Leaving university can be a significant life transition, and it's important to understand the implications for your student loans. When you leave your course, the repayment terms for your student loan may change. Typically, if you're still within a grace period after graduation, you won't be required to start repaying the loan immediately. However, once this grace period ends, you'll need to begin making payments, usually within six months of leaving university. It's crucial to explore the options available to manage your loan, such as income-driven repayment plans, which can adjust your monthly payments based on your earnings and financial situation. Understanding these options can help you navigate the transition and ensure you're making informed decisions about your student loan repayment.

What You'll Learn

- Loan Status: Understanding the impact of leaving university on loan status

- Repayment Options: Exploring repayment choices after university withdrawal

- Interest Accrual: How interest accrues on student loans during a leave

- Loan Forgiveness: Conditions and eligibility for loan forgiveness post-university

- Debt Management: Strategies for managing student debt after university

Loan Status: Understanding the impact of leaving university on loan status

Leaving university can be a significant life transition, and it's important to understand how it affects your student loan status. When you leave your studies, the terms and conditions of your loan agreement come into play, and several factors determine the immediate and long-term implications for your loan.

Loan Status and Repayment:

When you discontinue your university studies, the loan status changes, and you may no longer qualify for certain repayment options. Typically, while enrolled in school, you might have had access to deferment or forbearance, allowing you to postpone payments. However, once you leave, these options may no longer be available. The lender or servicer will likely require you to begin making payments according to the agreed-upon terms, which could include interest accumulation during the grace period. It is crucial to review your loan agreement to understand the specific repayment schedule and any associated fees.

Grace Period and Interest:

After leaving university, you typically enter a grace period, usually six months, during which you don't have to make payments. During this time, interest may continue to accrue on the loan, and it's essential to monitor your account to ensure you don't incur additional charges. Understanding the grace period and its duration is vital to avoid unexpected financial burdens.

Loan Default and Consequences:

If you fail to make payments during the grace period or after, the loan may go into default. Loan default can have severe consequences, including increased interest rates, late fees, and damage to your credit score. It may also lead to legal action by the lender to recover the debt. It is advisable to explore alternative repayment plans or seek financial assistance to manage the loan effectively.

Re-enrolling or Returning to School:

If you decide to return to university or re-enroll in another program, it's essential to inform your lender or servicer. Depending on the circumstances, you might be able to resume deferment or forbearance. However, each loan servicer has its policies, and you should contact them to understand your options and any potential benefits.

In summary, leaving university impacts your student loan status, requiring you to manage repayment responsibilities. Understanding the grace period, interest accumulation, and potential consequences of default is crucial. Staying informed and proactive in managing your loan can help you make informed decisions and ensure financial stability during this life transition.

University Students: Are Unemployment Benefits Claimable?

You may want to see also

Repayment Options: Exploring repayment choices after university withdrawal

When you decide to leave university, it's important to understand the implications for your student loan and the repayment options available. Student loans are typically designed to support students through their education, and the terms and conditions can vary depending on the country and the type of loan. If you withdraw from university, the loan provider will need to be informed, and this can trigger a series of actions that affect your repayment responsibilities.

