Navigating the financial aid process for Emory University can be a daunting task, but understanding how to secure student loans is a crucial step in funding your education. This guide will provide an overview of the loan application process, including the types of loans available, eligibility criteria, and steps to ensure you receive the financial support you need to pursue your academic goals at Emory.

What You'll Learn

- Eligibility Criteria: Understand the requirements for federal and private loans

- Application Process: Step-by-step guide to completing the FAFSA and loan applications

- Financial Aid Packages: Explore how loans fit into overall financial aid offers

- Repayment Options: Learn about repayment plans and potential loan forgiveness programs

- Interest Rates: Compare federal and private loans to find the best rates

Eligibility Criteria: Understand the requirements for federal and private loans

To secure student loans for Emory University, it's crucial to understand the eligibility criteria for both federal and private loans. Federal student loans, such as the Direct Subsidized and Unsubsidized Loans, are generally more accessible and offer better terms compared to private loans. Here's a breakdown of the key requirements:

Federal Loans:

- Citizenship or Eligibility: You must be a U.S. citizen, permanent resident, or eligible non-citizen to be eligible for federal student loans. International students may also qualify, but they typically need to demonstrate financial independence and a strong academic record.

- Enrollment Status: Federal loans are typically based on enrollment status. You must be enrolled in an eligible program at least half-time (6 credits or more for undergraduate students, 5 credits for graduate students).

- Financial Need: For subsidized loans, demonstrating financial need is essential. The Free Application for Federal Student Aid (FAFSA) is used to determine your eligibility, which considers your family's financial situation and assets.

- Credit History: Unlike private loans, federal loans do not require a credit history or cosigner. However, for PLUS loans (Parent PLUS Loans), the parent must have a good credit history.

Private Loans:

- Creditworthiness: Private lenders often require a good credit history or a co-signer with excellent credit. If you have a limited credit history, a co-signer can increase your chances of approval and may secure a lower interest rate.

- Enrollment Verification: Private lenders typically require proof of enrollment and academic progress. This can be verified through the school's financial aid office.

- Income and Employment: Some private lenders may consider your income and employment status. They might require a steady income or a job offer to ensure you can repay the loan.

- Loan Limits: Private loans often have higher limits compared to federal loans, allowing you to cover more significant expenses. However, it's essential to borrow only what you need and can reasonably repay.

Understanding these eligibility criteria is the first step in navigating the student loan process for Emory University. Federal loans are generally more accessible and offer better interest rates, while private loans can provide additional funding options. It's advisable to start with federal loan applications and explore private loans if needed, ensuring you meet all the requirements to secure the financial aid you deserve.

Unveiling Your Cincinnati Student ID: A Guide to Accessing Campus Resources

You may want to see also

Application Process: Step-by-step guide to completing the FAFSA and loan applications

The process of securing student loans for Emory University involves several steps, and understanding the application process is crucial for a successful outcome. Here's a step-by-step guide to help you navigate the financial aid journey:

- Complete the Free Application for Federal Student Aid (FAFSA): This is the initial and essential step in the process. The FAFSA is a federal form that determines your eligibility for various types of financial aid, including federal loans, grants, and work-study programs. Start by gathering the necessary information, such as your and your family's financial details, including income, assets, and expenses. Emory University's financial aid website will provide specific instructions and deadlines for submitting the FAFSA. Ensure you submit the form accurately and on time to maximize your chances of receiving federal aid.

- Research and Apply for Federal Loans: After submitting the FAFSA, you can apply for federal student loans, which often have more favorable terms than private loans. The most common federal loan programs include the Direct Subsidized Loan, Direct Unsubsidized Loan, and Direct PLUS Loan. Log in to your student aid account on the Federal Student Aid website and complete the necessary steps to apply. You will need to provide personal and financial information, and you may be required to complete entrance and exit counseling. Federal loans typically have lower interest rates and more flexible repayment options compared to private loans.

- Explore Private Loan Options: If you have exhausted federal aid options or need additional funding, private student loans can be considered. Research and compare different private lenders to find the best terms and interest rates for your needs. Private loans often require a good credit history or a co-signer. Complete the application process for each lender, providing the necessary documentation and financial information. Be cautious when applying for multiple private loans, as it may impact your credit score.

