Roosevelt University, a private, non-profit institution located in Chicago, Illinois, is known for its strong academic programs and vibrant campus life. Like many other universities, Roosevelt University offers a variety of financial aid options, including federal and institutional loans, to help students finance their education. One of the most common forms of student debt is federal student loans, which are available to all eligible students. However, the average debt from students at Roosevelt University can vary depending on several factors, such as the student's major, the length of their program, and their financial situation. Understanding these averages can provide valuable insights for prospective students and their families, helping them make informed decisions about financing their education at Roosevelt University.

What You'll Learn

- Tuition and Fees: Roosevelt University's tuition and fees contribute significantly to student debt

- Financial Aid: Understanding financial aid options can help manage student debt

- Scholarships and Grants: Exploring scholarships and grants can reduce the average debt

- Loan Repayment Plans: Roosevelt offers various loan repayment plans to ease financial burdens

- Debt Management Services: The university provides debt management resources for student loan repayment

Tuition and Fees: Roosevelt University's tuition and fees contribute significantly to student debt

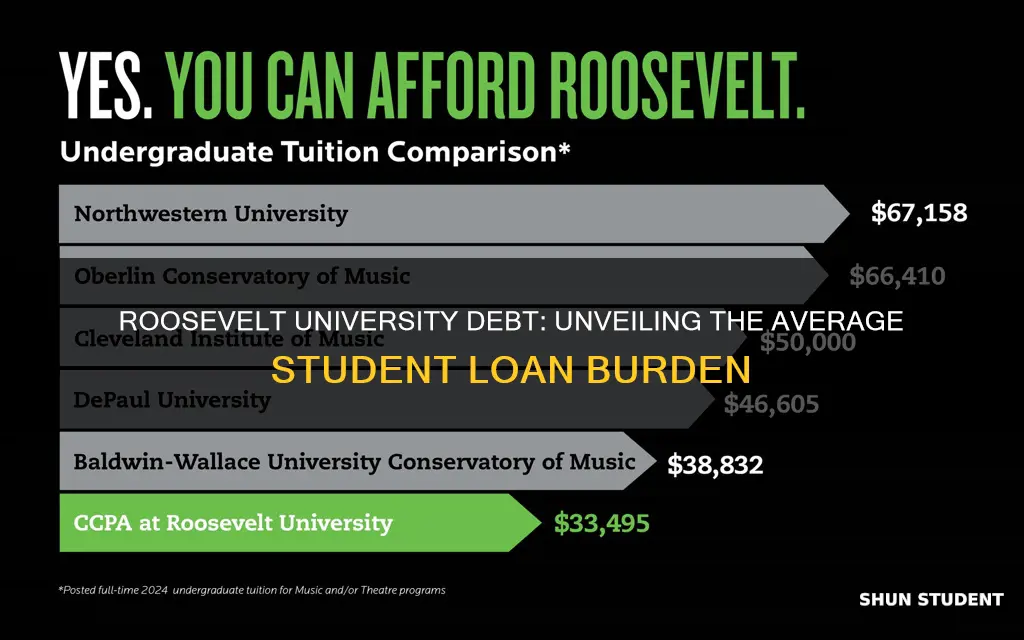

Roosevelt University, a private institution in Chicago, Illinois, has been a subject of interest when it comes to student debt. The university's tuition and fees play a significant role in the financial burden faced by its students. As of the latest available data, Roosevelt University's tuition and fees for the 2022-2023 academic year were $32,500 for in-state students and $37,500 for out-of-state students. These figures represent a substantial increase from the previous year, indicating a growing trend of rising costs.

The average debt incurred by Roosevelt University graduates is a concern for many. According to a recent study, the average student debt for the class of 2021 was approximately $28,000. This number highlights the financial challenges students face upon completing their education. The high tuition and fees, coupled with other expenses, contribute to this substantial debt burden.

The financial aid options available at Roosevelt University may provide some relief, but they do not fully address the issue of rising tuition and fees. Financial aid packages often include a combination of grants, scholarships, work-study programs, and loans. While these can help reduce the immediate financial strain, they do not eliminate the long-term debt incurred. Many students rely on loans to cover the gap between their financial aid and the total cost of attendance, which can lead to significant debt accumulation.

Furthermore, the impact of tuition and fees on student debt is not limited to the immediate financial strain. High debt levels can have long-term consequences, affecting graduates' financial stability and future opportunities. It may influence career choices, housing options, and overall quality of life. Managing and repaying student debt can be a significant challenge, requiring careful financial planning and potentially impacting graduates' ability to achieve their long-term goals.

