Tufts University offers comprehensive insurance coverage for its students, ensuring they are protected during their academic journey. The university's insurance program provides a range of benefits, including health, disability, and liability coverage, tailored to meet the unique needs of the student population. This coverage is designed to support students' well-being, provide financial protection, and offer peace of mind while they pursue their education. Understanding the details of this insurance coverage is essential for students to navigate their academic and personal responsibilities effectively.

What You'll Learn

- Tuition and Fee Coverage: Protects against financial loss due to tuition and fee increases

- Medical Expenses: Covers medical costs, including hospitalization and doctor visits

- Disability Insurance: Provides income replacement for students unable to attend due to illness or injury

- Property Damage: Insures personal belongings and university-owned property against damage or theft

- Liability Protection: Shields students and the university from legal claims arising from accidents or injuries

Tuition and Fee Coverage: Protects against financial loss due to tuition and fee increases

Tuition and Fee Coverage is a vital aspect of insurance for students at Tufts University, providing a safety net against the ever-increasing costs of education. This type of coverage ensures that students and their families are protected from financial strain and loss due to sudden tuition and fee hikes. It is a comprehensive solution designed to safeguard the educational journey of students, allowing them to focus on their studies without the added stress of financial uncertainty.

The primary purpose of Tuition and Fee Coverage is to provide financial security and peace of mind. It is especially relevant for students who rely on loans, grants, or family support to fund their education. With this insurance, students can be assured that any unexpected increases in tuition and fees will be covered, preventing them from incurring substantial debt or being forced to make difficult choices regarding their education. This coverage is particularly beneficial for students who have already invested significant resources in their education and want to avoid the burden of additional financial commitments.

When purchasing this insurance, students typically pay a premium, which is a fixed amount determined by various factors, including the student's age, the cost of tuition, and the level of coverage desired. The premium ensures that the insurance provider can offer financial protection in the event of tuition and fee increases. In the event of a covered increase, the insurance company will compensate the student or their family, typically up to a specified limit, ensuring that the financial impact is minimized.

It is essential to understand the terms and conditions of Tuition and Fee Coverage, as policies may vary. Some insurance providers may offer different coverage levels, with higher limits providing more comprehensive protection. Students should also be aware of any exclusions, such as increases due to changes in course offerings or non-tuition fees. By carefully reviewing the policy, students can ensure they are adequately protected and make informed decisions about their insurance coverage.

In summary, Tuition and Fee Coverage is a critical component of insurance for Tufts University students, offering financial protection against the unpredictable nature of tuition and fee increases. It empowers students to pursue their education with confidence, knowing that their financial well-being is safeguarded. This coverage is a valuable investment, ensuring that students can make the most of their time at Tufts without the added worry of financial strain.

Unveiling the Secrets: What Universities Seek in Psychology Applicants

You may want to see also

Medical Expenses: Covers medical costs, including hospitalization and doctor visits

Tufts University offers comprehensive insurance coverage for its students, ensuring they have access to quality healthcare services. One of the key aspects of this coverage is the provision of medical expenses, which is designed to provide financial protection and peace of mind to students. This insurance policy covers a wide range of medical costs, ensuring that students can access necessary healthcare without incurring substantial financial burdens.

Under this coverage, medical expenses encompass various healthcare services and treatments. It includes hospitalization fees, which can be significant, especially for extended stays or specialized care. Whether it's an emergency room visit, a routine check-up, or a complex surgical procedure, the insurance policy aims to cover the associated costs. For instance, if a student requires hospitalization due to an accident or an unexpected illness, the insurance will cover the expenses, ensuring they receive the necessary treatment without worrying about financial constraints.

Additionally, the coverage extends to doctor visits, which are essential for regular health check-ups, consultations, and treatments. Students can visit various medical professionals, including primary care physicians, specialists, and dentists, without incurring high out-of-pocket expenses. This aspect of the insurance is particularly beneficial as it encourages students to take a proactive approach to their health and seek timely medical attention.

The medical expenses coverage also includes other related costs, such as diagnostic tests, medications, and medical procedures. These expenses can often be substantial, and having insurance coverage ensures that students can access these essential services without financial barriers. It provides a safety net, allowing students to focus on their well-being and academic pursuits without the added stress of financial worries.

Furthermore, the insurance policy may also offer benefits like telemedicine services, which can be invaluable for students who prefer remote consultations or those with limited access to on-campus healthcare facilities. This flexibility ensures that students can receive medical advice and treatment conveniently and efficiently. Overall, the medical expenses coverage provided by Tufts University's insurance plan is a vital component, offering comprehensive support to students' healthcare needs.

