For Ohio Medicaid recipients who are university students, understanding the components of their income is crucial for maintaining eligibility and accessing necessary healthcare services. This paragraph aims to clarify what is considered income for these students under the Ohio Medicaid program. It will cover essential aspects such as financial aid, scholarships, and part-time employment, providing a comprehensive overview to ensure students are aware of their rights and responsibilities regarding income disclosure and its impact on their Medicaid benefits.

What You'll Learn

- Tuition and Fees: Costs directly related to enrollment and attendance at a qualified educational institution

- Books and Supplies: Essential educational materials required for courses

- Room and Board: Housing and meal expenses while attending school

- Transportation: Costs associated with getting to and from school

- Personal Care: Expenses for basic personal hygiene and health needs

Tuition and Fees: Costs directly related to enrollment and attendance at a qualified educational institution

When determining income for Medicaid eligibility, the state of Ohio considers various factors, including tuition and fees, for university students. These costs are directly related to the student's enrollment and attendance at a qualified educational institution. Here's a detailed breakdown:

Tuition and fees encompass a wide range of expenses associated with attending a college or university. This includes the cost of instruction, which is the primary educational service provided by the institution. It covers the lectures, seminars, and other instructional activities that contribute to the student's academic progress. Additionally, fees are mandatory charges imposed by the educational institution for various services and facilities. These fees often cover administrative costs, student support services, and the maintenance of campus facilities. For example, a university might charge a registration fee, a lab fee for access to specialized facilities, or a technology fee for online resources and IT support.

In the context of Medicaid eligibility, Ohio considers the total tuition and fees as a single amount. This means that the student's income and resources are assessed based on the combined total of these costs. It is important to note that the specific amount of tuition and fees can vary depending on the student's enrollment status, such as full-time or part-time, and the type of institution they attend.

For instance, if a student is enrolled in a four-year degree program at a public university, their tuition and fees might include annual charges for instruction, laboratory access, and other academic resources. In contrast, a community college student might have lower tuition and fees, reflecting the difference in the cost of instruction and facilities between a four-year and a two-year institution.

It is crucial for university students to understand that Medicaid eligibility rules may vary, and the inclusion of tuition and fees in income calculations can impact their financial aid and assistance. Students should review the specific guidelines provided by the Ohio Department of Medicaid and their educational institution to ensure they have the most accurate and up-to-date information regarding their financial situation and eligibility for Medicaid benefits.

State Universities: Student Population in the US

You may want to see also

Books and Supplies: Essential educational materials required for courses

When it comes to determining income for Medicaid eligibility, the specific requirements can vary depending on the state and the type of student. In the case of Ohio, understanding what is considered income is crucial for students applying for Medicaid, especially those attending university. Books and educational supplies are essential expenses for students, and their inclusion in income calculations can impact eligibility.

For Ohio Medicaid, income is typically defined as the total of all earnings and resources available to the student. This includes wages, salaries, and any other forms of income. However, there are certain exceptions and considerations for students, particularly those enrolled in higher education. University students often have unique financial needs, and their income assessment should reflect this.

Books and educational supplies are generally not included in the income calculation for Medicaid eligibility. These essential materials are considered necessary expenses for students to pursue their education. The state recognizes that students require these resources for their academic success and, therefore, exempts them from the income assessment. This ensures that financial aid and benefits are provided without penalizing students for their educational needs.

The specific criteria for determining what constitutes essential educational materials may vary. Typically, it includes textbooks, course readers, lecture notes, and other required reading materials for the student's enrolled courses. Additionally, items like laptops, calculators, and software necessary for the student's program of study may also be considered essential supplies. It is important for students to provide documentation or receipts for these purchases to support their claim for exemption from income calculations.

Understanding the income guidelines and the inclusion of books and supplies is vital for Ohio Medicaid applicants. Students should be aware of their rights and responsibilities to ensure they receive the appropriate financial assistance. By recognizing the essential nature of educational materials, the state aims to support students in their pursuit of higher education without compromising their access to necessary resources.

Indiana University: Orientation Length and What to Expect

You may want to see also

Room and Board: Housing and meal expenses while attending school

When determining income for Medicaid eligibility, Ohio considers various factors, including room and board expenses for students attending university. These expenses are crucial in assessing a student's financial need and determining their eligibility for Medicaid benefits. Here's a detailed breakdown of how room and board expenses are considered:

Housing Expenses:

- Rent or Tuition: The primary housing expense is typically the rent or tuition fees associated with the student's university accommodation. Ohio Medicaid takes into account the standard rent or tuition rates for the specific institution and location. This ensures that the income assessment reflects the actual cost of housing.

