Understanding the payment timeline for your student bill is crucial for managing your finances at Texas State University. The university's billing system operates on a specific schedule, and knowing when your bill is due can help you avoid late fees and ensure a smooth financial experience during your academic journey. This guide will provide an overview of the payment due dates, offering essential information to help you stay on top of your financial responsibilities at Texas State.

What You'll Learn

- Tuition and Fees: Understand the breakdown of your tuition and mandatory fees

- Payment Deadlines: Know the specific due dates for each payment period

- Payment Methods: Discover the accepted payment methods and online payment platforms

- Financial Aid Impact: Learn how financial aid affects your bill and payment schedule

- Late Payment Penalties: Be aware of late payment fees and consequences

Tuition and Fees: Understand the breakdown of your tuition and mandatory fees

When it comes to understanding your financial obligations at Texas State University, grasping the breakdown of tuition and mandatory fees is crucial. These charges are essential components of your student bill and play a significant role in your overall educational experience. Here's a detailed guide to help you navigate this aspect:

Tuition, a fundamental cost of attendance, covers the educational services provided by the university. It is typically calculated based on the number of credit hours you enroll in. Texas State University offers various tuition rates for different student categories, such as in-state, out-of-state, and international students. The university's website or the Office of Student Accounts will provide the specific tuition rates for the current academic year. It's important to note that tuition fees can vary depending on the program and level of study. For instance, graduate programs might have different tuition structures compared to undergraduate degrees.

In addition to tuition, students at Texas State University are subject to mandatory fees, which are essential for maintaining and improving campus facilities and services. These fees are standardized and applied to all students, ensuring a fair distribution of costs. Mandatory fees typically cover a range of services, including student health services, library access, technology infrastructure, and recreational facilities. The university provides a comprehensive breakdown of these fees, ensuring students are aware of the value they receive. It is advisable to review the fee schedule annually, as some fees may be subject to change or new fees may be introduced to support evolving campus needs.

Understanding the breakdown of these charges is vital for financial planning and budgeting. Students should carefully review their student bills to ensure accuracy and identify any discrepancies. The student bill will outline the specific amounts for tuition and mandatory fees, along with any applicable discounts or waivers. It is recommended to compare the billed amounts with the university's published fee schedules to ensure transparency and fairness.

Furthermore, Texas State University provides resources to assist students in managing their finances. Financial aid offices can offer guidance on scholarships, grants, and work-study programs that may help offset tuition and fee costs. Exploring these options can provide significant financial relief and support your academic journey.

By comprehending the tuition and fee structure, students can make informed decisions regarding their education and financial well-being. Staying informed about the due dates for payments and any available payment plans is essential to avoid late fees and maintain a good financial standing at Texas State University.

Illini Enrollments: Exploring the Student Population at UIUC

You may want to see also

Payment Deadlines: Know the specific due dates for each payment period

When it comes to managing your finances at Texas State University, understanding the payment deadlines is crucial. The university operates on a semester-based payment system, which means that each semester has its own set of due dates for tuition and fees. It's essential to be aware of these dates to avoid any late payment fees or disruptions to your academic journey.

The payment periods at Texas State University typically align with the start and end of each semester. For instance, the fall semester's payment period usually begins in late summer and ends in early October, while the spring semester's payment period starts in January and concludes in April. Each payment period has a specific due date, and it's your responsibility to ensure that you meet these deadlines. You can find the exact due dates for each payment period on the university's official website or by contacting the Student Financial Services office.

To avoid any inconvenience, it is recommended to mark these dates on your calendar or set reminders. Late payments may result in additional fees and penalties, which can impact your financial aid and overall academic experience. The university provides a clear breakdown of payment schedules, including important dates for early payment discounts, if applicable. By staying informed, you can plan your finances accordingly and ensure a smooth payment process.

It's worth noting that Texas State University offers various payment methods to accommodate students' needs. These options may include online payments, mail-in payments, or in-person payments at designated offices. The university's financial aid office can provide guidance on the preferred payment methods and any specific instructions for each payment period.

In summary, being aware of the payment deadlines is essential for students at Texas State University. By understanding the specific due dates for each payment period, you can manage your finances effectively and avoid any unnecessary fees or disruptions. Stay organized, keep track of important dates, and utilize the available resources provided by the university to ensure a seamless payment experience.

DeSales University Student Population: How Many Attend?

You may want to see also

Payment Methods: Discover the accepted payment methods and online payment platforms

When it comes to managing your finances at Texas State University, understanding the payment methods and due dates for your student bill is crucial. The university offers a range of options to ensure a smooth payment process, allowing students to choose the method that best suits their needs. Here's an overview of the accepted payment methods and online platforms you can utilize:

Payment Methods:

- Credit Cards: Texas State University accepts major credit cards, including Visa, Mastercard, American Express, and Discover. This method provides flexibility and convenience, allowing students to pay online or set up automatic payments. It's important to note that credit card payments may incur additional fees, so students should be aware of any associated costs.

