Managing finances can be a challenging task for university students, especially those facing the independence of student life for the first time. Effective money management is crucial to ensure a smooth and enjoyable university experience. This guide will provide practical tips and strategies to help students make the most of their financial resources, covering budgeting, saving, and understanding the various financial options available to them. By implementing these strategies, students can avoid financial pitfalls and make informed decisions to support their academic pursuits and overall well-being.

What You'll Learn

- Budgeting Basics: Track income and expenses to create a realistic budget

- Saving Strategies: Explore ways to save on essentials and non-essentials

- Financial Aid Options: Understand grants, scholarships, and work-study programs

- Debt Management: Learn to avoid debt traps and manage student loans

- Smart Spending: Prioritize spending and make informed financial choices

Budgeting Basics: Track income and expenses to create a realistic budget

Managing your finances as a university student can be challenging, but mastering the basics of budgeting is essential to ensure you stay on track financially. One of the fundamental steps towards achieving this is by tracking your income and expenses, which forms the backbone of a realistic budget. Here's a guide to help you get started:

Understand Your Financial Situation: Begin by identifying your sources of income. For students, this typically includes any part-time jobs, allowances, or grants. Calculate your total monthly income, including any one-time earnings from summer jobs or freelance work. It's crucial to have a clear picture of your financial inflows. Alongside income, you need to track your expenses. Make a list of all your regular and irregular expenses. Regular expenses might include rent, utilities, transportation, and groceries. Irregular ones could be textbooks, social events, or entertainment. The goal is to categorize and quantify your spending habits.

Create a Detailed Expense List: Break down your expenses into essential and non-essential categories. Essential expenses are those that are necessary for your daily life and well-being, such as tuition fees, accommodation, and textbooks. Non-essential expenses are discretionary and can be adjusted or reduced if needed, like dining out, entertainment, and travel. By separating these, you can better understand your spending patterns and prioritize your financial decisions.

Utilize Digital Tools: There are numerous budgeting apps and software available that can simplify the process of tracking income and expenses. These tools often provide user-friendly interfaces, allowing you to input your financial data quickly. Some apps even offer features like automatic categorization, spending alerts, and visual representations of your budget, making it easier to stay on top of your finances. You can also use a simple spreadsheet or a notebook to manually track your expenses, which can be particularly useful for those who prefer a more hands-on approach.

Set Realistic Budget Goals: Once you have a comprehensive understanding of your income and expenses, you can start creating a budget. Allocate your income to cover your essential expenses first. Then, determine how much you can realistically spend on non-essential items. Ensure your budget is tailored to your lifestyle and priorities. For instance, if you're a social butterfly, allocate a reasonable amount for social events, but also consider ways to save on entertainment costs. Regularly review and adjust your budget as needed to stay aligned with your financial goals.

Stay Disciplined and Adaptable: Budgeting requires discipline and a willingness to adapt. It's essential to stick to your budget as closely as possible, but also be prepared to make adjustments. If you find that you're consistently overspending in a particular category, identify ways to cut back or find alternative solutions. For example, if your dining out expenses are high, consider cooking more meals at home or exploring cheaper eating options. By being proactive and adaptable, you can ensure that your budget remains a practical and effective tool for managing your university finances.

Unveiling the Hub: Understanding University Student Centers

You may want to see also

Saving Strategies: Explore ways to save on essentials and non-essentials

Managing finances as a university student can be challenging, but with the right strategies, you can save money and make the most of your student budget. Here are some saving strategies to help you navigate the essentials and non-essentials of student life:

Essentials:

- Cook Your Own Meals: One of the most effective ways to save is by cooking at home instead of dining out or ordering takeout. Plan your meals, create a grocery list, and buy in bulk to save on food costs. Cooking allows you to control portions and reduce food waste, which can significantly impact your budget.

