When is student loan money available at the University of Cincinnati? Understanding the timeline for receiving financial aid is crucial for students planning their academic journey. The University of Cincinnati, known for its academic excellence, offers various financial assistance options, including federal and private student loans. These loans provide essential support to cover educational expenses, but the availability of funds can vary. Typically, federal student loans become accessible once the university has processed the student's financial aid package, which may take a few weeks. Private loans, on the other hand, often require a credit-worthy co-signer and may have different processing times. It's essential for students to stay informed about the university's financial aid timeline to ensure they have the necessary funds to cover their educational costs.

| Characteristics | Values |

|---|---|

| Availability | Student loan funds are typically available once the university has processed the student's financial aid package. This usually occurs after the student has been officially admitted and has submitted all required documents. |

| Timing | The exact timing can vary, but it often takes a few weeks from the time of admission to when the funds are disbursed. The university of Cincinnati's financial aid office provides updates on the availability of funds on their website. |

| Disbursement | Funds are usually disbursed directly to the student's school account, covering tuition, fees, and other eligible expenses. |

| Notification | Students will receive a notification when their aid package is ready, including information about the availability of loans and other financial aid. |

| Repayment | Loan amounts are determined based on the student's financial need and the cost of attendance. Repayment terms and interest rates vary depending on the loan type. |

What You'll Learn

- Eligibility Criteria: Understand the requirements for receiving federal and private student loans

- Award Notifications: Learn how and when you'll receive loan award notifications from the university

- Disbursement Schedule: Discover the timeline for when loan funds are disbursed to your university account

- Refinancing Options: Explore refinancing opportunities for existing student loans

- Repayment Plans: Learn about different repayment plans and their associated timelines

Eligibility Criteria: Understand the requirements for receiving federal and private student loans

Understanding the eligibility criteria for student loans is crucial for any student planning to finance their education. When it comes to federal and private loans, there are specific requirements that borrowers must meet to ensure they can access the financial aid they need. Here's a breakdown of the key factors to consider:

Federal Student Loans:

- Enrollment Status: Federal student loans typically require borrowers to be enrolled in a participating school at least half-time. This means you must be taking a certain number of credits per semester or term to be eligible. The exact requirements vary by loan program, so it's essential to check the specific guidelines for the loan you're applying for.

- Financial Need: For some federal loans, such as the Federal Pell Grant, financial need is a significant factor. These loans are designed to assist students who demonstrate genuine financial hardship and cannot afford the cost of education. The Free Application for Federal Student Aid (FAFSA) is used to determine financial need and eligibility.

- Citizenship or Residency: Most federal student loans require U.S. citizenship or permanent residency status. International students may have limited options, and some loans are specifically designed for them, often requiring a sponsor or cosigner.

- Creditworthiness: Federal loans generally do not require a credit check or cosigner. However, for PLUS loans (Parent PLUS Loans), the parent borrower must undergo a credit check, and in some cases, a cosigner may be required.

Private Student Loans:

- Credit History: Private lenders often consider credit history when evaluating loan applications. A good credit score and a history of responsible borrowing can increase your chances of approval and may lead to more favorable loan terms.

- Income and Employment: Lenders may assess your income potential and employment status. Having a steady source of income or a job offer can strengthen your application, especially for private loans that require a cosigner.

- Co-signer: Private lenders often require a co-signer, especially for students with limited credit history. A co-signer is someone who agrees to repay the loan if the primary borrower defaults. This can be a parent, guardian, or even a friend with a strong credit profile.

- Enrollment Verification: Similar to federal loans, private lenders may require proof of enrollment in an accredited school. This ensures that the loan is used for educational expenses.

Meeting these eligibility criteria is essential to ensure a smooth loan application process. It's advisable to start the process early, as some loans have specific deadlines and requirements. Understanding the terms and conditions of each loan type will help students make informed decisions about their financial aid options.

