A student grant is a financial aid package designed to support students in their pursuit of higher education. These grants are typically awarded based on financial need, academic merit, or a combination of both. They provide a valuable source of funding for students to cover various expenses associated with attending university, such as tuition fees, accommodation, textbooks, and living costs. Unlike loans, grants do not require repayment, making them an attractive option for students seeking financial assistance during their university years. Understanding the criteria and application processes for student grants is essential for students aiming to secure the necessary financial support for their education.

What You'll Learn

- Eligibility: Criteria for student grants, including academic performance and financial need

- Application Process: Steps to apply, including deadlines and required documents

- Types of Grants: Federal, state, and institutional grants, each with unique requirements

- Impact on Finances: How grants reduce the financial burden of university education

- Repayment and Terms: Conditions for grant repayment and any associated penalties

Eligibility: Criteria for student grants, including academic performance and financial need

When it comes to student grants for university, understanding the eligibility criteria is crucial for applicants. These grants are financial awards designed to support students with their educational expenses, often based on specific requirements and needs. The primary purpose is to ensure that talented and motivated students can access higher education without being burdened by excessive financial strain.

One of the key eligibility factors is academic performance. Universities and grant providers often seek students who demonstrate a strong commitment to their studies. This is typically assessed through a combination of high school grades, standardized test scores, and, in some cases, letters of recommendation. For instance, a student with a high-grade point average (GPA) in their previous academic pursuits is more likely to be considered for a grant, as it indicates a capacity for success in the rigorous environment of university. Additionally, extracurricular achievements and leadership roles can also enhance a student's eligibility, showcasing well-rounded abilities beyond academic performance.

Financial need is another critical aspect of eligibility. Student grants aim to support those who require additional financial assistance to pursue their education. This is often determined by a comprehensive financial assessment, which includes evaluating a student's family income, assets, and overall financial situation. The idea is to identify students who, despite their academic merit, might struggle to fund their university education without financial aid. This criterion ensures that grants are allocated to those who need them most, promoting equal opportunities for all.

The process of determining financial need typically involves a detailed application form, where students provide information about their family's financial circumstances. This may include income statements, tax returns, and other relevant documents. It is essential for students to be transparent and accurate in their applications to ensure fair consideration. In some cases, universities or grant providers may also conduct interviews or request additional documentation to verify the information provided.

Meeting the eligibility criteria for student grants is essential for accessing these financial awards. Academic performance and financial need are the two primary factors that grant providers consider. By understanding and fulfilling these requirements, students can increase their chances of receiving the necessary support to pursue their university education. It is a competitive process, but with the right preparation and documentation, students can navigate the eligibility process successfully.

Belmont University's Student Population: How Many Are There?