Unlocking University Dreams: When to Apply for Student Loans

You may want to see also

Disability Insurance: Provides income replacement for students unable to attend due to illness or injury

Disability insurance is a crucial component of the comprehensive insurance coverage available to students at Tufts University. This type of insurance is designed to provide financial support to students who are unable to attend classes or participate in their regular activities due to illness, injury, or other medical conditions. It offers a safety net that ensures students can maintain their financial stability and focus on their recovery during challenging times.

When a student experiences a disability, the last thing they want to worry about is the financial burden that may arise from missing classes, exams, or even the entire semester. Disability insurance steps in to bridge this gap by replacing a portion of the student's income, allowing them to cover essential expenses such as tuition, housing, and living costs. This coverage is particularly vital for students who rely on their education as a means of financial support, as it prevents them from falling into debt or facing financial hardship.

The insurance policy typically covers a percentage of the student's expected income, which is determined based on their enrollment status and the duration of the disability. For instance, a full-time student might receive a higher income replacement rate compared to a part-time student. The coverage period can vary, but it often includes a waiting period before benefits are paid, ensuring that students only receive support when they genuinely need it. During this waiting period, students are encouraged to utilize their sick days or other available resources.

Tufts University understands the importance of providing comprehensive insurance options to its students, and disability insurance is a significant part of this commitment. By offering this coverage, the university aims to create a supportive environment where students can focus on their well-being and academic pursuits without the added stress of financial uncertainty. It is a valuable resource that empowers students to take care of their health and manage their studies effectively.

In summary, disability insurance is an essential aspect of the insurance coverage provided to Tufts University students. It ensures that students facing medical challenges can continue their education without financial strain, allowing them to recover and re-engage with their studies. This type of insurance is a testament to the university's dedication to student welfare and financial security.

Gary Peterson's Minnesota University Mystery: Unveiling the Truth

You may want to see also

Property Damage: Insures personal belongings and university-owned property against damage or theft

Tufts University offers comprehensive insurance coverage for its students, ensuring that their personal belongings and the university's property are protected. This insurance is designed to provide financial assistance and peace of mind to students, covering various potential risks and losses. Here's a detailed breakdown of the property damage coverage:

Personal Belongings: Students' personal items are a significant investment, and insurance ensures that their possessions are safeguarded. The policy covers a wide range of personal belongings, including clothing, electronics, books, furniture, and other valuables. In the event of damage, theft, or loss, the insurance will provide financial compensation to help students replace or repair their items. This coverage is particularly beneficial for students living in university-owned housing, as it covers any personal belongings kept in their rooms or shared spaces.

University-Owned Property: The insurance policy also extends to protect the university's property, ensuring that the campus remains a safe and secure environment. This coverage includes buildings, facilities, and common areas. In the event of damage caused by natural disasters, accidents, or vandalism, the insurance will assist in the restoration and repair processes. For instance, if a storm damages a university building, the insurance will help cover the costs of repairs, ensuring that the university can quickly resume its operations and maintain a safe learning environment for students.

When it comes to property damage, the insurance coverage at Tufts University is designed to be comprehensive and tailored to the needs of students. It provides a safety net, allowing students to focus on their academic pursuits without constantly worrying about potential losses. The policy is typically included as part of the student's tuition and fees, making it easily accessible and ensuring that all enrolled students benefit from this essential coverage.

It is important for students to understand the specific terms and conditions of the insurance policy, including any exclusions or limitations. By doing so, they can ensure that they are adequately protected and know what to expect in various situations. The university's financial aid office or student services can provide further guidance and information regarding the insurance coverage and any additional resources available to students.

Exploring Fun: MSU Students' Favorite Pastimes

You may want to see also

Liability Protection: Shields students and the university from legal claims arising from accidents or injuries

Tufts University, like many educational institutions, offers liability protection as part of its student insurance coverage, which is a crucial aspect of ensuring a safe and secure environment for its students. This coverage is designed to shield both the students and the university from potential legal claims that may arise from various accidents, injuries, or incidents. Here's a detailed breakdown of this essential component:

Liability protection acts as a legal safeguard, providing financial and legal support in the event of lawsuits or claims. It covers a wide range of scenarios, including accidents occurring on campus, during university-organized events, or even while students are traveling as part of educational activities. For instance, if a student trips and falls in a university library, or if a sports-related injury occurs during a university-sponsored activity, the liability coverage comes into play. The university's insurance policy would then step in to handle the legal aspects and potential financial settlements, protecting the students and the institution from costly lawsuits.