Universities' Approach to Posthumous Student Grades

You may want to see also

Award Notifications: Learn how and when you'll receive loan award notifications from the university

The University of Cincinnati's financial aid office will notify you of your loan award status once your federal student aid application has been processed. This process typically takes a few weeks, and the university aims to provide timely updates to ensure students can plan their finances effectively. Here's a breakdown of what to expect regarding loan award notifications:

Notification Process:

- The university's financial aid team will review your FAFSA (Free Application for Federal Student Aid) and any additional required documents. This review process ensures that all eligibility criteria are met.

- Once your application is complete and approved, the university will calculate the total financial aid package, including grants, scholarships, and loans.

- Students will then receive an award letter outlining the specific loan amounts, terms, and conditions. This letter will detail the types of loans offered, such as federal Stafford loans or PLUS loans.

Timing of Notifications:

- Award notifications are typically sent out in batches, and the university aims to provide these updates regularly throughout the academic year.

- For federal student loans, the university will inform you of the loan amounts and any required steps to accept or decline the offer. This process usually takes a few weeks from the application submission.

- It is essential to review the award letter carefully and respond promptly to any requests for additional information or documentation.

Communication Channels:

- Notifications will be sent to your university email address, so it's crucial to keep this information up-to-date.

- The university may also communicate via regular mail, especially for more detailed award letters or if there are any issues with your email address.

- Students are encouraged to log in to their university portal regularly to check for any updates and messages from the financial aid office.

Acceptance and Disbursement:

- After accepting the loan offer, the university will disburse the funds according to the established schedule.

- The timing of disbursement may vary, but it typically occurs in installments throughout the semester.

- Students should monitor their university account and financial aid portal to track the disbursement process and ensure that funds are applied correctly.

Remember, the University of Cincinnati's financial aid office is dedicated to providing support and guidance throughout the loan application process. If you have any questions or concerns, don't hesitate to reach out to them for clarification and assistance.