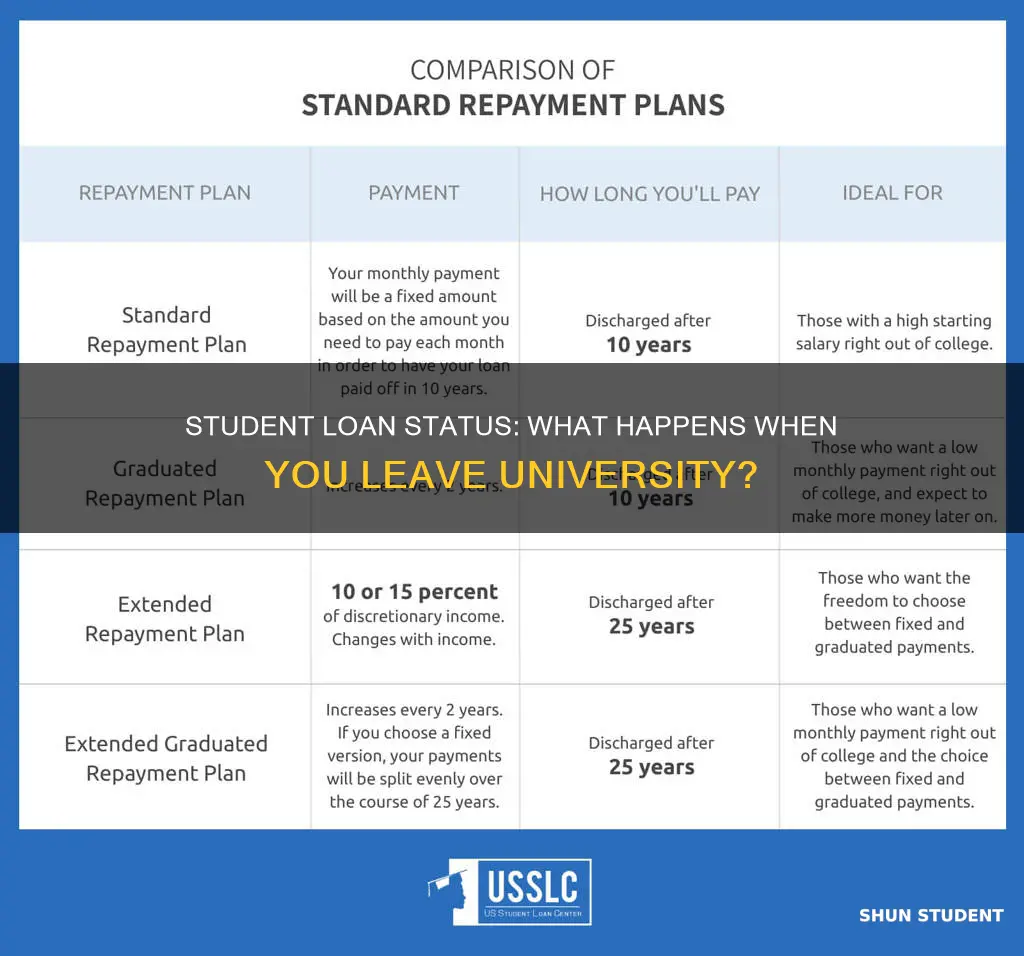

In many cases, if you leave university before completing your course, you may be considered a 'withdrawal' or 'dropout' in the eyes of the loan provider. This status can have significant consequences. Firstly, you may no longer be eligible for certain repayment plans or benefits that were available while you were a full-time student. For instance, you might lose access to income-driven repayment plans that adjust your monthly payments based on your earnings. These plans often provide more manageable repayment terms for borrowers with varying income levels.

One of the critical aspects to consider is the potential impact on your loan's status. If you withdraw, the loan may transition from an 'in-school' status to an 'out-of-school' or 'default' status. This change can affect the terms of your loan, including interest accrual and repayment requirements. In some cases, you might be required to start repaying the loan immediately, which can be a significant financial burden, especially if you have not yet found employment or a stable income source.

To navigate this situation effectively, it is advisable to contact your loan provider as soon as you decide to withdraw from university. They can provide specific guidance based on your loan type and country of residence. Many loan providers offer support and resources to help borrowers understand their options, including potential repayment strategies and any available deferment or forbearance options. These measures can provide temporary relief, allowing you to manage your finances while exploring alternative employment or further education.

Additionally, it's essential to review the terms of your loan agreement to understand your rights and responsibilities. Some loans may offer grace periods or special provisions for students who leave university early. By staying informed and proactive, you can make informed decisions about your student loan and develop a repayment strategy that suits your circumstances. Remember, early communication with your loan provider is key to managing the transition and ensuring you are aware of all available options.

Unveiling the Career Path: Michigan Computer Science Graduates' Success Stories

You may want to see also

Interest Accrual: How interest accrues on student loans during a leave

When you take a leave of absence from university, the consequences for your student loan can be significant, especially in terms of interest accrual. Interest is a crucial aspect of student loan management, and understanding how it accumulates during your absence is essential to managing your debt effectively.

Interest accrual on student loans refers to the process where interest is added to the loan balance over time. This means that even if you're not making payments, the loan's principal amount grows due to the accrued interest. During a leave of absence, several factors influence how interest accrues:

- Loan Type: The type of student loan you have is a critical factor. Federal student loans often have different interest accrual rules compared to private loans. For federal loans, interest typically accrues while you're in school and during any approved leave periods. This means the interest is calculated based on the loan's outstanding balance at the start of the leave. Private loans may or may not accrue interest during a leave, depending on the lender's policies.

- Grace Periods: Many student loans come with grace periods after graduation or leaving school. During these periods, you're not required to make payments, but interest still accrues. The grace period allows you to focus on other financial priorities, but it's essential to understand that the interest will be added to your loan balance, potentially increasing the overall amount you owe.

- Interest Rates: The interest rate on your loan determines how much interest accrues. Fixed-rate loans have a consistent interest rate throughout the loan term, while variable-rate loans may fluctuate. During a leave, the interest rate applies to the loan balance, and any accrued interest is added to the principal.

- Loan Servicer's Policies: The company or institution that services your loan may have specific policies regarding interest accrual during a leave. Some servicers might suspend interest accrual during approved leave periods, while others may continue to add interest. It's crucial to review your loan servicer's guidelines to understand their approach.

Managing interest accrual during a leave requires proactive steps. Consider contacting your loan servicer to inquire about their policies and explore options for interest capitalization or forbearance, which can help minimize the impact of interest accumulation. Understanding these details will enable you to make informed decisions about your student loan management strategy while on leave.