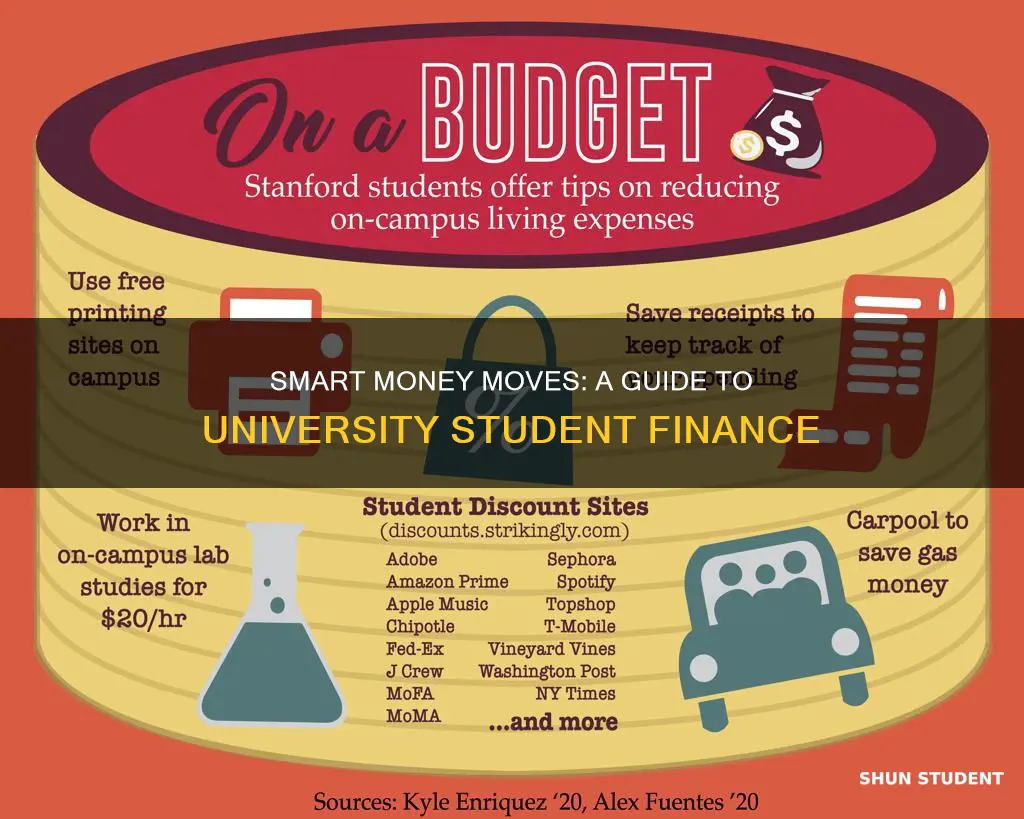

- Utilize Student Discounts: Many companies offer student discounts, so take advantage of these savings opportunities. From software and tech gadgets to clothing and electronics, these discounts can add up to substantial savings. Websites and apps dedicated to student discounts can help you stay updated on the latest offers.

- Share Resources: Consider sharing resources with roommates or friends. For example, buying household essentials like toilet paper, cleaning supplies, or toiletries in bulk can be more cost-effective. You can also take turns hosting movie nights or game nights, reducing individual expenses.

- Explore Affordable Transportation: Transportation costs can be a significant expense. Consider walking, biking, or using public transportation instead of owning a car. If you need a vehicle, look into carpooling or renting a car when needed, which can be more economical than owning one.

Non-Essentials:

- Set a Budget and Track Spending: Create a monthly budget and allocate funds for different expenses. Regularly track your spending to identify areas where you can cut back. There are numerous budgeting apps and spreadsheets available to help you stay organized and accountable.

- Shop Smart: When purchasing non-essential items, compare prices from different retailers. Look for sales, discounts, and student promotions. Buying second-hand or refurbished items can also be a great way to save on electronics, furniture, or clothing.

- Limit Impulse Purchases: Impulse buying can quickly derail your savings. Before making a purchase, ask yourself if it's a need or a want. Waiting a day or two before buying can help you make more rational decisions and avoid unnecessary expenses.

- Explore Free or Low-Cost Activities: University life offers numerous free or low-cost entertainment options. Attend free lectures, join student clubs, explore nature trails, or take advantage of campus events. These activities provide entertainment without straining your budget.