- Complete Emory University's Financial Aid Application: In addition to the federal FAFSA, Emory University requires its own financial aid application. This application will provide the university with more detailed information about your financial situation and aid preferences. Follow the university's instructions for submitting this application, which may include additional forms and essays. The financial aid office at Emory will use this information to determine your eligibility for institutional aid, including scholarships, grants, and work-study opportunities.

- Review and Accept Loan Offers: Once you have received loan offers from both federal and private lenders, carefully review the terms and conditions. Compare interest rates, loan limits, repayment plans, and any associated fees. Choose the loan(s) that best fit your financial needs and repayment capabilities. Accept the selected loan offers by following the lender's instructions, which may involve signing loan agreements and providing necessary documentation.

Remember, the key to a successful loan application is thorough preparation and timely submission of all required documents. Stay organized, keep track of deadlines, and don't hesitate to reach out to the financial aid offices at Emory University and your chosen lenders for guidance and clarification throughout the process.

Unlocking Your UND Student ID: A Guide to Accessing Campus Resources

You may want to see also

Financial Aid Packages: Explore how loans fit into overall financial aid offers

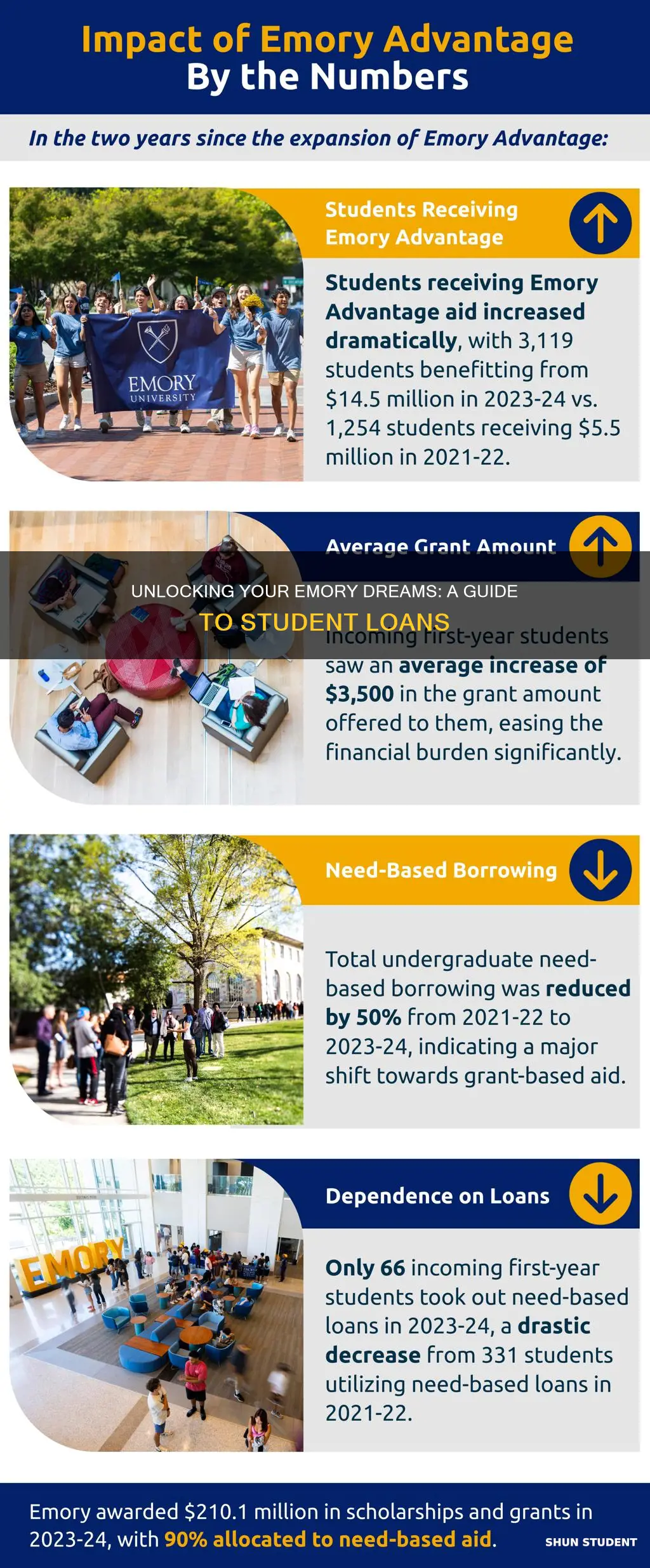

When considering your financial aid package for Emory University, understanding the role of student loans is crucial. Loans are a significant component of the financial aid offered to students, providing the necessary funds to cover educational expenses. Here's a breakdown of how loans fit into the overall financial aid offer:

Loan Amounts and Limits: Emory University, like many institutions, offers loans to cover the remaining costs after other financial aid sources, such as grants and scholarships, have been applied. The university provides federal and institutional loans. Federal loans, such as the Stafford Loan, have fixed interest rates and flexible repayment options, making them a popular choice. Institutional loans, often offered by the university, may have more competitive interest rates but typically have higher borrowing limits. It's essential to review the loan limits set by the university and the federal government to understand how much you can borrow.

Loan Repayment Terms: Financial aid packages often include detailed information about loan repayment. Federal loans usually offer grace periods after graduation or withdrawal, during which you don't have to make payments. After the grace period, repayment begins, and the terms can vary. Some loans provide fixed monthly payments, while others may offer income-driven repayment plans, which adjust monthly payments based on your income and family size. Understanding these repayment terms is vital to managing your long-term financial obligations.

