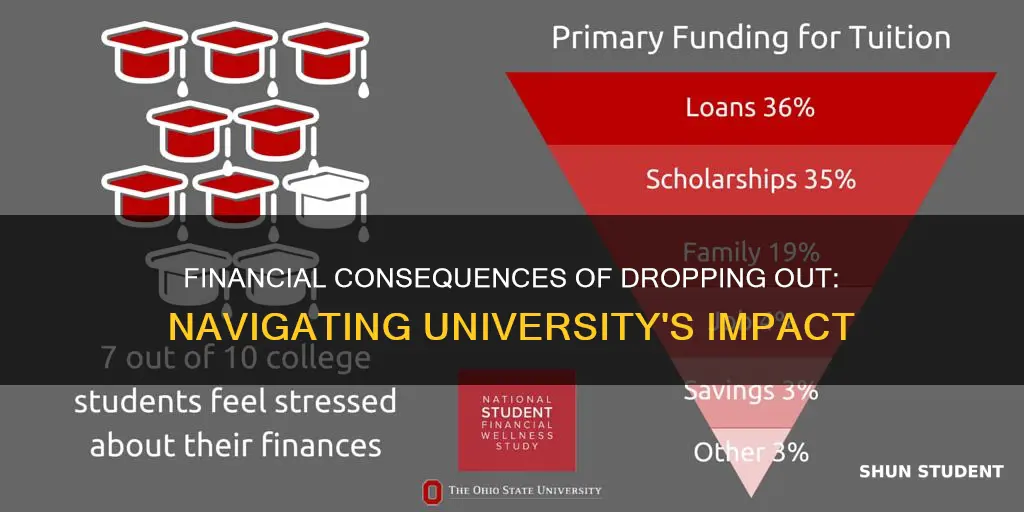

Dropping out of university can have significant financial implications, especially when it comes to the various forms of financial aid that students often rely on. One of the most immediate consequences is the potential loss of access to scholarships, grants, and loans, which are crucial for covering educational expenses. These financial aid options are typically based on a student's academic performance, financial need, and, in some cases, their enrollment status. When a student decides to leave their institution, they may no longer meet the criteria for these aid programs.

Scholarships, for instance, are often awarded to students who demonstrate academic excellence, leadership qualities, or a specific skill set. These awards are highly competitive and are designed to support students throughout their educational journey. If a student withdraws from their program, they might no longer be considered for these scholarships, especially if the award was tied to their continued enrollment. Similarly, grants, which are typically need-based, may also be at risk. Financial aid offices often reassess the financial situation of students who drop out, and if their circumstances no longer align with the grant's criteria, they could lose this vital source of funding.

Student loans, another essential component of financial aid, are also affected by dropout status. Federal and private loans often require students to maintain satisfactory academic progress to remain eligible. When a student drops out, they may no longer meet this requirement, leading to potential loan repayment issues. In some cases, dropping out could result in the immediate need to start repaying loans, causing financial strain, especially if the student had planned to continue their education and gradually manage loan repayments.

Furthermore, the impact of dropping out on future financial aid opportunities cannot be overlooked. Many students rely on their academic record and financial aid history to secure funding for graduate school or other advanced educational pursuits. A dropout status may create a gap in their academic record, making it challenging to access scholarships, grants, or loans for further studies. This can significantly limit their options and potentially delay their career goals, especially if the field of study requires advanced degrees.

In summary, the decision to drop out of university has far-reaching financial consequences, particularly regarding scholarships, grants, and loans. Students should carefully consider the potential loss of these financial aid opportunities and the long-term impact on their educational and career prospects. It is essential to explore all available options and seek guidance from financial aid advisors to navigate the financial implications of such a significant life decision.

Columbia University's Student Body: A Diverse and Vibrant Community

You may want to see also

Tuition Costs: Dropping out can lead to wasted tuition fees, especially if you've already paid for the semester

Dropping out of university can have significant financial implications, particularly when it comes to tuition costs. If you've already paid your tuition fees for the semester, continuing your studies is a commitment that you've made to the institution. When you decide to drop out, the financial burden of those fees remains on you. This can be a substantial amount, often covering a significant portion of your annual expenses. The decision to leave can be challenging, especially if you've invested a considerable sum of money and time into your education.

The financial impact is twofold. Firstly, you've already paid for the services and resources that the university provides, including lectures, facilities, and support staff. These costs are typically non-refundable, meaning you won't get a refund for the remaining semester. Secondly, dropping out may result in a loss of financial aid and scholarships that were contingent on your continued enrollment. This can further exacerbate the financial strain, especially if you were relying on these sources of funding to cover your expenses.