Post-Grad Paths: Exploring Career Choices of University of Michigan Graduates

You may want to see also

Financial Aid Options: Understand grants, scholarships, and work-study programs

When it comes to managing finances during your university years, understanding the various financial aid options available is crucial. These options can significantly reduce the financial burden and allow you to focus on your studies and personal growth. Here's a breakdown of grants, scholarships, and work-study programs:

Grants: These are financial awards provided to students based on financial need, academic merit, or other specific criteria. Unlike loans, grants do not require repayment, making them an attractive option for students. Many universities and external organizations offer grants to support students' educational expenses. To find grants, start by researching your university's financial aid office, as they often have information about available grants and the application process. Additionally, explore government-funded programs, as they may provide grants to students from diverse backgrounds or those pursuing specific fields of study. Keep an eye out for community foundations and non-profit organizations that also offer grants to support student education.

Scholarships: Similar to grants, scholarships are financial awards, but they often come with specific requirements or criteria that students must meet. These requirements can vary widely and may include academic performance, extracurricular achievements, community involvement, or even unique talents. Scholarships can be highly competitive, so it's essential to start your search early and explore various sources. Many scholarships are institution-specific, so visit your university's website to find scholarship opportunities tailored to your field of study. Additionally, consider external scholarships offered by private organizations, corporations, or alumni networks. These scholarships often have dedicated websites or databases where you can search for opportunities based on your demographics, interests, or academic background.

Work-Study Programs: These programs provide part-time employment opportunities for students, typically with the federal government or the university itself. Work-study jobs are designed to offer a flexible way to earn income while maintaining a balance between work and studies. The earnings from these jobs can help cover educational expenses and even provide a small savings cushion. To access work-study programs, students usually need to complete a financial aid application, which includes an assessment of their financial need. Once selected, students can work in various on-campus positions, such as teaching assistants, library assistants, or administrative roles. These jobs often provide a steady income and a chance to gain valuable work experience while studying.

Understanding and applying for these financial aid options can significantly impact your university experience. Grants and scholarships can reduce the need for student loans, while work-study programs offer a practical way to earn while learning. It's essential to start your research early, as many of these opportunities have specific application deadlines. Keep track of the various sources and maintain a well-organized approach to ensure you don't miss out on these valuable financial support options.

International Students at the University of Sao Paulo: Who's Welcome?

You may want to see also

Debt Management: Learn to avoid debt traps and manage student loans

Managing student debt can be a daunting task, but with the right strategies, you can avoid falling into debt traps and ensure a healthier financial future. Here's a guide to help you navigate the world of student loans and debt management:

Understand Your Debt: The first step towards effective debt management is knowledge. Start by gathering all the necessary information about your student loans. This includes the total amount borrowed, interest rates, repayment terms, and any associated fees. Many financial aid offices provide detailed loan summaries, and you can also contact your loan servicer for clarification. Understanding the specifics of your debt is crucial to making informed decisions.

Create a Repayment Plan: Develop a structured plan to tackle your student loans. Consider the following strategies: Firstly, prioritize high-interest loans; focus on paying them off first to minimize long-term costs. Secondly, explore income-driven repayment plans, which can adjust your monthly payments based on your income and family size, making repayment more manageable. Lastly, consider consolidating your loans, which combines multiple loans into one, often with a lower interest rate, simplifying repayment.

Explore Loan Forgiveness Programs: Governments and institutions often offer loan forgiveness programs to support students. Research and apply for these programs if you meet the eligibility criteria. For instance, the Public Service Loan Forgiveness (PSLF) program in the US forgives loans for borrowers who work full-time in qualifying public service jobs. Understanding and utilizing such programs can significantly reduce your debt burden.

Practice Responsible Spending: While student loans provide access to education, it's essential to borrow wisely. Evaluate your financial needs and only take out loans for essential expenses. Avoid unnecessary purchases that can lead to unnecessary debt. Living within your means during your studies will contribute to a more stable financial future.

Stay Informed and Take Action: Debt management is an ongoing process. Stay updated on any changes to your loan terms, interest rates, or repayment options. Loan servicers typically provide regular updates, and you can also set up notifications for important loan-related events. Take proactive steps to ensure timely payments and consider setting up automatic payments to avoid late fees and potential negative impacts on your credit score.

By implementing these strategies, you can effectively manage your student debt, avoid the pitfalls of excessive borrowing, and work towards a financially secure future. Remember, staying informed and taking control of your finances is key to a successful and debt-free student experience.