Prince George's University Student Population: A Comprehensive Overview

You may want to see also

Loan Forgiveness: Conditions and eligibility for loan forgiveness post-university

Leaving university can be a significant life transition, and understanding what happens to your student loan during this period is crucial for financial planning. When you leave your institution, the terms of your loan agreement come into play, and there are several options available to manage your debt. One of the most appealing options for many borrowers is loan forgiveness, which can provide relief and potentially help you rebuild your financial future.

Loan forgiveness programs are designed to offer financial assistance to borrowers who meet specific criteria. These programs aim to encourage borrowers to continue their education or work in certain fields or areas where there is a high demand for professionals. The conditions and eligibility for loan forgiveness can vary depending on the type of loan and the country's lending policies. For instance, in the United States, the federal government offers several loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) and the Income-Driven Repayment (IDR) plans.

To be eligible for loan forgiveness, borrowers typically need to meet certain requirements. One common condition is that you must have received a specific type of loan, such as a Direct Loan, and have completed your eligibility period. For example, with the PSLF program, borrowers must work full-time for a qualified employer for a certain number of years, depending on their loan type and repayment plan. During this period, your loan payments are often deferred or reduced, and you may be eligible for loan forgiveness if you meet the program's criteria.

Another important aspect of loan forgiveness is the need to stay informed and take proactive steps. Borrowers should regularly review their loan servicer's website or contact their loan provider to understand the specific conditions and requirements for their loan type. Some loans may offer forbearance or deferment options, allowing borrowers to temporarily pause or reduce their payments if they face financial difficulties. It is essential to explore these options and understand the potential impact on your loan forgiveness eligibility.

In summary, loan forgiveness can be a valuable tool for managing student loan debt post-university. By understanding the conditions and eligibility criteria, borrowers can make informed decisions about their repayment strategies. Staying informed, reviewing loan agreements, and exploring available options can help individuals navigate the complexities of student loan management and potentially qualify for loan forgiveness programs.

Unveiling the Political Spectrum: UChicago's Conservative Student Population

You may want to see also

Debt Management: Strategies for managing student debt after university

Managing student debt can be a daunting task, especially when you're navigating the transition from university to the working world. If you've recently left university and are grappling with the question of what happens to your student loan, you're not alone. Many graduates find themselves in a similar situation, and understanding your options is the first step towards effective debt management.

When you leave university, your student loan typically enters a grace period, which can last for several months. During this time, you are not required to make any payments, and the loan servicer will not report any late payments to credit bureaus. This grace period provides an opportunity to assess your financial situation and plan your next steps. It's crucial to use this time wisely to avoid any negative impacts on your credit score.

After the grace period, you'll need to decide on a repayment strategy. There are several options available, including income-driven repayment plans, which can significantly reduce your monthly payments by linking them to your income and employment status. These plans are particularly beneficial for graduates with high-interest loans or those who anticipate a significant drop in income post-graduation. Another strategy is to explore loan consolidation, which combines multiple loans into one, often with a lower interest rate, making repayment more manageable.

Additionally, consider the possibility of deferment, which allows you to temporarily suspend payments if you're unable to afford them. This option is often available for students pursuing further education or those facing financial hardship. However, it's important to remember that interest will continue to accrue during the deferment period, so you may want to explore other options to minimize the long-term cost of your debt.

Lastly, if you're struggling to meet your repayment obligations, you should reach out to your loan servicer. They may be able to offer solutions such as forbearance, which provides temporary relief from payments, or they might suggest alternative repayment plans tailored to your financial circumstances. Effective debt management is about taking control of your financial future, and understanding your options is the first step towards achieving that goal.

Indiana Wesleyan University's Student Population: A Comprehensive Overview

You may want to see also

Frequently asked questions

If you withdraw from your course or leave university before completing your degree, your student loan may still be active and you will continue to be responsible for repaying it. The loan terms and conditions typically remain in effect, and you will still be required to make payments as agreed upon with the loan provider or the government body managing the loan. It's important to understand the specific policies of your loan type and any potential consequences of leaving your course early.

Loan discharge is a process where the loan is canceled or forgiven under certain circumstances. If you leave university, the loan may not automatically be discharged, but you can explore options for loan forgiveness or repayment plans. Some loan programs offer discharge if the borrower meets specific criteria, such as working in a public service job or teaching in a low-income area. It's advisable to review the terms of your loan and consult with the loan provider to understand the potential for discharge and the application process.

Yes, interest will typically continue to accrue on your student loan even if you leave university. Interest is the cost of borrowing money, and it accumulates over time, increasing the total amount you owe. The interest rate and accrual period may vary depending on the type of loan and the loan provider's policies. It's crucial to manage your loan and make payments to prevent the accumulation of large interest amounts, which can make repayment more challenging in the long run.