Leaving university can be a significant transition, and it's important to understand the implications for your student finance. When you leave university, your student finance arrangements may change, and it's crucial to know what to expect. This paragraph will explore the options available for managing your student finance after leaving university, including the potential impact on repayment, the possibility of a grace period, and any other relevant considerations. Understanding these aspects can help you make informed decisions about your financial future.

| Characteristics | Values |

|---|---|

| Grace Period | Most student finance agreements offer a grace period after leaving university, typically 6 months, during which no payments are required. |

| Repayment Terms | Repayment terms can vary. Some loans may be repaid through income-contingent repayment plans, where payments are linked to income and employment status. Others might be repaid through fixed monthly installments. |

| Interest Rates | Interest may continue to accrue on outstanding balances during the grace period and any repayment period. |

| Default and Consequences | Failing to repay student finance on time can result in default status, which may lead to additional fees, penalties, and a negative impact on credit ratings. |

| Deferment | In some cases, student finance can be deferred, allowing borrowers to temporarily stop making payments without incurring penalties. |

| Loan Forgiveness | Certain loan types may offer loan forgiveness programs for borrowers who meet specific criteria, such as working in certain professions or in low-income areas. |

| Contact with Student Finance | It's important to maintain contact with the student finance provider to understand your rights and responsibilities, especially if you're leaving university. |

| Variations by Country | Repayment terms and conditions can vary depending on the country and the specific student finance agreement. |

What You'll Learn

- Withdrawal and Refunds: Understand the process of withdrawing from university and the refund of financial aid

- Loan Repayment Options: Explore different repayment plans for student loans after leaving university

- Grace Periods: Learn about grace periods for loan payments and their implications

- Income-Driven Repayment: Discover how income-driven repayment plans can adjust loan payments based on income

- Default and Consequences: Understand the risks of loan default and its long-term effects

Withdrawal and Refunds: Understand the process of withdrawing from university and the refund of financial aid