Loan Interest and Fees: Interest accrues on unpaid loan balances, and it's essential to consider the interest rates associated with your loans. Federal loans typically have lower interest rates compared to private loans. Emory University may offer interest-free periods during the repayment grace period, allowing you to manage your finances effectively. Additionally, be aware of any loan processing fees and origination fees, which are typically deducted from the loan amount before disbursement.

Loan Management and Refinancing: Effective loan management is crucial to avoid financial strain. Consider creating a budget that accounts for loan payments and explore strategies to reduce loan amounts or interest. Refinancing options may be available, allowing you to consolidate loans or secure a lower interest rate. Emory University's financial aid office can provide guidance on loan management and refinancing, ensuring you make informed decisions about your financial future.

In summary, student loans are an integral part of financial aid packages for Emory University students. By understanding loan amounts, repayment terms, interest rates, and management strategies, you can make informed choices to ensure a sustainable financial future. It is advisable to review all financial aid offers and seek guidance from the university's financial aid office to navigate the loan process successfully.

Fairfield University's Student Population: How Many Attend?

You may want to see also

Repayment Options: Learn about repayment plans and potential loan forgiveness programs

When it comes to managing your student loans after enrolling at Emory University, understanding the various repayment options is crucial. The university's financial aid office provides resources to help students navigate their loan repayment journey, ensuring they can make informed decisions about their financial future. Here's an overview of the repayment plans and loan forgiveness programs you should be aware of:

Standard Repayment Plan: This is the most common repayment option for federal student loans. With this plan, borrowers typically make fixed monthly payments over a set period, usually 10 years. The payments are calculated to cover the principal amount borrowed and the interest accrued. Emory University encourages students to choose this plan as it provides a structured approach to repaying the loan, ensuring that the debt is managed effectively.

Income-Driven Repayment (IDR) Plans: These plans are designed to make loan repayment more manageable, especially for borrowers with high loan balances and low incomes. IDR plans include options like the Income-Based Repayment (IBR) and the Pay As You Earn (PAYE) plans. With these programs, monthly payments are calculated based on a percentage of the borrower's discretionary income, ensuring that payments are affordable. After a certain period, often 20 years, any remaining loan balance may be forgiven, providing significant relief for borrowers.

Grace Period: After completing your studies, you are typically given a grace period of six months (or nine months for Perkins Loans) during which you don't have to make any payments. This period allows you to focus on finding employment and establishing your financial independence. It's important to note that interest continues to accrue during this time, so borrowers should consider making interest-only payments or exploring other repayment strategies to minimize the overall cost of the loan.