This type of insurance is particularly important for students, as it offers a safety net in case of unforeseen incidents. It ensures that students can focus on their academic pursuits without constantly worrying about the legal and financial consequences of accidents. For the university, it provides a layer of protection against potential liabilities that could arise from various student-related activities. The coverage typically includes defense costs, settlements, and judgments, ensuring that the university can manage legal matters efficiently.

In the context of student insurance, liability protection is often an integral part of the overall coverage package. It complements other forms of insurance, such as medical coverage, which focuses on individual health and wellness. By offering liability protection, Tufts University demonstrates its commitment to the well-being of its students and the institution's ability to manage potential risks. This comprehensive approach to student insurance ensures that students can fully engage in their university experience without unnecessary legal concerns.

Understanding the specifics of liability coverage is essential for students and their families. It empowers individuals to make informed decisions and appreciate the comprehensive nature of the university's insurance offerings. With this protection in place, students can pursue their education with the knowledge that they and their institution are safeguarded against potential legal claims, fostering a more secure and conducive learning environment.

Exploring Enrollment at Colorado State University Fort Collins

You may want to see also

Frequently asked questions

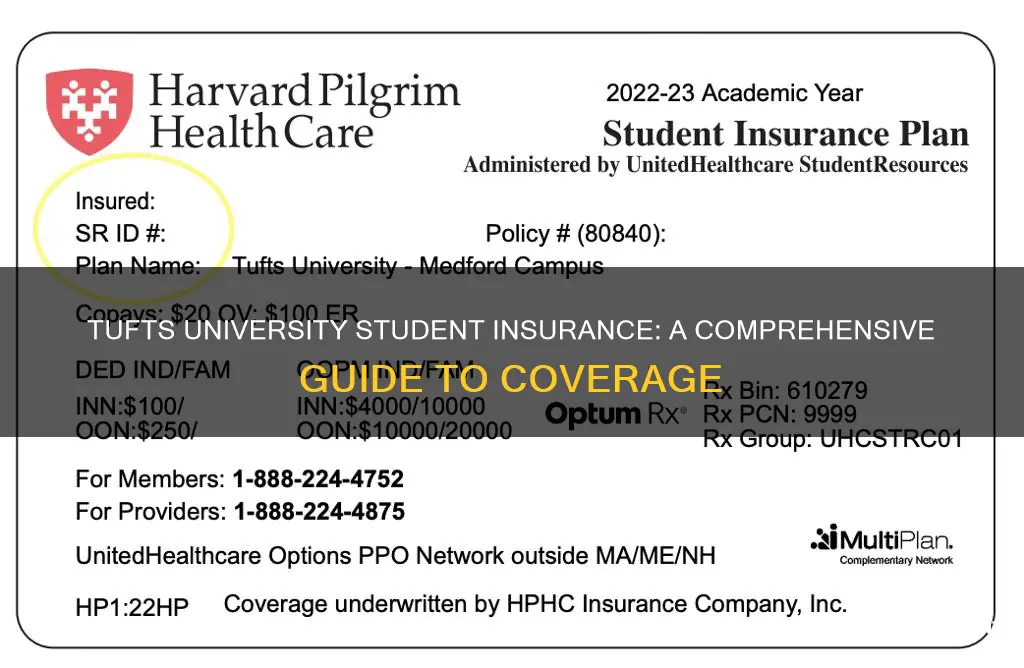

Tufts University offers a comprehensive insurance plan designed specifically for students. This plan typically includes medical, dental, vision, and prescription drug coverage. It may also provide additional benefits such as accident insurance, critical illness coverage, and mental health services.

Enrolling in the student insurance plan is usually automatic for all enrolled students. You can review the details of your coverage in the student portal or by contacting the university's student health insurance office. They will provide you with the necessary information and any available options for customization.

Yes, Tufts University often provides options to tailor the insurance plan to individual needs. This may include choosing different levels of coverage, adding or removing specific benefits, or selecting optional riders for enhanced protection. Students can work with the insurance office to create a plan that suits their personal preferences and financial situation.

The student insurance plan at Tufts University is designed to accommodate students with pre-existing conditions. It ensures that essential health services and treatments are covered, regardless of the student's medical history. Students with special health needs can discuss their requirements with the university's health services and insurance providers to ensure adequate coverage.

Tufts University often has partnerships with international student insurance providers to offer coverage while studying abroad. Students can inquire about these options and ensure their insurance follows them during their international exchange. Proper planning and communication with the university's international office can help students maintain their insurance coverage during their study abroad experience.