You may want to see also

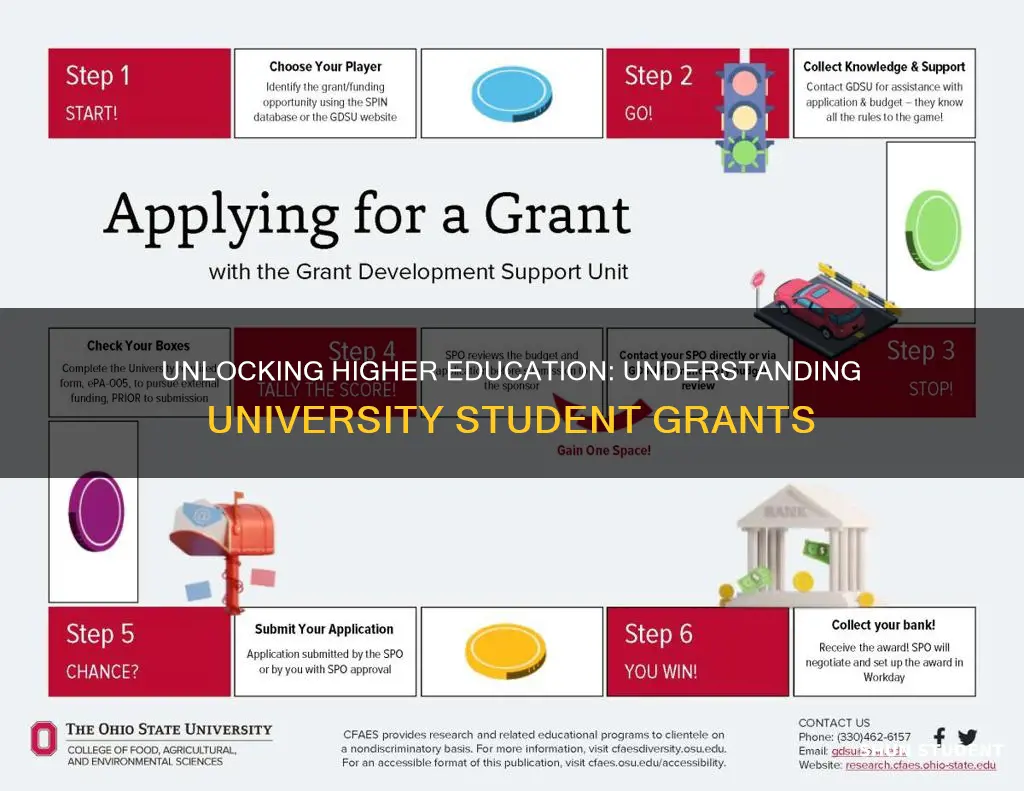

Application Process: Steps to apply, including deadlines and required documents

The application process for university grants can vary depending on the institution and the specific grant program. Here is a general step-by-step guide to help you navigate the application journey:

- Research and Identify Grants: Begin by researching various sources to find relevant grants. This includes university-specific financial aid offices, government grant portals, and private foundations. Each grant will have its own criteria and eligibility requirements, so it's crucial to understand the specific guidelines for each opportunity.

- Check Deadlines: One of the most critical aspects of the application process is meeting deadlines. Grant applications often have strict timelines, and late submissions may result in rejection. Create a calendar and mark the application deadlines for each grant you're interested in. Some grants may have multiple rounds, while others might have a single window, so plan accordingly.

- Gather Required Documents: Each grant application will request specific documents. Common documents include:

- Personal identification (e.g., passport, driver's license)

- Academic transcripts or proof of enrollment

- Letters of recommendation

- Personal essays or statements of purpose

- Financial aid forms

- Proof of residency or citizenship

- Any additional supporting materials related to your field of study

Ensure you have all the necessary documents ready before starting the application.

- Complete the Application: Carefully follow the instructions provided by the grant provider. Fill out the application form accurately and provide all the required information. Pay attention to details, as any missing or incorrect information may lead to disqualification. Double-check your application for errors before submission.

- Submit and Follow Up: After submitting your application, keep a record of the submission date and any confirmation received. If you don't hear back by the expected decision date, don't hesitate to contact the grant provider to inquire about the status of your application.

Remember, the application process can be competitive, and it's essential to start early, allowing sufficient time for research, gathering documents, and completing the application. Each grant may have its own unique requirements, so always refer to the official guidelines provided by the grantor.

How to Stand Out: Trinity University's Application Requirements

You may want to see also

Types of Grants: Federal, state, and institutional grants, each with unique requirements

When it comes to funding your university education, grants can be a valuable source of financial support. They are essentially awards given to students based on various criteria, such as academic merit, financial need, or specific areas of study. Understanding the different types of grants available can help you navigate the application process and secure the financial assistance you need. Here's an overview of federal, state, and institutional grants, each with its unique requirements:

Federal Grants:

These grants are funded by the U.S. government and are designed to support students from diverse backgrounds. One of the most well-known federal grants is the Pell Grant, which provides need-based financial aid to undergraduate students. To be eligible, you must demonstrate financial need and meet specific academic criteria. Federal grants often have a broad application process, and students can apply through the Free Application for Federal Student Aid (FAFSA). These grants are highly competitive, and the amount awarded can vary based on factors like family income and the cost of attendance at your chosen institution. Federal grants typically do not need to be repaid, making them an attractive option for students.

State Grants:

State governments also offer grants to support students within their jurisdiction. These grants often have specific eligibility criteria, such as residency requirements or enrollment in a particular state institution. State grants may consider both financial need and academic merit. The application process can vary, with some states requiring separate applications, while others integrate it with the FAFSA. The amount and availability of state grants can differ significantly from one state to another, so it's essential to research the specific opportunities in your state.

Institutional Grants:

Universities and colleges often provide grants to attract and support students. These grants are typically awarded based on academic performance, leadership qualities, or specific talents. For example, a university might offer a grant to students with exceptional athletic abilities or those pursuing unique academic programs. Institutional grants can vary widely in terms of requirements and amounts. Some institutions may have merit-based scholarships, while others might focus on need-based aid. The application process usually involves submitting a separate application to the university, which may include essays, letters of recommendation, and other supporting documents.

Each type of grant has its own set of requirements and application procedures. Federal grants often require a comprehensive financial aid application, while state and institutional grants may have additional criteria specific to their respective programs. It is crucial to research and understand the eligibility criteria, application deadlines, and any unique requirements set by the grant providers. By exploring these different grant options, students can increase their chances of securing financial assistance and making their university education more accessible.

