Finding a university's student loan default rate is an important step in making informed decisions about your education financing. Default rates indicate the percentage of students who have failed to repay their federal student loans within a specific timeframe after leaving school. Understanding these rates can help you assess the financial stability of different institutions and choose a university that aligns with your long-term financial goals. This guide will provide insights into the methods and resources available to locate and interpret student loan default rates, empowering you to make a well-informed choice for your higher education journey.

What You'll Learn

- Loan Default Data Sources: Explore federal databases, institutional reports, and government websites for default rate information

- Time Periods: Understand default rates over different academic years and graduation cohorts

- Loan Types: Compare default rates for federal vs. private loans and different loan programs

- Student Demographics: Analyze default rates by student characteristics like enrollment status and program type

- Default Prevention Strategies: Study institutional practices and policies to reduce loan defaults

Loan Default Data Sources: Explore federal databases, institutional reports, and government websites for default rate information

When researching the default rates of student loans at universities, there are several valuable data sources to explore. Firstly, federal databases are a primary source of information. The U.S. Department of Education's National Center for Education Statistics (NCES) provides a comprehensive database called the Integrated Postsecondary Education Data System (IPEDS). This database offers a wealth of data on postsecondary institutions, including default rates for federal student loans. You can access IPEDS online and search for specific universities to find their default rates over various time periods. The NCES also provides detailed reports and publications on student loan defaults, offering insights into trends and comparisons across institutions.

In addition to federal databases, institutional reports are another crucial resource. Many universities and colleges publish annual reports or financial aid publications that include default rate data. These reports often provide information on the performance of their students in repaying loans, broken down by various demographics and programs. You can contact the university's financial aid office or research department to request these reports or search their official websites for publicly available data. Institutional reports may offer more detailed and specific information compared to federal sources, allowing you to gain a deeper understanding of the loan default rates within a particular university.

Government websites are also a valuable source of student loan default rate data. The U.S. Department of Education's website, for example, provides a loan default rate calculator and a database of institutional compliance with federal regulations. You can use these tools to search for default rates by state, institution type, and other factors. Additionally, government agencies like the Consumer Financial Protection Bureau (CFPB) and the National Student Clearinghouse Research Center publish reports and studies on student loan defaults, offering valuable insights and comparisons. These sources often provide a broader perspective on loan default rates across different institutions and regions.

Furthermore, exploring federal databases like the National Student Clearinghouse (NSC) can be beneficial. The NSC offers a comprehensive database of student loan information, including default rates. Their website provides tools and resources to search for default rates by school, program, and other variables. The NSC also collaborates with various organizations to provide default rate data, ensuring a wide range of coverage. By utilizing these federal databases, you can access up-to-date and reliable information on student loan defaults.

Lastly, it is essential to cross-reference and compare data from different sources. Default rates can vary depending on the time period, methodology, and specific definitions used by each source. By comparing federal databases, institutional reports, and government websites, you can gain a more comprehensive understanding of the loan default rates at universities. This approach ensures that you have a well-rounded perspective and can make informed decisions or analyses based on the most accurate and relevant data.

Black Student Enrollment at the University of Texas

You may want to see also

Time Periods: Understand default rates over different academic years and graduation cohorts

Understanding the default rates of student loans over different time periods and graduation cohorts is crucial for prospective students, their families, and policymakers. This information provides valuable insights into the long-term financial outcomes of graduates from various institutions, helping to make informed decisions about higher education. Here's a guide on how to analyze default rates over time and across different graduation groups:

Academic Years and Default Trends: Start by examining default rates for each academic year or fiscal year. Many countries and institutions release annual reports or data snapshots that provide default rates for students who graduated in a specific year. For example, if you're interested in a university's performance, look for reports that compare default rates for graduates from the classes of 2015, 2016, and so on. This approach allows you to track the default trends over time, identifying any increasing or decreasing patterns. A consistent decrease in default rates over multiple years could indicate improved financial management or better student support systems.