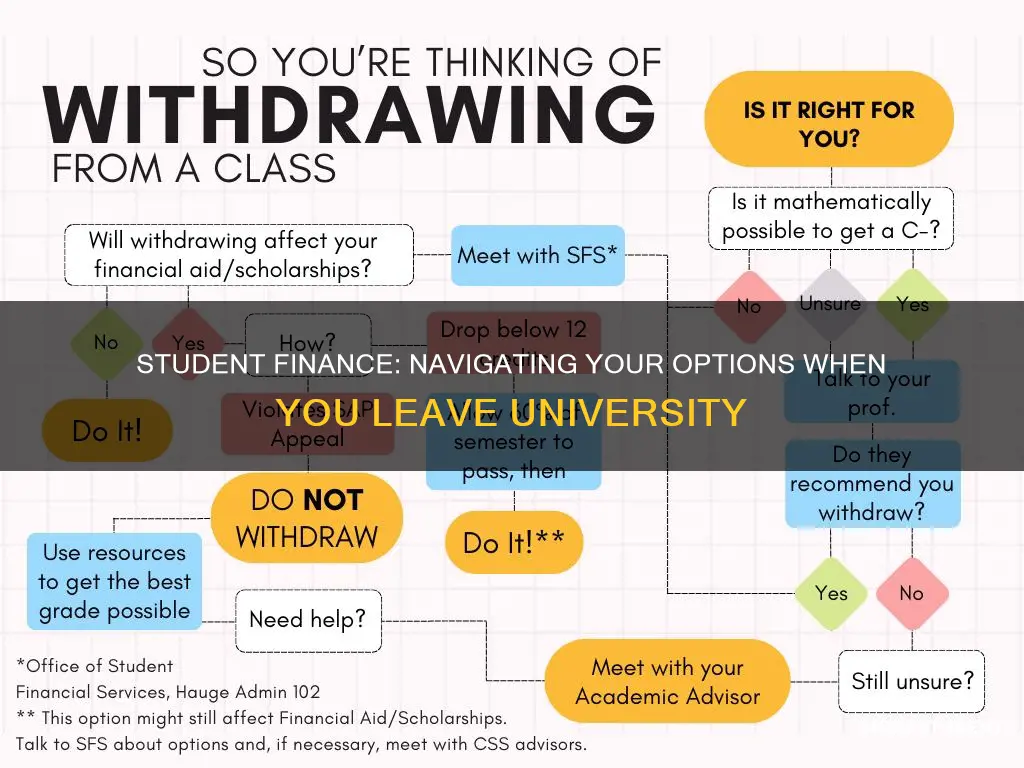

When a student decides to withdraw from their university program, it triggers a series of financial implications, and understanding the process is crucial to ensure a smooth transition. The first step is to officially notify the university of your withdrawal. This is typically done through a designated withdrawal process, which may vary depending on the institution. It's essential to follow the university's guidelines and deadlines for withdrawal to avoid any unnecessary fees or penalties. Once the withdrawal is processed, the financial aid office will review your situation and determine the appropriate course of action regarding your financial aid.

The refund process for financial aid can be complex and depends on several factors. Firstly, the timing of your withdrawal is critical. If you withdraw during the academic year, you may be eligible for a prorated refund of your financial aid. This means that the amount of aid you receive will be adjusted based on the percentage of the year you have completed. For instance, if you withdraw in the middle of the semester, you might receive a refund for the remaining aid that was intended for the semester. However, if you withdraw at the beginning of the year, the refund might be less significant.

In some cases, if you withdraw completely and permanently from the university, you may be required to repay a portion or all of the financial aid received. This is especially true if you have already received a substantial amount of aid for the year. The university will calculate the refund based on the difference between the total financial aid awarded and the actual costs incurred up to the point of withdrawal. It's important to carefully review the university's financial aid policies and communicate any changes in your enrollment status promptly to avoid misunderstandings.

Furthermore, students should be aware of the potential impact on their creditworthiness. Withdrawing from university might affect your credit history, especially if financial aid was provided through a loan. It is advisable to maintain open communication with the financial aid office and explore options for managing any outstanding financial obligations. They can provide guidance on repayment plans or alternative arrangements to ensure a positive impact on your financial record.

In summary, withdrawing from university requires a proactive approach to manage financial aid and potential refunds. Students should familiarize themselves with the university's withdrawal procedures and financial aid policies to make informed decisions. By understanding the refund process and any associated fees, students can navigate the transition smoothly and minimize any financial strain during this period of change.

Universities and Overweight Students: Discrimination or Health Concern?

You may want to see also

Loan Repayment Options: Explore different repayment plans for student loans after leaving university

Leaving university and entering the workforce marks a significant shift in your financial responsibilities, especially if you've taken out student loans. Understanding the various loan repayment options available is crucial to managing your debt effectively and ensuring a smooth transition into your career. Here's a comprehensive guide to exploring different repayment plans for student loans post-university:

- Standard Repayment Plan: This is the most common repayment option. With this plan, you make fixed monthly payments over a set period, typically 10 years. The payments are calculated based on the total loan amount, interest rate, and your income. While it may result in higher monthly payments, it ensures that you pay off the loan in a structured manner, providing peace of mind.

- Income-Driven Repayment Plans: These plans are designed to make loan repayment more manageable, especially for those with lower incomes or variable earnings. There are several types of income-driven plans:

- Income-Based Repayment (IBR): Your monthly payment is calculated as a percentage of your discretionary income (income above a certain threshold). This plan often results in lower monthly payments, making it suitable for recent graduates with limited earnings.

- Pay As You Earn (PAYE): Similar to IBR, PAYE sets your payment as a percentage of your discretionary income. It also offers a 20-year repayment term, providing flexibility.

- Revised Pay As You Earn (REPAYE): This plan is available for federal student loans and adjusts your monthly payment based on your income and family size. It's an excellent option for those who want a flexible repayment strategy.

- Extended Repayment Plan: If you choose this plan, your loan payments will be lower, but they will last longer, typically 25 years. This option is beneficial for those who prefer smaller monthly payments, but it may result in paying more interest over the long term.

- Loan Forgiveness Programs: For those facing financial challenges, loan forgiveness programs can provide relief. Here are a few options:

- Public Service Loan Forgiveness: If you work full-time for a qualified public service organization, you may be eligible for loan forgiveness after 10 years of on-time payments.

- Income-Driven Repayment Forgiveness: After 20 years of payments under an income-driven plan, any remaining federal student loan debt may be forgiven.

