University education is a significant investment, and students often face a range of expenses beyond tuition fees. From accommodation and textbooks to transportation and social activities, the costs can add up quickly. Understanding these expenses is crucial for students to plan their finances effectively and make the most of their university experience. This paragraph aims to explore the various financial commitments students encounter during their academic journey, providing a comprehensive overview of the expenses they might encounter.

What You'll Learn

- Tuition Fees: The cost of attending classes and accessing educational resources

- Accommodation: Rent or fees for on-campus housing or off-campus living

- Books and Materials: Textbooks, notes, and other learning resources

- Transportation: Commuting costs, including public transport or vehicle maintenance

- Social Activities: Student club fees, events, and extracurricular participation costs

Tuition Fees: The cost of attending classes and accessing educational resources

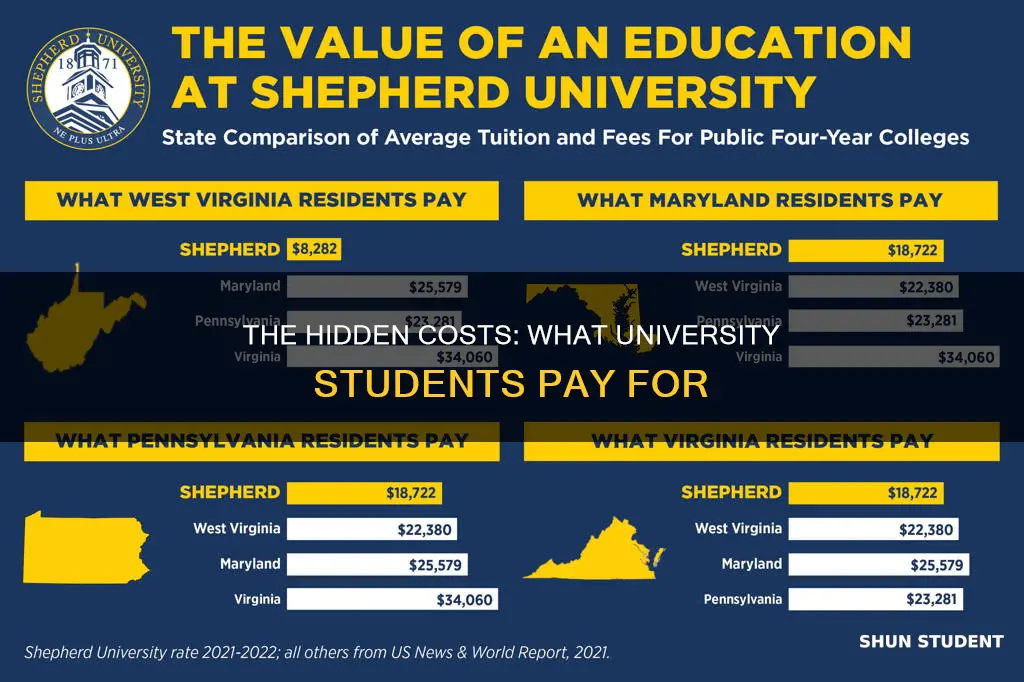

University education is a significant investment, and students often incur various expenses beyond just tuition. One of the most substantial financial commitments for students is the tuition fee, which covers the cost of attending classes and accessing educational resources. These fees vary widely depending on the country, institution, and program chosen.

Tuition fees are typically set by universities and can be categorized into different types. The most common type is the annual tuition fee, which students pay for each year of their course. This fee covers the cost of lectures, seminars, and other academic activities. It also includes access to libraries, laboratories, and other facilities essential for a student's learning experience. In some cases, universities may offer a flat fee for the entire program, which can be a significant financial burden for students, especially those on a tight budget.

The cost of tuition can vary greatly depending on the country and the type of institution. For instance, public universities in the United States often have lower tuition fees compared to private institutions. Similarly, in the UK, tuition fees for home students (those from the EU) are generally lower than for international students. It is essential for students to research and compare fees to make an informed decision about their education. Many universities also offer different fee structures, such as per-credit or per-course fees, which can impact the overall cost.

In addition to the annual tuition fee, students may also have to pay for other educational resources and services. This includes textbooks, course materials, and sometimes even technology or software required for specific subjects. Some universities provide access to online resources and databases, which may incur additional costs. Furthermore, students might need to pay for field trips, internships, or practical training, which are often mandatory components of their degree. These expenses can vary significantly depending on the course and the institution's policies.

Managing tuition fees and other educational expenses can be challenging for students, especially those from low-income backgrounds. Many institutions offer financial aid, scholarships, and work-study programs to support students in their education. It is crucial for prospective students to explore these options and plan their finances accordingly. Understanding the breakdown of tuition fees and associated costs can help students make better decisions and ensure they are prepared for the financial commitment of higher education.