In summary, Roosevelt University's tuition and fees contribute significantly to the average debt incurred by its students. The rising costs of education have led to increased financial burdens, and while financial aid options are available, they may not fully alleviate the issue. Understanding the impact of tuition and fees on student debt is crucial for students and their families to make informed decisions about their education and financial future.

Exploring Central State University's Student Population Over the Years

You may want to see also

Financial Aid: Understanding financial aid options can help manage student debt

Understanding financial aid options is crucial for students at Roosevelt University to effectively manage their student debt. The average debt incurred by students at this institution can vary depending on factors such as program, year of study, and individual circumstances. However, it is essential to recognize that financial aid plays a pivotal role in mitigating the financial burden associated with higher education.

Financial aid encompasses a range of resources designed to support students in their educational pursuits. This includes grants, scholarships, work-study programs, and loans. Grants and scholarships are typically need-based or merit-based, providing financial assistance without the requirement of repayment. Work-study programs offer part-time employment opportunities, allowing students to earn money while maintaining their studies. Loans, on the other hand, are a form of financial aid that needs to be repaid, often with interest, after the completion of the academic program.

Roosevelt University, like many other institutions, offers various financial aid packages to eligible students. These packages may include institutional scholarships, federal grants, and work-study positions. It is imperative for students to thoroughly research and understand the different types of financial aid available to them. By doing so, they can make informed decisions regarding their educational funding and develop a comprehensive plan to manage their debt.

When considering financial aid, students should explore all possible options. This includes applying for federal grants and loans, such as the Federal Pell Grant or Direct Subsidized and Unsubsidized Loans. These programs often have lower interest rates and more flexible repayment terms compared to private loans. Additionally, students can seek out institutional scholarships, which may be offered based on academic merit, community involvement, or other criteria specific to Roosevelt University.

Managing student debt effectively requires a strategic approach. Students should aim to minimize the reliance on high-interest loans and prioritize grants and scholarships. Creating a budget and exploring part-time work opportunities can also contribute to debt management. Furthermore, understanding the terms and conditions of any financial aid received is essential to avoid unexpected financial obligations. By taking a proactive approach to financial aid, students at Roosevelt University can make informed choices, reduce their debt burden, and ensure a more secure financial future.

Oklahoma Panhandle State University: Enrollment Figures and Trends

You may want to see also

Scholarships and Grants: Exploring scholarships and grants can reduce the average debt

The average debt incurred by students at Roosevelt University can be a significant financial burden, but there are strategies to mitigate this. One effective approach is to explore scholarships and grants, which can provide much-needed financial support and reduce the overall debt burden.

Scholarships and grants are essentially free money that can be used to cover educational expenses. They are available in various forms, including merit-based awards, need-based aid, and specialized grants for specific fields of study. When applied for and received, these financial aids can significantly lower the cost of attendance at Roosevelt University. For instance, merit-based scholarships often reward students for academic achievements, leadership qualities, or community involvement, while need-based grants consider financial circumstances to ensure that all students, regardless of background, have access to higher education.

The process of finding and applying for scholarships and grants can be a bit daunting, but it is a worthwhile endeavor. Students should start by researching available opportunities on the university's financial aid website or by contacting the financial aid office directly. Many external organizations, such as private foundations, corporations, and community groups, also offer scholarships and grants. These sources can provide a comprehensive list of available funds, ensuring that students don't miss out on potential financial support.

When applying for scholarships and grants, it is essential to pay attention to the specific requirements and deadlines. Each award may have unique criteria, such as academic performance, extracurricular involvement, or community service, so students should carefully review and tailor their applications accordingly. Additionally, maintaining a good academic standing and actively participating in campus life can increase the chances of receiving financial aid.

By exploring scholarships and grants, students at Roosevelt University can take control of their financial future. This proactive approach not only reduces the average debt but also fosters a sense of financial responsibility and awareness. It is a valuable skill to learn how to navigate the financial aid system and secure additional funding, ensuring a more sustainable and less stressful educational journey.

Unveiling Georgian Court University's Diverse Student Body: Who Attends?

You may want to see also

Loan Repayment Plans: Roosevelt offers various loan repayment plans to ease financial burdens

Roosevelt University, a private institution in Chicago, understands the financial challenges students often face during and after their academic journey. To provide support and alleviate the burden of student debt, Roosevelt offers a range of loan repayment plans tailored to individual needs. These plans are designed to make loan management more accessible and flexible, ensuring that graduates can focus on their future goals without the added stress of overwhelming debt.