- Direct Deposit/Electronic Transfer: For those who prefer a more traditional approach, direct deposit or electronic fund transfer is an option. Students can set up recurring payments directly from their bank account, ensuring timely bill payments. This method is often preferred by students who want to avoid potential late fees.

- Check or Money Order: Physical payments are also accepted. Students can mail their payments to the designated address or drop them off at the university's finance office. It is recommended to use certified mail or a secure drop-box system to ensure the payment reaches the correct department.

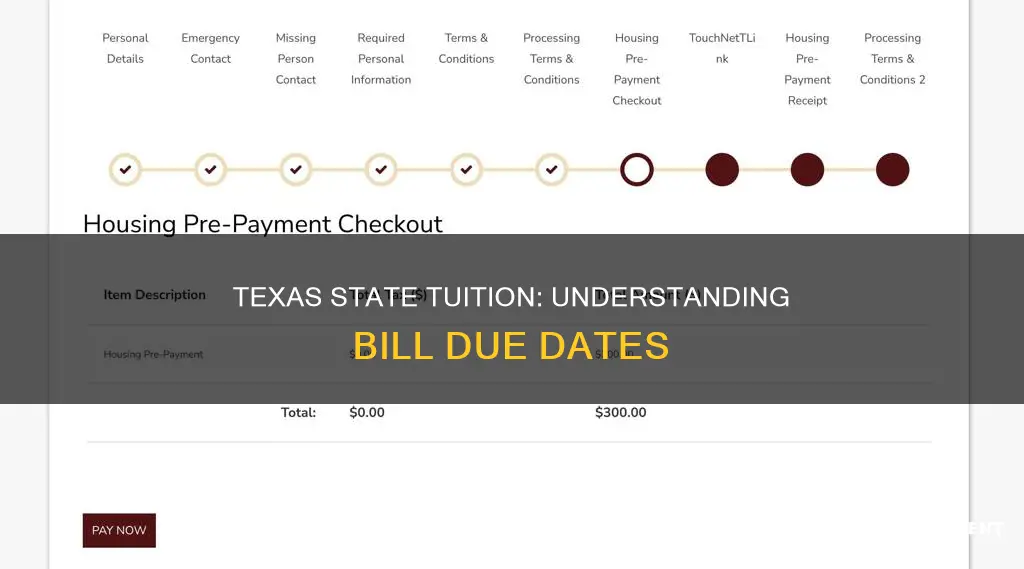

- Online Payment Platforms: The university has partnered with various online payment platforms to facilitate secure transactions. These platforms often provide a user-friendly interface, allowing students to manage their bills, make payments, and set up payment reminders. Some popular options include the university's official payment portal, third-party payment processors, and mobile banking apps.

Online Payment Platforms:

- Texas State University's Online Bill Payment Portal: This is the university's official platform for managing student accounts. Students can access their bills, view payment history, and make payments online. The portal often provides options for one-time payments or setting up recurring payments. It may also offer the ability to update personal information and communicate with the finance department.

- Third-Party Payment Processors: Several third-party companies offer online payment services for educational institutions. These platforms typically provide a secure and user-friendly interface, allowing students to pay their bills from anywhere. Students can usually set up automatic payments, receive payment confirmations, and manage their accounts online. Examples of such platforms include PaymentConnect, Tuition.io, and other similar services.

- Mobile Banking Apps: Many banks now offer mobile apps that enable users to manage their finances on the go. Students with bank accounts can often link their accounts to these apps and make payments directly. Some banks provide the option to pay bills, transfer funds, and receive real-time notifications, making it a convenient choice for those who prefer a mobile-first approach.

By utilizing the accepted payment methods and exploring the available online platforms, students can efficiently manage their student bills at Texas State University. It is advisable to familiarize yourself with the university's payment policies and due dates to avoid any late payment fees or disruptions to your academic journey.

Exploring Lawrence Tech University's Student Population

You may want to see also

Financial Aid Impact: Learn how financial aid affects your bill and payment schedule

When it comes to your financial responsibilities as a student at Texas State University, understanding the impact of financial aid is crucial. Financial aid, whether in the form of grants, scholarships, work-study programs, or loans, plays a significant role in determining your bill and payment schedule. Here's a detailed breakdown of how financial aid influences these aspects:

Bill Calculation: Financial aid directly impacts the amount you owe for tuition, fees, and other educational expenses. The university calculates your bill based on the total cost of attendance, which includes tuition, fees, room and board, books, and other estimated expenses. When you receive financial aid, the university considers these funds as part of your financial resources. As a result, the amount you need to pay out of pocket is reduced, making it more manageable. For example, if your total bill is $20,000 and you receive a scholarship covering $5,000, your bill will be adjusted accordingly, reflecting the reduced financial burden.