Summer Break: University Students' Guide to Fun and Learning

You may want to see also

Accommodation: Rent or fees for on-campus housing or off-campus living

University students often face the challenge of finding suitable and affordable accommodation. The cost of living can vary significantly depending on the location and type of accommodation chosen. When it comes to accommodation expenses, students have two main options: on-campus housing and off-campus living.

On-campus housing, also known as residence halls or student accommodation, is typically provided by the university itself. It offers a convenient and often more affordable option for students. The cost of on-campus housing can vary depending on the institution and the specific residence. Students may pay a weekly or monthly rent, which often includes utilities such as electricity, water, and internet. Some universities also provide meals or a meal plan as part of the accommodation package. On-campus housing is particularly beneficial for freshmen or those seeking a more structured living environment, as it provides a sense of community and easy access to university facilities.

Off-campus living, on the other hand, involves renting a private property or apartment away from the university grounds. This option offers more independence and flexibility but can be more expensive. Students can choose to live in shared accommodations, where they split the rent and utilities with roommates, or opt for a private room in a shared house. The cost of off-campus housing depends on factors such as location, property size, and amenities. Students should consider the proximity to the university, as a longer commute may result in higher transportation costs. Additionally, off-campus students might need to pay for utilities, internet, and other living expenses separately.

When deciding between on-campus and off-campus accommodation, students should consider their budget, personal preferences, and the overall university experience they desire. On-campus housing often provides a more comprehensive package, including amenities and a sense of community, while off-campus living offers independence and the opportunity to live in a more residential area.

It is essential for students to research and compare different accommodation options to find the best fit for their needs and financial situation. Many universities provide resources and support to help students navigate the accommodation process, including guidance on budgeting and financial planning. Understanding the costs associated with accommodation is a crucial step in managing a student's overall expenses during their university journey.

Uncovering the Traits of Successful Students at the University of Michigan

You may want to see also

Books and Materials: Textbooks, notes, and other learning resources

University students often face the challenge of managing their finances, especially when it comes to the various expenses associated with their education. One of the most significant and recurring costs is the purchase of books and learning materials. Textbooks, in particular, are a staple in a student's life, providing the foundation for their academic journey. These books are essential for understanding the core concepts of their chosen subjects and are often required for lectures, seminars, and exams. However, the cost of textbooks can be prohibitively expensive, often priced at a premium. Many students find themselves spending a substantial amount of money on these resources, which can be a significant burden, especially for those on a tight budget.

In addition to textbooks, students also rely on notes, lecture slides, and other learning materials provided by their professors or peers. These resources are crucial for supplementing lectures and understanding complex topics. While some students may opt to create their own notes, many others rely on the convenience and efficiency of purchasing or accessing digital versions of these materials. This can include lecture notes shared by classmates, online tutorials, or even study guides. The availability of such resources can vary, and students might need to invest time in searching for and organizing these materials to ensure they have a comprehensive study toolkit.

The financial impact of these books and materials is significant. Textbooks, in particular, are often priced at a premium, with new editions carrying a high price tag. Students might find themselves spending hundreds of dollars on a single textbook, especially for specialized or advanced courses. Moreover, the cost of multiple textbooks for different subjects can quickly add up, making it a substantial expense for the entire academic year. This financial burden can be alleviated to some extent by purchasing used textbooks or renting them, but the quality and availability of such resources may vary.

To manage these costs, students can explore various strategies. One approach is to buy used textbooks, which are often significantly cheaper than their new counterparts. Many students also opt to rent textbooks, especially for courses that are only taken once or for those who want to save money for future semesters. Another strategy is to look for digital versions of textbooks, which can be more affordable and environmentally friendly. Students can also consider creating their own study guides or flashcards, utilizing online resources, and participating in study groups to share notes and materials.

In conclusion, books and learning materials are essential components of a university student's life, but they can also be a significant financial burden. From textbooks to notes and other resources, students must navigate the costs associated with these academic tools. By exploring cost-effective options, such as used books, rentals, and digital alternatives, students can better manage their expenses and focus on their academic goals. Additionally, institutions and organizations can play a role in supporting students by providing access to affordable learning materials and promoting sustainable practices in education.

UC Students' Fight for Equity: The Spark of Protest

You may want to see also

Transportation: Commuting costs, including public transport or vehicle maintenance

University students often face a variety of expenses, and one of the significant costs they encounter is related to transportation. Commuting to and from campus can be a substantial financial burden, especially for those who rely on public transportation or own a vehicle. Public transport costs can vary depending on the city and the student's location. In metropolitan areas, monthly passes for buses, trains, or subways can range from $70 to $150, and this price often excludes any additional fares for specific routes or services. Students may also need to purchase tickets for different zones or pay for transfers, which can add up quickly. For those living further away from the university, the cost of fuel, parking, or toll roads can be considerable.