- On-Campus Housing: If the student resides in on-campus housing, the Medicaid program may consider the provided meal plan and housing fees as a single expense. This comprehensive approach simplifies the assessment process.

- Off-Campus Housing: For students living off-campus, Medicaid will consider the average rent or mortgage payments in the student's area, along with any additional costs like utilities and maintenance.

Meal Expenses:

- Meal Plans: Many universities offer meal plans that include a certain number of meals per week or month. Medicaid may consider the cost of these meal plans as a significant portion of the student's room and board expenses.

- Self-Prepared Meals: Students who opt for self-prepared meals may need to provide documentation of their actual food costs. This could include grocery receipts or estimates based on the student's dietary needs.

- Special Dietary Requirements: Students with specific dietary restrictions or medical conditions requiring specialized diets should provide relevant documentation to ensure their meal expenses are accurately reflected.

Additional Considerations:

- Relocation: If a student is moving to a different location for university, Medicaid may require proof of the new housing and meal expenses, especially if the costs differ significantly from the previous location.

- Financial Aid: Financial aid packages, scholarships, or grants that cover housing and meal expenses should be considered when assessing income. These sources of funding can impact Medicaid eligibility.

- Dependency Status: Medicaid may differentiate between dependent and independent students. Dependent students may have different income considerations, especially if they receive financial support from their parents.

Understanding these factors is essential for students to accurately report their room and board expenses when applying for Medicaid. It ensures that the income assessment is fair and reflects the actual financial needs of the student.

Unveiling the Unique Spirit of UChicago: A Student's Perspective

You may want to see also

Transportation: Costs associated with getting to and from school

When considering the transportation costs for students receiving Medicaid in Ohio, it's important to understand the specific criteria and guidelines set by the state's Medicaid program. For university students, the focus is often on the expenses incurred to travel to and from their educational institution. These costs can vary depending on the student's living situation and the distance between their residence and the university.

In Ohio, Medicaid may cover transportation expenses for students who meet certain eligibility requirements. These requirements typically include demonstrating that the student's income and resources are below the federal poverty level. For university students, this often means that their financial aid package, including scholarships, grants, and work-study programs, does not cover the full cost of transportation. In such cases, Medicaid can provide financial assistance to cover these transportation costs.

The transportation costs considered for Medicaid coverage may include expenses for public transportation, such as bus fares, subway passes, or train tickets. For students who own a vehicle, the costs of fuel, maintenance, and insurance for their personal car can also be eligible for coverage. Additionally, expenses related to carpooling or ride-sharing services may be included, especially if the student's income does not cover these alternative transportation methods.

It is essential for students to understand that the transportation costs covered by Medicaid are generally limited to the minimum necessary for attending their university. This means that students should provide documentation of their transportation needs, such as bus schedules, parking permits, or receipts for fuel and maintenance. By providing accurate and detailed information, students can ensure that their transportation expenses are adequately considered for Medicaid coverage.

Furthermore, students should be aware of any additional transportation-related services that may be available through their university or local transportation authorities. These services could include discounted or free transportation passes for students, carpool programs, or even financial assistance for purchasing bicycles or other sustainable transportation options. Exploring these resources can help students manage their transportation costs more effectively while also contributing to a more environmentally friendly approach to commuting.

Diverse Student Body: Unveiling Wisconsin's Madison University Demographics

You may want to see also

Personal Care: Expenses for basic personal hygiene and health needs

When it comes to determining income for Ohio Medicaid eligibility, the focus is on understanding what constitutes income and how it impacts a university student's financial situation. For personal care expenses, it's important to recognize that these are essential costs related to maintaining basic hygiene and health. These expenses can include a range of items and services, ensuring that students can take care of their well-being while pursuing their education.

Personal care expenses typically cover the costs of everyday health and hygiene needs. This includes purchasing personal care products such as soap, shampoo, toothpaste, and other basic toiletries. Additionally, it may involve expenses for medications, bandages, and other over-the-counter health items that students might require for minor ailments or to manage chronic conditions. These items are crucial for maintaining personal cleanliness and overall health, especially in a university setting where students often live in close quarters.

In some cases, personal care expenses can also extend to services. This could include visits to a dentist, optometrist, or other healthcare professionals for routine check-ups and treatments. These services are essential for preventive care and early detection of potential health issues. By covering these costs, Ohio Medicaid ensures that students can access necessary medical attention, promoting their long-term health and well-being.

It's worth noting that the specific expenses considered under personal care may vary depending on individual needs and circumstances. For instance, students with specific medical conditions or disabilities might have additional costs related to their unique requirements. Understanding these nuances is crucial for accurately assessing a student's financial situation and ensuring they receive the appropriate level of Medicaid assistance.