- Teacher Loan Forgiveness: Teachers who work in low-income areas or high-need subjects may qualify for loan forgiveness after a certain number of years of teaching.

Loan Consolidation: Consolidating your student loans can simplify repayment by combining multiple loans into one. This option allows you to choose a new repayment plan, including income-driven options, and may offer benefits like a fixed interest rate for the life of the loan.

When considering repayment plans, it's essential to assess your financial situation and future prospects. If you anticipate a significant change in income or employment status, explore flexible repayment options. Additionally, stay informed about any government loan forgiveness programs that might apply to your situation. Remember, proactive management of your student loans can help alleviate financial stress and ensure a brighter financial future.

University of Evansville: Student Population and Campus Life

You may want to see also

Grace Periods: Learn about grace periods for loan payments and their implications

When you leave university, the terms and conditions of your student finance agreement come into play, especially regarding loan repayment. One crucial aspect to understand is the concept of a grace period. A grace period is a temporary reprieve from repayment, allowing you to focus on other priorities after your studies. This period is typically applied to student loans, providing a financial cushion during the initial stages of your career or while you pursue further education.

The duration of the grace period can vary depending on the type of loan and the country's regulations. For instance, in the United Kingdom, the standard grace period for student loans is usually 21 months after you finish your course. During this time, you are not required to make any loan repayments, giving you the opportunity to secure employment, start a business, or even return to further education. It's important to note that this grace period is not an extension of your studies but a financial support mechanism to ease the transition from student life to the working world.

During the grace period, the loan provider will typically send you regular updates and reminders to ensure you are aware of the repayment terms. It is your responsibility to keep track of these communications and understand the implications of the grace period ending. Once the grace period expires, you will be required to start repaying the loan, usually through direct debit or other agreed-upon methods.

Understanding the grace period is essential for managing your finances effectively after university. It provides a financial safety net, allowing you to focus on your career or further education without the immediate pressure of loan repayment. However, it's crucial to remember that this period is not indefinite, and you should plan accordingly to ensure you are prepared for the repayment process once the grace period ends.

Elevate Your University Profile: LinkedIn Tips for Students

You may want to see also

Income-Driven Repayment: Discover how income-driven repayment plans can adjust loan payments based on income

Leaving university can present a unique challenge for students who have accumulated student loans, as they may find themselves in a position where their repayment obligations need to be carefully managed. One of the most effective strategies to address this issue is by exploring income-driven repayment plans. These plans are specifically designed to provide financial relief and flexibility for borrowers, especially those who have recently graduated and are starting their careers.

Income-driven repayment plans are a type of repayment strategy that adjusts the loan payment amount based on the borrower's income. This means that as your income increases, your loan payments will also increase, and when your income decreases, the payments will be reduced accordingly. The primary goal of this approach is to ensure that loan repayments remain manageable and affordable for individuals, especially those who might experience fluctuations in their earnings over time. For instance, if a recent graduate's income is significantly lower than their peers, the income-driven plan can cap the monthly payment at a percentage of their discretionary income, making it more sustainable.

The process of enrolling in an income-driven repayment plan typically involves a few key steps. Firstly, borrowers need to complete an income-driven repayment application, which can usually be found on the website of the student loan servicer. This application requires detailed information about your income, family size, and other relevant financial details. Once approved, you will be assigned a specific repayment plan that suits your circumstances. It's important to note that different income-driven plans have varying terms and conditions, so understanding the specifics of your plan is crucial.

One of the significant advantages of income-driven repayment is the potential for loan forgiveness. After a certain number of years, typically 20 or 25, of making consistent payments under this plan, the remaining balance of your loan may be forgiven. This can be a powerful incentive for borrowers, especially those who have taken out substantial loans, as it provides a clear end goal and financial relief. However, it's essential to be aware of the potential tax implications of loan forgiveness, as it may be subject to taxation.

In summary, income-driven repayment plans offer a practical solution for students who have left university and are concerned about their loan repayments. By adjusting payments based on income, these plans provide flexibility and can help borrowers manage their debt more effectively. Understanding the application process and the specific terms of the plan is crucial to making an informed decision and potentially benefiting from loan forgiveness in the long term.