For students who own a car, the expenses can be quite different. Vehicle maintenance and insurance are recurring costs that can be substantial. Regular servicing, tire replacements, and repairs are necessary to ensure the car remains reliable and safe. These expenses can vary widely depending on the make and model of the vehicle, but they often add up to a significant amount each month. Additionally, car insurance premiums can be expensive, especially for young drivers, and may include coverage for liability, comprehensive, and collision.

Another aspect of transportation costs is the potential need for a reliable and efficient mode of travel. Students might require a vehicle that can accommodate their books, sports equipment, or other personal belongings. This could mean investing in a larger car or an SUV, which would increase both the purchase price and the ongoing maintenance costs. Alternatively, some students may opt for carpooling or ride-sharing services, which can help reduce individual expenses but may still require some form of payment for the shared journey.

In some cases, universities offer solutions to mitigate these transportation costs. Many institutions provide discounted or free public transport passes to students, making it more affordable to commute. Some schools also have agreements with local transport authorities to offer special rates or dedicated student travel options. Additionally, carpooling programs or bike-sharing initiatives can be promoted to encourage more sustainable and cost-effective travel choices.

Managing transportation costs is an essential part of a student's financial planning. It is advisable to research and compare different options, consider the availability of student discounts, and explore alternative transportation methods to keep expenses under control. By understanding the various transportation costs associated with university life, students can make informed decisions to ensure they stay within their budget while also enjoying the benefits of a well-connected campus.

Unveiling the Transfer Student's Guide: Which Universities Welcome You?

You may want to see also

Social Activities: Student club fees, events, and extracurricular participation costs

University life offers a plethora of social opportunities, and student clubs and societies play a significant role in shaping the social fabric of campus life. These clubs provide a platform for students to connect, share interests, and engage in various activities. However, participating in these social activities often comes with associated costs that students need to consider.

One of the primary expenses related to social activities is student club fees. Many universities offer a wide range of clubs, from sports teams and cultural societies to academic clubs and hobby groups. Each club typically charges an annual or semester fee to cover the costs of running the organization. These fees contribute to various aspects, such as equipment, travel, and event expenses. For instance, a sports club might use the fees to rent facilities, purchase sports gear, and organize tournaments, while a cultural society could use the funds to host performances, exhibitions, or workshops. It is essential for students to research and understand the fee structures of different clubs to make informed decisions about their social engagements.

In addition to club fees, students often incur costs related to attending events and participating in extracurricular activities. Many clubs organize social events, competitions, and outings throughout the academic year. These events may require tickets or registration fees, which can vary depending on the club and the nature of the event. For example, a music club might charge a small fee for a concert, while a debate society could have a registration process for inter-university competitions. Students should be aware of these costs and plan their budgets accordingly to ensure they can actively participate in the social events they are interested in.

Furthermore, extracurricular participation can also involve additional expenses. Some clubs may require members to purchase specific gear or uniforms, such as sports teams needing equipment or drama societies requiring costumes. These costs can vary widely depending on the club's nature and the level of equipment or resources required. Students should consider these expenses when joining clubs to avoid financial surprises.

Managing these social activity costs is an essential aspect of university budgeting. Students should create a comprehensive budget that accounts for club fees, event tickets, and any necessary equipment purchases. Financial planning can help ensure that students can actively engage in the social life of their university without incurring unnecessary debt. It is also beneficial to explore scholarship opportunities or financial aid provided by the university or external organizations to support students' participation in extracurricular activities.

In summary, university students have various social activities and clubs to choose from, but these options often come with associated costs. Understanding and budgeting for student club fees, event expenses, and extracurricular participation costs are crucial for a well-rounded university experience. By being aware of these financial considerations, students can make informed decisions and actively participate in the social life of their campus.

Transfer Students: UK University Acceptance and Requirements

You may want to see also

Frequently asked questions

University students often incur various expenses, including tuition fees, which vary depending on the institution and program. Additionally, students may need to budget for accommodation, whether it's on-campus housing or renting off-campus. Textbooks, course materials, and online resources are also significant costs. Other expenses include transportation, meals, social activities, and personal items. It's essential to create a comprehensive budget to manage these financial commitments effectively.

Yes, there can be several hidden costs. These may include mandatory club or society fees, study abroad programs, field trips, and special course materials. Some universities also charge additional fees for student services, sports facilities, or alumni benefits. It's advisable to review the university's fee structure and financial policies to anticipate and plan for these potential expenses.

Effective financial management is crucial for students. Firstly, creating a budget and sticking to it can help students track their expenses. Prioritizing spending and seeking cost-saving opportunities, such as buying used textbooks or utilizing student discounts, can also be beneficial. Many universities offer financial aid, scholarships, and work-study programs to support students. Additionally, maintaining open communication with financial aid officers and exploring all available resources can help students navigate their financial responsibilities during their university journey.