Graduation Cohorts: Default rates can also be analyzed by graduation cohort, which refers to a group of students who entered a program or institution at the same time and graduated together. By comparing default rates across different graduation cohorts, you can identify any long-term financial impacts associated with specific student groups. For instance, you might compare the default rates of students who graduated during the economic boom of the late 1990s with those who graduated during the 2008 financial crisis. This analysis can reveal how economic conditions during their formative years influence loan default rates later in life.

When researching, look for comprehensive reports or databases that provide default rate data for multiple years and graduation cohorts. These sources often offer detailed breakdowns, allowing you to compare rates for different demographics, such as gender, race, and field of study. By analyzing these trends, you can identify potential disparities and make more informed choices.

Additionally, consider the context of each time period. Economic recessions, for instance, often lead to higher default rates as graduates struggle to find employment and repay loans. Conversely, periods of economic growth might result in lower default rates as graduates benefit from better job prospects. Understanding these contextual factors is essential for interpreting the data accurately.

In summary, analyzing student loan default rates over different time periods and graduation cohorts provides a comprehensive view of financial outcomes. It allows you to identify trends, potential disparities, and the impact of external factors on loan repayment. By studying these patterns, students and their families can make more strategic decisions about higher education, ensuring they choose institutions that align with their long-term financial goals and stability.

Faulkner University's Student Population: An Overview

You may want to see also

Loan Types: Compare default rates for federal vs. private loans and different loan programs

When considering student loans, understanding the default rates associated with different loan types is crucial for making informed financial decisions. Default rates provide valuable insights into the likelihood of borrowers repaying their loans, which can significantly impact one's financial future. Here's a breakdown of how to compare default rates for federal and private loans, as well as different loan programs:

Federal Student Loans:

- Default rates for federal student loans are typically lower compared to private loans. This is primarily due to the government's involvement in underwriting and managing these loans. Federal loans often offer more flexible repayment options, including income-driven repayment plans, which can make repayment more manageable for borrowers.

- The U.S. Department of Education provides default rate data for federal student loans on its website. You can search for default rates by loan type, such as Direct Subsidized Loans, Direct Unsubsidized Loans, or PLUS Loans. This information is usually available for a specific time frame, often the most recent year or a few years back.

- For example, as of the 2021-2022 academic year, the default rate for federal Direct Loans (unsubsidized and subsidized) for borrowers who entered repayment in 2017 was approximately 7.4%. This rate can vary depending on the borrower's financial situation and repayment history.

Private Student Loans:

- Private student loans are offered by banks, credit unions, and other financial institutions. Default rates for private loans tend to be higher than those of federal loans. This is often because private lenders assess creditworthiness more rigorously and may not offer the same level of borrower protection.

- Researching private loan default rates can be more challenging, as lenders may not publicly disclose this information. However, some private lenders provide default rate data on their websites or through third-party sources.

- It's essential to consider your creditworthiness and the terms of the loan before borrowing from private lenders. Defaulting on a private loan can have more severe consequences, including damage to your credit score and potential legal action by the lender.

Different Loan Programs:

- Within federal student loan programs, different loan types may have varying default rates. For instance, PLUS Loans, which are often used by parents to finance their children's education, might have higher default rates compared to Direct Subsidized Loans, which are available to undergraduate students.

- Loan programs with more stringent eligibility criteria or those targeted at specific demographics (e.g., Perkins Loans for low-income students) may also have different default rate trends.

- When comparing loan programs, consider factors such as interest rates, repayment terms, and any additional benefits or drawbacks associated with each program.

Factors Influencing Default Rates:

- Default rates can be influenced by various factors, including the borrower's income, employment status, loan amount, and repayment history. Borrowers with a higher income and stable employment are generally less likely to default.

- Additionally, the type of repayment plan chosen can impact default rates. Income-driven repayment plans, for instance, may lower monthly payments but could result in longer repayment periods, potentially increasing the risk of default over time.