Loan Forgiveness Programs: Emory University and the federal government offer loan forgiveness programs to provide relief to borrowers. The most well-known program is the Public Service Loan Forgiveness (PSLF) program, which forgives any remaining federal student loan debt after 10 years of qualified employment in public service jobs. Other programs include the Income-Driven Repayment Plan's forgiveness option, where borrowers may be eligible for loan forgiveness after 20 years of on-time payments under an IDR plan. Exploring these options can be a strategic move to manage your debt effectively.

Understanding the repayment plans and loan forgiveness programs available is essential for making informed financial decisions. Emory University's financial aid office can provide detailed guidance and resources to help students navigate the repayment process successfully. It is recommended to review the university's website or consult with financial aid advisors to gather specific information tailored to your loan type and personal circumstances.

Housing Options: Cornell University's Graduate Student Accommodation

You may want to see also

Interest Rates: Compare federal and private loans to find the best rates

When considering student loans for Emory University, understanding interest rates is crucial as they significantly impact the total cost of your education. Here's a breakdown of how to compare federal and private loans for the best rates:

Federal Loans:

- Fixed Interest Rates: Federal student loans typically offer fixed interest rates, meaning the rate remains the same throughout the loan's life. For the 2023-2024 academic year, the standard interest rate for undergraduate students is 5.5% for subsidized loans and 7.05% for unsubsidized loans.

- Subsidized vs. Unsubsidized: Subsidized loans don't accrue interest while you're in school at least half-time, during the grace period after graduation, and during approved deferment periods. Unsubsidized loans accrue interest from the first day of enrollment, so managing this interest is crucial.

- Benefits: Federal loans are generally more accessible with less stringent credit requirements. They also offer income-driven repayment plans that can make monthly payments more manageable after graduation.

Private Loans:

- Variable Interest Rates: Private loans often have variable interest rates, which can fluctuate based on market conditions. This means your monthly payments could change over time.

- Competitive Rates: Private lenders may offer lower interest rates than federal loans, especially for borrowers with strong credit histories. However, be cautious of teaser rates that drop after a certain period.

- Considerations: Private loans generally require a good credit history or a co-signer. They might also have stricter repayment terms and fewer forgiveness options compared to federal loans.

Comparing Options:

- Shop Around: Don't settle for the first loan you find. Compare interest rates, repayment terms, loan limits, and any additional fees from multiple lenders.

- Consider Your Financial Situation: If you have a solid credit history, private loans might be a good option. However, if you're concerned about long-term affordability, federal loans with their fixed rates and repayment plans could be more suitable.

- Utilize Online Tools: Websites and calculators can help you estimate your potential loan payments based on different interest rates and repayment scenarios.

Remember:

- Interest rates are a key factor in the overall cost of your education.

- Federal loans generally offer more borrower-friendly terms.

- Carefully weigh your financial situation, creditworthiness, and long-term goals when choosing a loan.

Liberty University Students React: Falwell's Photos Shock and Divide

You may want to see also

Frequently asked questions

The process for applying for student loans to attend Emory University involves several steps. First, you need to complete the Free Application for Federal Student Aid (FAFSA) to determine your eligibility for federal loans. Emory University also offers its own institutional aid, which may include loans, and you can apply through the university's financial aid office. It's recommended to start the application process early and explore all available options, including federal and private loans.

Yes, there are specific requirements and restrictions. Federal loans, such as the Direct Subsidized and Unsubsidized Loans, have annual limits and eligibility criteria based on financial need and enrollment status. Emory University's institutional loans may have different terms and conditions, including interest rates, repayment plans, and any additional fees. It's important to review the university's financial aid website for detailed information and to understand the terms before borrowing.

Enhancing your chances of securing a student loan involves several strategies. Maintaining a good credit history and score can make a difference, as lenders often consider creditworthiness. Providing comprehensive and accurate financial information in your application is crucial. Additionally, exploring scholarship opportunities and grants can help reduce the reliance on loans. Building a strong relationship with the financial aid office at Emory University can also provide guidance and support throughout the application process.