African American Students at Loyola University: Representation Matters

You may want to see also

Default and Consequences: Understand the risks of loan default and its long-term effects

Leaving university can be a significant life transition, and it's important to understand the implications of your student finance arrangements, especially if you decide to leave your studies. One critical aspect to consider is the potential risk of defaulting on your student loan, which can have far-reaching consequences.

When you default on a student loan, it means you have failed to meet the repayment obligations as per the agreed terms. This situation can arise if you leave university and are no longer eligible for the standard repayment plans or if you struggle to find employment and income to cover the loan repayments. Defaulting can have serious financial and legal repercussions. Firstly, it will negatively impact your credit score, making it challenging to secure future loans, credit cards, or even rent an apartment. Lenders and landlords often rely on credit scores to assess your financial responsibility.

The consequences of defaulting go beyond credit issues. Once a loan is in default, the lender may take legal action to recover the debt. This could result in wage garnishment, where a portion of your income is automatically deducted to pay off the loan, or even legal action to seize your assets. In extreme cases, defaulting on a student loan can lead to a judgment against you, which may result in a lien on your property or other assets.

Furthermore, defaulting on a student loan can have long-term effects on your financial well-being. It may impact your ability to secure future employment, as many employers conduct credit checks during the hiring process. A default on your record could raise red flags and potentially disqualify you from job opportunities. Additionally, if you plan to pursue further education or professional development, a defaulted loan could hinder your progress, as financial aid and scholarships often require a good credit history.

To avoid these risks, it is crucial to explore all available options if you find yourself in a situation where you can no longer continue your studies. Contact your student finance provider to discuss alternative repayment plans, such as income-driven repayment, which can adjust your monthly payments based on your income and family size. They may also offer forbearance or deferment options, allowing you to temporarily pause repayments if you're facing financial hardship. Understanding your rights and responsibilities as a borrower is essential to making informed decisions and managing your student finance effectively.

Unveiling the Top-Ranked University for Student Population

You may want to see also

Frequently asked questions

If you withdraw from your course or leave university before completing your studies, your student finance may be affected. The specific consequences depend on the type of financial support you receive and the circumstances of your departure. In most cases, you will no longer be eligible for further payments, but there are some important points to consider:

- Tuition Fee Loan: If you have a tuition fee loan, it will typically continue to be repaid as per the original terms. You may still be required to inform the Student Finance Service about your withdrawal to ensure the correct repayment arrangements are in place.

- Maintenance Loan: For a maintenance loan (which covers living costs), you will generally not be entitled to any further payments. However, if you leave due to exceptional circumstances, such as health issues or family emergencies, you might be able to apply for a 'leave of absence' or 'withdrawal' adjustment, which could allow you to receive some of the remaining loan amount.

- Overpayment and Refunds: If you have already received more financial support than your entitlement, you may need to repay the overpayment. The Student Finance Service will calculate the amount you owe based on the difference between what you received and what you were entitled to.

Yes, if you have received more financial support than you are entitled to, you may be able to apply for a refund. The process and eligibility criteria for refunds can vary depending on the country and the specific student finance system. Here's a general overview:

- Application Process: You will typically need to contact your student finance provider and provide details of your withdrawal, including the date and reason for leaving. They may request documentation to support your claim.

- Refund Amount: The refund amount will depend on the difference between the overpaid amount and any fees or penalties associated with the early withdrawal.

- Timeframe: Refunds may take some time to process, and there might be a waiting period before the funds are returned to your account.

No, if you leave university early, your student finance will generally not cover any living expenses beyond the withdrawal date. Your maintenance loan or grant will stop being paid from the day you withdraw or leave the course. It's important to plan your finances carefully and consider alternative sources of income or savings to cover any remaining living costs.

Yes, you may be able to reapply for student finance if you decide to return to university at a later date. The process and eligibility criteria will depend on your individual circumstances and the policies of your student finance body. Here are some key points:

- Reapplication Process: You will need to provide updated information about your course, financial situation, and any changes since your initial application.

- Eligibility: Factors such as age, previous study history, and income may affect your eligibility. Some student finance systems have specific rules regarding breaks in study, so it's essential to understand the regulations.

- Additional Support: If you have a gap in your studies, you might need to provide evidence of your financial circumstances during that period, especially if you are applying for maintenance loan support.