Payment Schedule: Financial aid also influences the timing of your payments. The university often sets payment deadlines based on the availability of financial aid funds. If you receive aid early in the semester, you might have a more extended period to pay your bill, allowing for better cash flow management. However, it's essential to be aware that late payment fees may apply if you don't meet the specified deadlines. Understanding the payment schedule and any associated fees is crucial to avoid financial penalties.

Grant and Scholarship Impact: Grants and scholarships are typically need-based or merit-based awards that do not require repayment. When you receive these forms of financial aid, they directly reduce the amount you owe. For instance, if you're awarded a scholarship covering $3,000, this amount will be subtracted from your bill, leaving a lower balance to be paid. It's important to keep track of all awarded grants and scholarships to ensure an accurate bill calculation.

Loan Considerations: Student loans, whether federal or private, are a significant aspect of financial aid. Loans provide immediate financial assistance but come with the responsibility of repayment. When you receive a loan, it increases the amount you need to pay back after graduation. The university will consider your loan amounts when calculating your bill, ensuring that the total amount owed is accurately reflected. It's essential to explore loan options, understand repayment terms, and create a plan to manage loan payments effectively.

Work-Study Programs: Work-study programs offer part-time employment opportunities for students with financial need. Earnings from these jobs can be applied to your bill, reducing the amount you need to pay. Work-study funds are typically disbursed in installments, allowing you to cover expenses as you earn. This form of financial aid provides a practical way to manage your finances while pursuing your education.

Understanding the impact of financial aid on your bill and payment schedule is essential for effective financial planning. It allows you to make informed decisions, explore available resources, and ensure a smooth academic journey at Texas State University. Remember to regularly review your financial aid status, bill details, and payment options to stay on top of your financial responsibilities.

Top U.S. Universities for Indian Students: A Comprehensive Guide

You may want to see also

Late Payment Penalties: Be aware of late payment fees and consequences

When it comes to managing your finances at Texas State University, understanding the due dates and potential late payment penalties for your student bill is crucial. Late payments can lead to a series of financial consequences, and being aware of these fees is essential to avoid any unexpected financial burdens. Here's a detailed breakdown of what you need to know:

Due Dates and Payment Schedules: Texas State University typically sets specific payment deadlines for each semester or term. These dates are usually communicated to students through their university accounts and financial portals. It is imperative to mark these dates on your calendar to ensure timely payments. The university may offer multiple payment options, such as online portals, direct deposits, or payment centers, allowing students to choose the most convenient method.

Late Payment Fees: One of the primary concerns for students is the late payment fee. These fees are imposed when the student bill remains unpaid by the due date. The amount of the late fee can vary, often ranging from a flat rate to a percentage of the total bill. For instance, the university might charge a $25 flat fee for each semester if the payment is not received by the due date. It's important to note that these fees accumulate, meaning the longer a payment is late, the more the penalty will increase.

Consequences of Late Payments: Late payments can have several negative impacts on your university experience. Firstly, late fees can add up quickly, leading to significant financial strain. Moreover, repeated late payments may result in a negative financial record, which could affect your credit score. This can be particularly problematic for students planning to take out loans or apply for credit in the future. Additionally, the university may take administrative actions, such as suspending your access to certain services or holding your transcripts, until the outstanding balance is resolved.

Payment Planning and Tips: To avoid late payment penalties, consider creating a payment plan or budget that accommodates the due dates. Many students find it helpful to set up automatic payments or reminders to ensure they don't miss the deadline. If you anticipate financial difficulties, it is advisable to contact the university's financial aid or billing office as soon as possible. They may offer options like payment extensions or financial assistance programs to help students manage their bills.

Understanding the payment process and potential late fees is a vital step towards a smooth academic journey. By being proactive and informed, students can ensure they meet their financial obligations without incurring unnecessary penalties. Remember, timely payments contribute to a positive financial standing and a stress-free university experience.

When Do Student Loans Deposit at Luberty University? A Guide

You may want to see also

Frequently asked questions

The due date for student bills at Texas State University is typically set for the 10th of each month. It's important to note that late payments may result in additional fees and penalties, so it's advisable to plan and pay on time.

Yes, Texas State University offers a payment plan option for students. You can contact the university's Business Office to set up a plan that suits your financial needs. This allows you to spread out the payment over multiple installments, making it more manageable.

Missing the due date can lead to late fees and potential financial penalties. The university may also report late payments to credit bureaus, which could impact your credit score. It's crucial to stay on top of your payments and consider setting reminders to avoid late submissions.

Yes, Texas State University provides various financial aid resources to assist students with their educational expenses. This may include scholarships, grants, work-study programs, and loans. It's recommended to review the university's financial aid website or consult with the financial aid office to explore the options available to you.