DVM-PhD Admissions: University of Wisconsin Selects the Best

You may want to see also

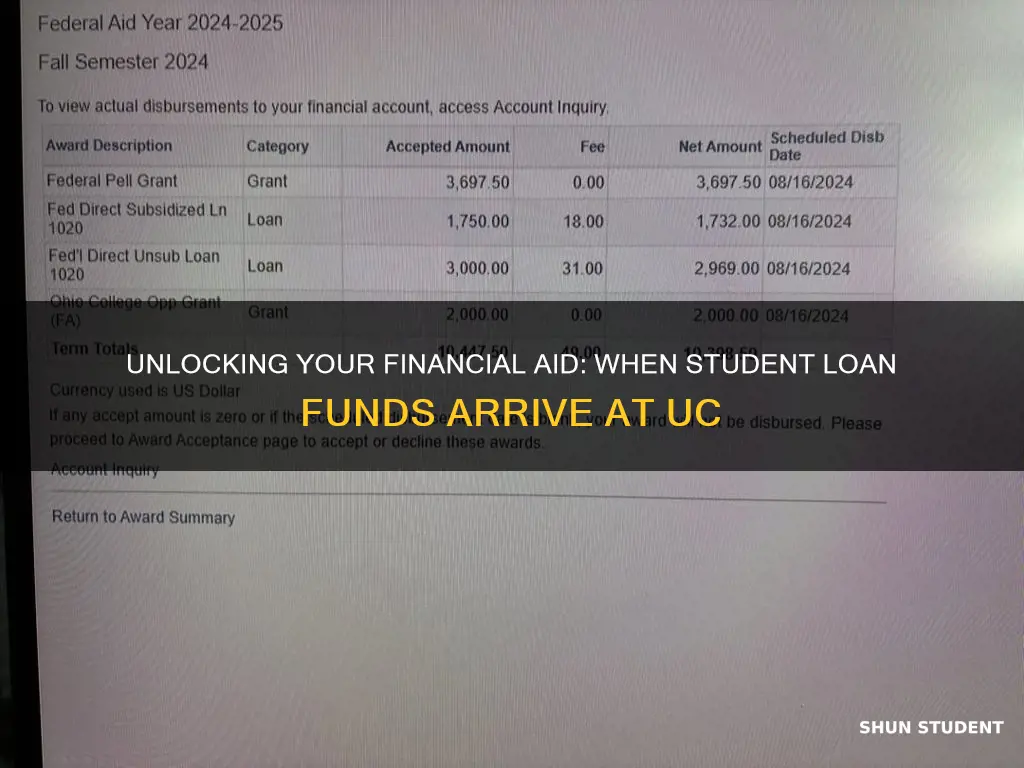

Disbursement Schedule: Discover the timeline for when loan funds are disbursed to your university account

The University of Cincinnati's financial aid office manages the disbursement of federal and private student loans to ensure a smooth and timely process. Understanding the timeline for when loan funds become available in your university account is crucial for effective financial planning. Here's a detailed breakdown of the disbursement schedule:

Federal Student Loans:

The University of Cincinnati typically receives federal loan funds in two installments. The first disbursement usually occurs in the fall semester, covering a significant portion of the academic year. This initial disbursement aims to provide students with the necessary financial support for the beginning of their studies. The second disbursement, if applicable, is often made in the spring semester, ensuring that students have the funds they need to complete their education. It's important to note that the exact timing of these disbursements may vary slightly from year to year, so staying updated with the university's financial aid office is essential.

Private Student Loans:

Private lenders have their own disbursement processes, and the timing can vary widely. Some private lenders may disburse funds directly to the university, while others may provide the funds to the borrower, who then pays the university. It is advisable to review the terms and conditions of your private loan agreement to understand the lender's disbursement policy. Typically, private loans are processed and disbursed in a single payment, either at the start of the academic year or in multiple installments throughout the year, depending on the lender's discretion.

Important Considerations:

- Direct Deposits: The university often uses direct deposit methods to ensure funds are deposited into your university account promptly. This process can take a few days, so plan accordingly to avoid any delays in accessing your financial aid.

- Refunds and Overpayments: In some cases, if your loan funds exceed your educational expenses, the university may refund the excess amount to you. This can happen if your financial aid exceeds the cost of attendance or if there are overpayments.

- Communication: Regularly check your university account and financial aid portal for updates. The university's financial aid office may provide additional information and notifications regarding loan disbursements, so staying informed is crucial.

Understanding the disbursement schedule is key to managing your finances effectively during your time at the University of Cincinnati. By knowing when to expect loan funds, you can plan your expenses, budget accordingly, and ensure a smooth academic journey. Remember, timely communication with the financial aid office can provide valuable insights and address any concerns you may have regarding your student loan disbursement.

Unveiling the Student Population: A Look at UVM's Diversity

You may want to see also

Refinancing Options: Explore refinancing opportunities for existing student loans

When it comes to refinancing existing student loans, it's important to understand the process and the potential benefits it can offer. Refinancing allows borrowers to consolidate their loans, potentially secure a lower interest rate, and simplify their repayment process. Here's an overview of the refinancing options available and how to explore them:

Assess Your Current Loans: Before diving into refinancing, take a comprehensive look at your existing student loans. Gather information about each loan, including the lender, interest rate, loan amount, and remaining balance. This assessment will help you identify the loans eligible for refinancing and understand the potential savings or benefits.

Research Refinancing Lenders: Explore various refinancing options by researching different lenders. Many companies offer refinancing services, including banks, credit unions, and online lenders. Compare their interest rates, repayment terms, fees, and any additional benefits they provide. Look for lenders who specialize in student loan refinancing and have a good reputation for customer service.

Consider Your Financial Goals: Refinancing should align with your financial objectives. If your goal is to reduce monthly payments, refinancing might be a good strategy. Lower interest rates can significantly impact the overall cost of your loans. Alternatively, if you aim to pay off your loans faster, refinancing to a shorter repayment term could be beneficial. Evaluate your financial situation and decide whether refinancing will help you achieve your goals.