Understanding the default rates associated with different loan types is a critical step in managing student debt effectively. By comparing federal and private loans, as well as exploring various loan programs, borrowers can make informed choices to minimize the risk of default and ensure a more secure financial future.

Louisiana Tech University: Ideal Student-Teacher Ratio for Success

You may want to see also

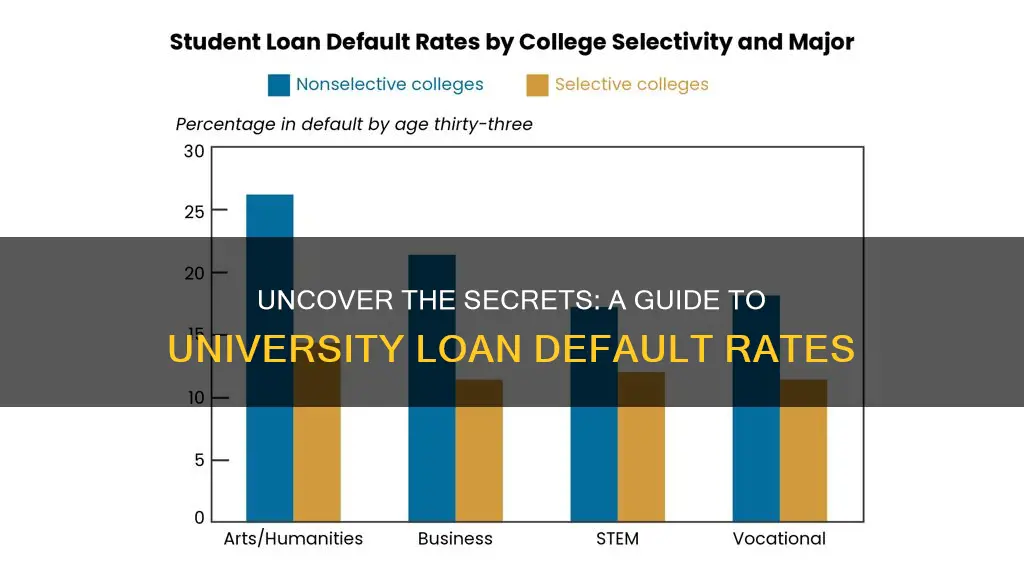

Student Demographics: Analyze default rates by student characteristics like enrollment status and program type

When examining student loan default rates, it's crucial to consider the demographics of the student population. This analysis can provide valuable insights into the factors contributing to loan defaults and help identify at-risk groups. Here's a breakdown of how to analyze default rates based on student characteristics:

Enrollment Status:

- Full-time vs. Part-time: Default rates may vary between full-time and part-time students. Full-time students often have more structured support systems, including academic advisors and access to campus resources, which can influence their ability to manage loan obligations. Part-time students might face challenges in balancing studies with work and other commitments, potentially leading to higher default rates.

- Enrollment Duration: Analyzing default rates over different enrollment periods can be insightful. Freshmen or sophomores might have different default patterns compared to seniors. Understanding these trends can help identify if certain stages of enrollment are more critical for loan management.

Program Type:

- Undergraduate vs. Graduate: Default rates can differ significantly between undergraduate and graduate programs. Undergraduate students often have more time to repay loans after graduation, while graduate students might be pursuing advanced degrees with higher tuition fees, potentially leading to more substantial loan amounts.

- Field of Study: Certain fields of study may correlate with higher default rates. For instance, students in high-cost professional programs like medicine or law might face substantial loan burdens. Alternatively, students in fields with lower employment prospects could struggle to find well-paying jobs, increasing the likelihood of default.

To conduct this analysis, you can utilize data from the National Student Clearinghouse or other reputable sources that provide loan default rate statistics. By comparing default rates across different student demographics, you can identify patterns and trends. For example, you might find that students in specific programs or enrollment statuses have consistently higher default rates. This information can be invaluable for universities and financial aid offices to develop targeted interventions and support systems to assist at-risk students.