Loughborough University's Student Population: A Comprehensive Overview

You may want to see also

Impact on Finances: How grants reduce the financial burden of university education

Grants for university students can significantly ease the financial strain associated with higher education, offering a vital lifeline to those facing economic challenges. These financial awards are designed to support students in their pursuit of academic excellence, often by covering a portion or all of the costs associated with attending university. The impact of such grants is profound, as they directly address the financial burden that often deters many talented individuals from pursuing their educational goals.

One of the most significant advantages of student grants is their ability to provide financial relief, ensuring that students can focus on their studies without the constant worry of affording tuition fees, living expenses, or other educational costs. This is particularly crucial for students from low-income families or those facing unexpected financial hardships during their university years. By reducing the financial pressure, grants enable students to make the most of their university experience, allowing them to dedicate more time to their studies, engage in extracurricular activities, and build a strong network of connections.

The impact of grants extends beyond the individual student. When more people have access to financial support, it can lead to a more diverse and inclusive university environment. Students from various socioeconomic backgrounds can attend, contributing to a richer learning experience and fostering a more equitable society. This diversity can enhance the educational experience, encourage cultural exchange, and promote a more comprehensive understanding of different perspectives within the student body.

Furthermore, grants can have a long-lasting effect on a student's future. By alleviating the immediate financial burden, these awards provide an opportunity for students to develop better financial management skills and a more positive attitude towards personal finance. This can lead to more informed and responsible financial decisions in the future, potentially reducing the risk of debt accumulation and promoting long-term financial stability.

In summary, student grants play a pivotal role in reducing the financial burden of university education. They empower students to pursue their academic aspirations, contribute to a diverse and inclusive learning environment, and foster financial literacy. By providing financial support, grants ensure that education remains accessible to those who need it most, ultimately benefiting both the individual and society as a whole.

Dallas Baptist University Student Population: How Many?

You may want to see also

Repayment and Terms: Conditions for grant repayment and any associated penalties

When it comes to student grants for university, understanding the repayment terms and conditions is crucial for managing your finances effectively. These grants are typically financial aid provided to students to cover educational expenses, and they often come with specific guidelines regarding repayment. Here's an overview of the key aspects related to repayment and terms:

Repayment Obligation: Student grants, unlike loans, generally do not require immediate repayment upon completion of the university program. However, they are still considered a form of financial assistance and may have repayment obligations attached. The repayment process is designed to ensure that the grant benefits are returned to the funding body or government agency. Repayment terms can vary depending on the grant type and the country's educational funding policies.

Repayment Period: The repayment period for grants is often longer than that of loans, providing borrowers with more time to manage their finances. For instance, in some countries, grants may be repaid over a period of several years, starting after the student graduates or completes their course. This extended repayment period can be advantageous, especially for students who may not have a steady income immediately after graduation.

Repayment Amount: The amount to be repaid is typically calculated based on the grant received. It is essential to understand that the repayment amount might not be the full grant amount. Some grants may have a cap on the repayable amount, ensuring that students are not burdened with excessive repayment. Additionally, repayment amounts can be adjusted based on the student's income and financial situation, with lower-income earners often having more flexible repayment plans.

Penalties and Interest: Late repayment of student grants may incur penalties and interest charges, similar to loan defaults. If a grant recipient fails to meet the repayment terms, they may face financial consequences. Penalties could include additional fees, increased interest rates, or even legal action. It is crucial to adhere to the repayment schedule to avoid these penalties and maintain a positive financial standing.

Income-Driven Repayment: In some cases, income-driven repayment plans may be available for student grants. This approach ties the repayment amount to the borrower's income, ensuring that the repayment is manageable. If the grant recipient's income falls below a certain threshold, the repayment amount may be reduced or waived, providing financial relief.

Understanding the specific repayment terms and conditions of any student grant is essential to avoid unexpected financial burdens. It is advisable to review the grant agreement thoroughly and seek clarification from the relevant authorities if needed. Proper financial planning and awareness of the repayment process can help students manage their university finances effectively.

University of People: Defer Student Loans?

You may want to see also

Frequently asked questions

A student grant is a financial aid award provided to eligible students to help cover the costs of their education. It is typically need-based and aims to support students who may not have the financial means to fund their university studies. Grants can be used to cover various expenses, including tuition fees, accommodation, books, and living costs.

The application process for grants varies depending on the institution and the funding body. Generally, students need to complete an application form, providing details about their financial situation, academic performance, and personal circumstances. This information is used to assess the student's financial need and determine eligibility for the grant. Some grants may also require a personal statement or letter of recommendation.

Yes, while both provide financial support, grants and scholarships have distinct characteristics. A grant is typically a non-repayable award, meaning the student doesn't need to pay it back. It is often based on financial need and may be need-based or merit-based. On the other hand, scholarships are usually awarded for specific achievements, talents, or academic merit. They may be one-time awards or renewable, and the recipient often has to maintain certain criteria to continue receiving the scholarship.