By including personal care expenses in the income assessment for Ohio Medicaid, the program aims to provide comprehensive support to university students. This approach recognizes the importance of basic health and hygiene in a student's life, enabling them to manage their personal care needs effectively while focusing on their academic pursuits.

Youngstown State University: Student Population and Campus Life

You may want to see also

Frequently asked questions

Ohio Medicaid considers various income sources when assessing eligibility for university students. This includes earned income from part-time or full-time employment, scholarships, grants, and any other financial aid that provides a stipend or stipend-like benefit.

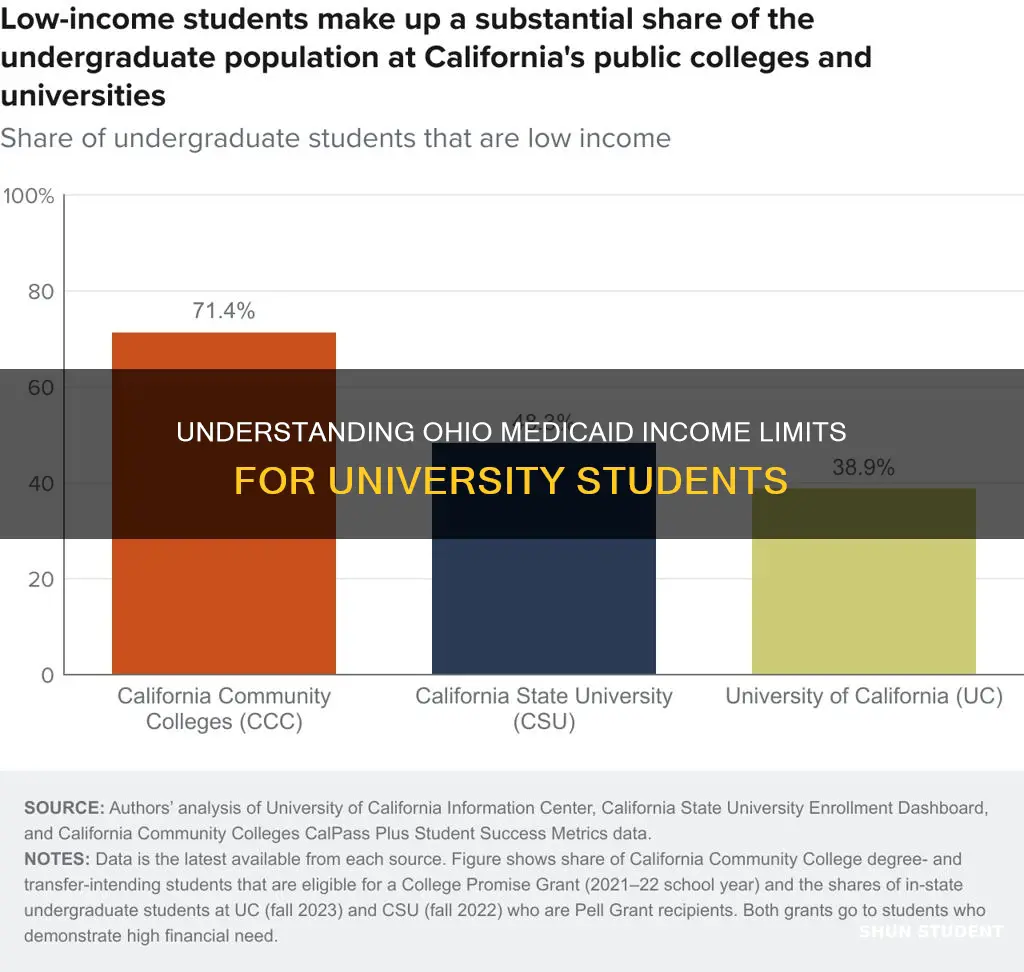

Income limits for Ohio Medicaid vary depending on the student's household size and composition. As of 2023, the income limit for an individual student is set at 138% of the Federal Poverty Level (FPL). For a family of two, the limit is slightly higher. Students should check the current guidelines as these limits may be updated annually.

The income of a student's parents or guardians is generally not included in the eligibility determination for Ohio Medicaid. The program focuses on the student's own income and resources. However, if the student's household income exceeds the set limits, they may need to consider other financial resources or explore alternative coverage options.

No, scholarships and grants that are awarded based on academic merit or need do not count towards income for Medicaid eligibility. These funds are typically intended to support educational expenses and are often tax-free. However, if a scholarship or grant provides a stipend or stipend-like benefit, it may be considered as income.

Income from a part-time job that provides a stipend is considered earned income and is typically included in the eligibility assessment for Ohio Medicaid. The amount of stipend received will be taken into account when determining the student's overall income. Students should report all sources of income accurately to ensure proper eligibility determination.