It's important to carefully consider the reasons for your potential dropout. If you're facing financial difficulties, it might be worth exploring alternative solutions such as seeking financial aid, applying for grants, or discussing payment plans with the university. Many institutions offer support and resources to help students manage their finances and continue their education. They may provide options like deferring enrollment, reducing course loads, or exploring alternative study options that could help you stay enrolled without incurring additional debt.

Additionally, if you've already paid for the semester and decide to drop out, you may also need to consider the costs associated with leaving the university. This could include expenses for moving out of your student accommodation, selling or storing personal belongings, and potentially finding a new place to live if you were relying on university housing. These additional costs can further contribute to the financial burden of dropping out.

In summary, dropping out of university can result in wasted tuition fees, especially when you've already paid for the semester. It's crucial to carefully evaluate your financial situation and explore all available options before making a decision. Seeking financial advice and understanding the university's policies regarding withdrawals and refunds can help mitigate the potential financial losses associated with dropping out.

The Elite Ivy Leaguers: Yale University Students

You may want to see also

Student Loans: Defaulting on loans is a risk, with potential consequences like late fees and a damaged credit score

Defaulting on student loans can have significant and long-lasting consequences, and it's important to understand the potential risks before making any decisions. When you fail to make payments on your student loans, you enter a state of default, which can lead to a series of financial complications. One of the immediate effects is the accumulation of late fees. These fees can add up quickly, increasing the total amount you owe. Late fees are typically charged for each missed payment, and they can be substantial, especially if you have multiple missed payments. This additional financial burden can make it even more challenging to repay the loan.

The impact on your credit score is another critical aspect. Your credit score is a crucial factor in your financial health, as it determines your creditworthiness. When you default on a loan, it gets reported to credit bureaus, and this negative information can significantly lower your credit score. A poor credit score can have long-term implications, making it harder to secure future loans, credit cards, or even rent an apartment. Lenders and landlords often review credit reports, and a default will likely raise red flags, potentially leading to rejections or higher interest rates.

Furthermore, defaulting on student loans can result in wage garnishment. In some cases, the government or the loan servicer can legally require a portion of your wages to be withheld and applied to the outstanding loan balance. This process can be stressful and may impact your ability to meet other financial obligations. Additionally, defaulting may lead to legal action, including lawsuits and potential asset seizures, which can further exacerbate your financial situation.

It's essential to explore all available options before considering default. If you're struggling to make payments, reach out to your loan servicer and discuss potential solutions. They may offer forbearance, which allows temporary relief from payments, or provide alternative repayment plans that better suit your financial circumstances. Many loan servicers also offer financial counseling services to help borrowers manage their debt effectively.

In summary, defaulting on student loans is a serious matter that can have far-reaching consequences. Late fees, a damaged credit score, wage garnishment, and legal issues are just a few of the potential outcomes. It is crucial to approach student loan repayment with a strategic mindset, seeking help when needed to avoid these detrimental situations. Understanding your options and taking proactive steps can help mitigate the risks associated with student loan default.

Exploring Sacred Heart University's Student Population

You may want to see also

Employment: A degree can enhance job prospects; without one, finding employment may be more challenging

The decision to drop out of university can have significant implications for your future, especially when it comes to employment prospects. While it may seem like a tempting option to avoid financial strain or personal dissatisfaction, the impact on your career path should not be overlooked. Here's an exploration of how a university dropout's journey might differ from someone with a degree:

Enhanced Job Prospects: One of the most apparent advantages of having a university degree is the potential boost it gives to your employment opportunities. Many employers require a bachelor's degree as a minimum qualification for entry-level positions, especially in fields like business, finance, engineering, and healthcare. A degree signifies a certain level of knowledge, critical thinking skills, and a basic understanding of your chosen discipline, making you a more attractive candidate. It opens doors to a wider range of job opportunities and can even lead to more competitive salaries and benefits.

Challenges in the Job Market: Without a degree, the job market can present unique challenges. Many entry-level positions are specifically tailored for graduates, and without a degree, you may find yourself competing with a more extensive pool of candidates. Certain industries and roles may require specific qualifications or certifications, which can be difficult to obtain without a degree. For instance, professions in law, medicine, teaching, and research often mandate advanced degrees or specialized training. As a result, you might need to consider alternative career paths or be prepared to invest in further education to bridge the gap.

Alternative Career Paths: Dropping out of university doesn't necessarily mean you have to abandon your career aspirations entirely. It could be an opportunity to explore different avenues. Consider pursuing vocational training or apprenticeships, which can provide practical skills and on-the-job experience. Many trades and professions offer pathways to certification and licensing, which can be valuable assets. Additionally, entrepreneurship and freelance work have become increasingly popular, allowing individuals to leverage their unique skills and talents without the traditional degree requirement.