Unveiling Your Cincinnati Student ID: A Guide to Accessing Campus Resources

You may want to see also

Smart Spending: Prioritize spending and make informed financial choices

Managing your finances as a university student can be challenging, but with a strategic approach to spending, you can make your money work for you and ensure a more secure financial future. Here are some tips to help you prioritize spending and make informed financial choices:

Create a Realistic Budget: Start by understanding your income and expenses. Calculate your total monthly income, including any allowances, part-time jobs, or grants. Then, list all your expected expenses, such as tuition fees, accommodation, textbooks, transportation, and daily living costs. Allocate a reasonable amount for each category, ensuring that your essential needs are covered first. A well-structured budget will help you visualize your spending and identify areas where you can cut back if needed.

Distinguish Between Needs and Wants: Prioritize spending on necessities and long-term goals. Needs include essential items like textbooks, stationery, and a reliable mode of transportation to attend classes. Wants, on the other hand, are discretionary purchases that can be postponed or reduced. For example, instead of buying the latest smartphone, consider buying a used one or saving up for a more affordable model. Distinguishing between needs and wants will help you make conscious decisions and avoid unnecessary debt.

Explore Cost-Saving Options: University life can be expensive, but there are ways to save money without compromising your experience. Look for second-hand bookstores or online platforms where you can buy textbooks at a fraction of the original price. Consider joining study groups or online forums to exchange notes and resources, reducing the need for multiple purchases. For transportation, explore student discounts for public transport or consider carpooling to save on fuel and maintenance costs.

Practice Conscious Consumption: Be mindful of your spending habits and ask yourself if each purchase is necessary. Before making a purchase, consider the following: Will I use this item regularly? Can I afford it without compromising my other financial commitments? Waiting a day or two before buying impulse items can help you make more rational decisions. Additionally, opt for cheaper alternatives for non-essential items, such as cooking at home instead of dining out frequently.

Utilize Student Discounts and Rewards: Many businesses offer student discounts, so take advantage of these opportunities to save. Check with local stores, restaurants, and entertainment venues for student-specific deals. Some banks also provide student accounts with rewards and cashback offers. Accumulating these savings can significantly contribute to your overall financial well-being.

By implementing these strategies, you can develop a healthier relationship with money, ensuring that your spending is intentional and aligned with your financial goals. Remember, smart spending is about making informed choices, prioritizing your needs, and finding creative ways to save without sacrificing your university experience.

Scholarship Generosity: Top Australian Universities for International Students

You may want to see also

Frequently asked questions

Budgeting is a crucial skill for managing finances during your student life. Start by listing your monthly income sources, such as grants, scholarships, or part-time work. Then, categorize your expenses into essentials (tuition fees, accommodation, utilities), discretionary spending (entertainment, dining out), and savings. Allocate a reasonable amount for each category and track your spending to ensure you stay within your budget. Consider using budgeting apps or spreadsheets to make the process easier.

University life can be expensive, but there are ways to cut costs. Firstly, take advantage of student discounts whenever possible; many businesses offer reduced prices for students. Cook your own meals instead of eating out frequently, as cooking at home is generally more affordable. Opt for second-hand textbooks or online resources to save on book costs. Consider sharing expenses with roommates, such as splitting grocery bills or utility costs. Lastly, be mindful of your spending habits and prioritize your needs over wants.

Maximizing your financial aid is essential to ensure you have sufficient funds for university. Start by understanding the terms and conditions of your loan or aid package. Prioritize covering essential expenses first, such as tuition and accommodation. Create a budget that accounts for your expected income and expenses, and try to live below your means. Consider taking on a side hustle or part-time job to boost your income. Regularly review your financial situation and make adjustments to your budget as needed.

Saving for the future is an important habit to develop during your student years. Set clear financial goals, such as saving for a post-graduate trip or a future car purchase. Open a dedicated savings account and try to contribute a small amount regularly. Consider automating your savings by setting up direct deposits from your paycheck or allowance. Explore opportunities to earn extra money, like tutoring or selling unwanted items. By consistently saving, you'll build a financial cushion and achieve your long-term objectives.