Understand the Refinancing Process: Refinancing typically involves applying for a new loan to pay off the existing ones. The process may include a credit check, which lenders use to assess your creditworthiness. It's essential to maintain a good credit score to secure favorable refinancing terms. Be prepared to provide financial information and documentation to support your application.

Explore Government Refinancing Programs: In addition to private lenders, the government offers refinancing options through programs like the Federal Direct Consolidation Loan. This program allows borrowers to combine multiple federal student loans into one, often with lower interest rates and flexible repayment plans. Research these programs to see if they meet your needs and provide additional benefits.

By exploring refinancing options, you can potentially save money, simplify loan management, and gain better control over your student loan repayment journey. Remember to carefully review the terms and conditions of any refinancing offer and consider seeking professional advice if needed.

International Students' Guide to Affording Australian Universities

You may want to see also

Repayment Plans: Learn about different repayment plans and their associated timelines

When it comes to managing your student loan debt after graduating from the University of Cincinnati, understanding the various repayment plans available is crucial. These plans can significantly impact your financial journey post-graduation, helping you navigate the transition from student to borrower. Here's a breakdown of the common repayment strategies and their associated timelines:

Standard Repayment Plan: This is the most straightforward approach, where borrowers pay a fixed monthly amount over a set period, typically ten years. The standard plan offers a consistent payment structure, making it easy to budget. Each payment covers a combination of principal and interest, ensuring a steady reduction in debt. This plan is ideal for those who prefer a structured repayment process and can afford consistent monthly payments.

Extended Repayment Plan: For those seeking more flexibility, the extended repayment plan allows borrowers to pay a lower monthly amount over a more extended period, often up to 25 years. This option is particularly beneficial for graduates with substantial loan amounts, as it reduces the monthly burden. However, it may result in paying more interest over the long term. Borrowers can choose this plan if they anticipate lower income in the initial years after graduation and want to manage their debt more gradually.

Income-Driven Repayment Plans: These plans are designed to make repayment more manageable based on your income and family size. There are multiple income-driven plans, each with its own timeline and rules. For instance, the Income-Based Repayment (IBR) plan adjusts your monthly payment to be affordable, considering your income and family size. The Pay As You Earn (PAYE) plan offers a similar approach, capping monthly payments at 10% of your discretionary income. These plans are excellent for graduates with varying income levels and those who want to ensure their monthly payments align with their financial capabilities.

Grace Period: Before entering repayment, borrowers typically have a grace period, usually six months, during which they don't have to make payments. This period allows new graduates time to secure employment and establish a financial routine. It's essential to be aware of this grace period to avoid late payments and potential penalties.

Understanding these repayment plans is the first step in managing your student loan debt effectively. Each plan has its advantages and considerations, so borrowers should evaluate their financial situation, income prospects, and comfort with varying repayment structures. Consulting with a financial advisor or loan counselor can provide personalized guidance, ensuring you choose the most suitable repayment strategy for your unique circumstances.

Exploring Student Diversity: Numbers at Liverpool John Moores University

You may want to see also

Frequently asked questions

The availability of your student loan funds depends on the type of loan and the timing of your application. Federal Direct Loans typically disburse in two disbursements: one in the fall semester and one in the spring semester. Private loans may have different disbursement schedules, so it's essential to review the terms of your loan agreement.

The University of Cincinnati often aims to have all student loan funds available by the start of the fall semester to ensure students can cover their initial expenses. However, this timeline may vary, and it's recommended to check with the financial aid office for the exact disbursement dates for the current academic year.

If you haven't received your loan funds by the expected date, contact the financial aid office at the University of Cincinnati. They can provide information on the status of your loan, any potential delays, and the steps you can take to ensure your financial aid is processed correctly. It's best to reach out early to resolve any issues promptly.