Personal Development and Lifelong Learning: University provides not only academic knowledge but also a platform for personal growth and networking. Dropping out might mean missing out on these opportunities. However, it also emphasizes the importance of lifelong learning. You can consider enrolling in online courses, attending workshops, or pursuing certifications to enhance your skills and stay relevant in the job market. Many online platforms offer flexible learning options, allowing you to upskill while working or managing other commitments.

In summary, while dropping out of university may impact your immediate employment prospects, it doesn't define your future. It is a personal decision that should consider your long-term goals and the specific requirements of your desired career path. With careful planning, a willingness to adapt, and a commitment to continuous learning, you can navigate the post-university journey successfully, whether it involves a degree or not.

Rice University's Graduate Student Population: How Many?

You may want to see also

Career Progression: Dropping out can delay career goals, affecting long-term professional success and earning potential

Dropping out of university can have significant implications for your career trajectory, especially in fields like finance, where a degree is often a prerequisite for entry-level positions. The decision to leave an educational program can be challenging, but understanding the potential consequences is crucial for making an informed choice. Here's an exploration of how dropping out might impact your career progression in the financial sector:

Delayed Entry into the Job Market: Obtaining a degree is typically a gateway to various career opportunities. In finance, many roles require a bachelor's degree, and sometimes even a master's degree, as a minimum qualification. If you decide to drop out, you may find yourself at a disadvantage when competing for these positions. Employers often prioritize graduates, and without a degree, you might miss out on initial job prospects, leading to a delay in entering the professional world.

Limited Access to Networking Opportunities: University provides a unique platform for networking, which is invaluable in the job market. Through classes, extracurricular activities, and campus events, students can connect with peers, alumni, and industry professionals. These connections can lead to mentorship, internships, and job referrals. Dropping out means losing access to these networking channels, which could hinder your ability to secure internships or job interviews, especially in competitive industries like finance.

Skill Gaps and Knowledge Deficits: A university education equips students with a comprehensive understanding of financial concepts, analytical skills, and industry-specific knowledge. Dropping out may result in skill gaps, where you lack certain competencies that are essential for financial roles. For instance, you might not have the necessary financial modeling skills, investment analysis techniques, or regulatory knowledge required by employers. This knowledge deficit could make it challenging to compete with graduates who have completed their degrees.

Long-Term Earning Potential: Career progression in finance is often tied to education and experience. A degree can open doors to higher-paying positions and provide a solid foundation for career advancement. Graduates often have access to entry-level roles with competitive salaries, which can serve as a stepping stone to more senior positions. Dropping out might limit your earning potential in the short and long term, as you may start at a lower salary level and have fewer opportunities for rapid career growth.

Impact on Professional Reputation: In certain industries, a university degree is a symbol of credibility and expertise. Dropping out could potentially damage your professional reputation, especially in fields like finance, where employers value academic qualifications. It may raise questions about your commitment to the profession and your ability to complete a specialized program. This perception could influence hiring decisions and limit your career prospects.

Making the decision to drop out should involve careful consideration of these career implications. While it might be a challenging path, staying committed to your education can provide a strong foundation for a successful career in finance, ensuring you have the necessary qualifications, skills, and opportunities for long-term professional growth.

Unveiling the Student ID Mystery: University of Mississippi's Code

You may want to see also

Frequently asked questions

Dropping out of university can have significant financial consequences. Firstly, you will have invested a considerable amount of time and money into your education, and this investment may not be fully recoverable. Tuition fees, accommodation costs, and other expenses incurred during your course will not be refunded, and you may have already taken out student loans or used personal savings to fund your studies. It's important to carefully consider the reasons for dropping out and explore alternative options to minimize financial loss.

Student finance eligibility is typically based on your enrollment status and the specific criteria set by the financial aid provider in your country. If you withdraw from your university course, you may no longer meet the requirements for ongoing student finance support. However, some institutions offer financial assistance for students who are leaving, such as refunding unused tuition fees or providing support for finding alternative employment. It's advisable to contact your university's financial aid office to understand the specific policies and any potential support available.

Managing finances after dropping out requires careful planning and consideration. You should review your financial situation and create a budget to ensure you can cover essential expenses. If you have taken out student loans, you will still be responsible for repaying them, and it's crucial to understand the repayment terms and explore options for managing debt. Consider seeking advice from financial advisors or student support services to develop a strategy for financial stability during this transition period.