Additionally, consider the economic context and the specific challenges associated with each student group. For instance, understanding the impact of the economic recession on default rates can provide a more comprehensive view. This analysis allows for a more nuanced understanding of student loan defaults and enables institutions to tailor their support and guidance accordingly.

Unveiling Gender Dynamics: Female Students at UW-Madison

You may want to see also

Default Prevention Strategies: Study institutional practices and policies to reduce loan defaults

Understanding the default rates on student loans is crucial for both borrowers and lenders, as it provides valuable insights into the financial health and stability of educational institutions. Default rates can indicate the effectiveness of financial aid programs, the quality of education, and the overall economic well-being of students. For borrowers, knowing the default rates of their chosen universities can help them make informed decisions about loan management and repayment strategies.

To study institutional practices and policies aimed at reducing loan defaults, one should begin by examining the specific strategies employed by each university. Many institutions have developed comprehensive programs to support students through their financial aid journey, including loan management workshops, financial literacy courses, and personalized repayment plans. For instance, some universities offer 'Debt Management 101' workshops, teaching students about budgeting, debt repayment strategies, and the importance of timely loan payments. These workshops often provide practical tools and resources to help students make informed financial decisions.

Another critical aspect to consider is the availability and accessibility of financial aid and scholarship opportunities. Universities that offer a wide range of financial aid options, including grants, work-study programs, and low-interest loans, can significantly reduce the financial burden on students. By providing alternative funding sources, these institutions lower the likelihood of students relying heavily on loans, thus decreasing the potential for default. Additionally, scholarship programs that target specific demographics or academic achievements can further alleviate financial stress and improve loan repayment rates.

Institutional policies and procedures also play a vital role in preventing loan defaults. Universities should establish clear guidelines and communication channels regarding loan application processes, repayment schedules, and default prevention measures. Effective communication ensures that students are well-informed about their financial responsibilities and the potential consequences of defaulting on loans. Moreover, institutions should provide regular updates and reminders about upcoming repayment milestones, offering support and resources to students who may be struggling with loan management.

Furthermore, studying institutional practices can involve analyzing the impact of financial aid counseling and support services. Many universities employ dedicated financial aid counselors who provide one-on-one guidance and assistance to students. These counselors help students navigate the complexities of loan management, offering personalized advice and strategies to improve financial literacy and repayment behavior. By providing ongoing support, institutions can foster a sense of financial responsibility and empower students to make informed choices.

In summary, reducing student loan defaults requires a comprehensive approach that involves understanding institutional practices and policies. By examining the strategies employed by universities, borrowers can gain valuable insights into the financial support available and the potential risks associated with different loan options. Effective communication, accessible financial aid, and comprehensive support services are key components in preventing loan defaults and ensuring a positive financial outcome for students.

Liberty University Students React: Falwell Photos Spark Debate

You may want to see also

Frequently asked questions

The student loan default rate is a measure of the percentage of borrowers who fail to make timely payments on their federal or private student loans. It is an important indicator of the financial health of a university's student loan portfolio and can provide insights into the effectiveness of the institution's financial aid and loan management programs.

The default rate is typically calculated by the U.S. Department of Education for federal student loans. It is determined by the percentage of borrowers who are at least 270 days past due on their loan payments, including those in deferment or forbearance, within a specific time frame, usually a fiscal year.

Understanding the default rate can help students and prospective students make informed decisions about their education financing options. A higher default rate may indicate potential financial challenges for students, suggesting the need for better loan management resources and support. It can also impact a university's reputation and its ability to attract students and funding.

The U.S. Department of Education's website provides a comprehensive database where you can search for the default rates of various institutions. You can access the National Center for Education Statistics' (NCES) website and use their search tool to find the default rate for federal student loans. Additionally, many universities provide this information on their financial aid or student services websites.