One of the key features of Roosevelt's loan repayment strategy is the flexibility it provides to borrowers. Students can choose from various repayment options, including income-driven repayment plans. These plans are particularly beneficial for those with varying income levels, allowing them to make monthly payments that align with their current financial situation. By adjusting the payment amount based on income, Roosevelt ensures that graduates can manage their loans effectively, even if their earnings fluctuate over time.

For those with substantial student debt, Roosevelt also provides extended repayment options. This approach allows borrowers to distribute their loan payments over a more extended period, reducing the monthly financial burden. By spreading out the repayment, students can focus on other priorities, such as finding employment or starting a career, without the immediate pressure of high monthly installments. This extended repayment plan is an excellent solution for graduates who want to prioritize their long-term financial stability.

Additionally, Roosevelt University offers forbearance and deferment options, which can provide temporary relief for borrowers facing financial hardships. Forbearance allows students to temporarily suspend their loan payments if they encounter difficulties in making payments. This option can be particularly useful during periods of unemployment, medical emergencies, or other unforeseen circumstances. Deferment, on the other hand, enables borrowers to postpone their loan payments for a specified period, providing a breather before they need to start repaying their loans.

The university's commitment to student financial well-being also includes providing resources and guidance to help borrowers understand their loan agreements and repayment options. Roosevelt offers comprehensive loan counseling services, ensuring that students are well-informed about their rights and responsibilities as borrowers. This proactive approach empowers students to make informed decisions regarding their loan management, allowing them to take control of their financial future.

Western Ontario University: Student Population Insights

You may want to see also

Debt Management Services: The university provides debt management resources for student loan repayment

Roosevelt University, a private institution in Chicago, Illinois, has a strong commitment to supporting its students' financial well-being, especially when it comes to managing student loan debt. Understanding the financial challenges that many graduates face, the university offers comprehensive debt management services to assist students with their loan repayment journey.

The university's financial aid office provides dedicated resources and guidance to help students navigate the complexities of student loan debt. This includes offering workshops and seminars on financial literacy, budgeting, and debt management strategies. These educational sessions empower students with the knowledge to make informed decisions about their loans and future financial planning. By providing these resources, Roosevelt University aims to ensure that its graduates are equipped with the skills to manage their debt effectively.

One of the key services offered is a personalized debt management plan. The university's financial advisors work closely with students to assess their financial situation, including income, expenses, and loan amounts. Through this assessment, a tailored plan is created to help students repay their loans efficiently. This may involve strategies such as income-driven repayment plans, loan consolidation, or exploring options for loan forgiveness programs. By offering these customized solutions, the university ensures that students can manage their debt in a way that aligns with their individual circumstances.

Additionally, Roosevelt University has established partnerships with reputable debt management companies and financial advisors. These partnerships provide students with access to professional guidance and support. Students can benefit from one-on-one consultations, where they receive expert advice on loan repayment strategies, tax implications, and long-term financial planning. These partnerships further reinforce the university's commitment to helping students overcome the challenges associated with student loan debt.

By offering these debt management services, Roosevelt University demonstrates its dedication to the overall success and well-being of its students. The university understands that managing student loan debt is a significant concern for many graduates and aims to provide the necessary tools and resources to ensure a smooth transition into the financial responsibilities of adulthood. With these comprehensive support systems in place, Roosevelt University students can approach their loan repayment journey with increased confidence and a sense of financial security.

University of Minnesota: A Destination for Thousands of Students

You may want to see also

Frequently asked questions

The average student debt at Roosevelt University is approximately $25,000 for undergraduate students and around $30,000 for graduate students. This amount includes both federal and private loans.

Roosevelt University's average student debt is relatively competitive when compared to other private universities in the Midwest. It is slightly lower than the national average for private non-profit institutions, which is around $28,000 for undergraduate students.

Yes, Roosevelt University offers various financial aid packages, including scholarships, grants, work-study programs, and loans. The university also encourages students to explore external scholarship opportunities and provides resources to help students manage their finances and debt effectively.

Absolutely. Federal student loans are a common source of funding for students at Roosevelt University. These loans often have lower interest rates and more flexible repayment options compared to private loans. Students can complete the Free Application for Federal Student Aid (FAFSA) to determine their eligibility for federal grants, loans, and work-study programs.