A university student loan is a financial aid option designed to help students cover the costs of higher education, including tuition fees, living expenses, and other educational-related expenses. These loans are typically offered by governments, financial institutions, or educational organizations to provide financial support to students who may not have the means to fund their education through other means. They are often interest-free or have low-interest rates, and repayment terms can be flexible, allowing students to start repaying the loan after graduation or when they begin earning an income. Student loans can be a crucial resource for those pursuing higher education, enabling them to focus on their studies and achieve their academic goals without the immediate burden of financial strain.

What You'll Learn

Loan Types: Federal vs. Private Loans

When it comes to financing your education, understanding the different types of student loans available is crucial. Student loans can be broadly categorized into two main types: federal loans and private loans. Each type has its own set of advantages and considerations, and choosing the right one can significantly impact your financial journey during and after your university years.

Federal Loans:

Federal student loans are funded by the government and are an excellent option for many students. One of the key advantages is that they typically offer lower interest rates compared to private loans. The interest on federal loans starts accruing only after you graduate, leave school, or drop below half-time enrollment. During this grace period, you are not required to make any payments. Additionally, federal loans often provide more flexible repayment options, including income-driven repayment plans, which can be tailored to your financial situation after graduation. These plans may offer lower monthly payments and even potential loan forgiveness under certain conditions. Another benefit is that federal loans generally do not require a co-signer, making them accessible to students with limited credit history.

Private Loans:

Private student loans, on the other hand, are offered by banks, credit unions, or other financial institutions. These loans often have higher interest rates than federal loans and may require a co-signer, especially for students with limited credit. Private loans usually have less flexible repayment terms, and the interest may start accruing during the loan period, which can increase the overall cost. However, private loans can be advantageous in certain situations. For instance, if you've exhausted your federal loan options, private loans can provide additional funding to cover educational expenses. Some private lenders also offer unique benefits like interest-only payments during school or extended repayment terms.

Key Differences:

The primary distinction between federal and private loans lies in the interest rates and repayment terms. Federal loans generally provide more favorable conditions, including lower interest rates and flexible repayment options. Private loans, while potentially offering more competitive interest rates, may require a co-signer and have stricter repayment terms. It's essential to consider your financial situation, credit history, and long-term goals when deciding between the two.

In summary, federal loans are often the preferred choice due to their lower interest rates and flexible repayment plans. Private loans can be a valuable supplement, especially when federal options are exhausted, but they should be approached with caution due to their higher interest rates and potential requirements for a co-signer. Understanding these differences will enable you to make informed decisions regarding your student loan choices.

University of Albany Student Population: A Comprehensive Overview

You may want to see also

Interest Rates: Fixed or Variable

When it comes to student loans, understanding the interest rates is crucial as they can significantly impact the total cost of your education. The choice between fixed and variable interest rates is an important decision that borrowers should carefully consider.

Fixed interest rates remain constant throughout the loan term, providing borrowers with predictable monthly payments. This predictability is advantageous as it allows students and parents to plan their budgets effectively. With a fixed rate, you know exactly how much you'll owe each month, ensuring financial stability. For instance, if you borrow $10,000 at a 5% fixed interest rate, your monthly payment will be a fixed amount until the loan is repaid, making it easier to manage your finances. This stability is particularly beneficial for long-term financial planning, as it provides a clear roadmap for repayment.

On the other hand, variable interest rates fluctuate based on market conditions, typically tied to a specific index like the London Interbank Offered Rate (LIBOR) or the Prime Rate. This means your monthly payments can change over time, potentially increasing or decreasing. Variable rates often start lower than fixed rates, which might be appealing to borrowers seeking lower initial monthly payments. However, this comes with the risk of higher interest costs in the future if market rates rise. For instance, if the variable rate increases to 7%, your monthly payment would also increase, potentially making repayment more challenging.

The decision between fixed and variable rates depends on individual circumstances and risk tolerance. Fixed rates offer certainty and control, ensuring that your budget remains unaffected by market changes. In contrast, variable rates can provide initial savings but carry the risk of higher costs. It's essential to consider your financial situation, the length of your education, and your ability to manage potential rate increases when making this choice.

In summary, when considering a university student loan, the interest rate is a critical factor. Fixed rates offer stability and predictability, while variable rates provide flexibility but with the risk of higher future costs. Borrowers should carefully evaluate their financial goals and risk tolerance to determine the most suitable interest rate option for their needs.

George Mason University Students: Inside Jokes and Campus Culture

You may want to see also

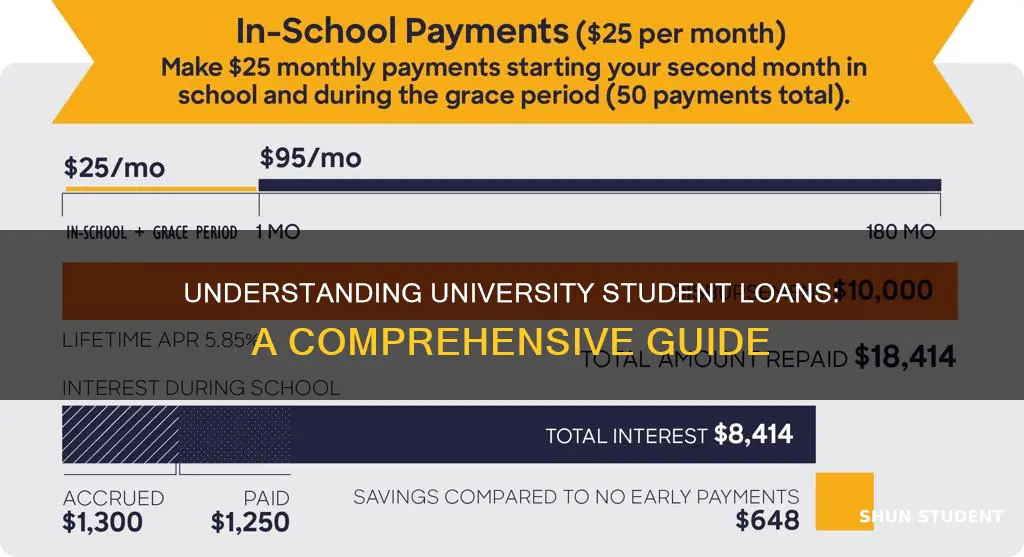

Repayment Terms: Grace Periods and Schedules

When you take out a university student loan, it's important to understand the repayment terms, especially the grace periods and schedules, as these can significantly impact your financial journey post-graduation. A grace period is a temporary reprieve from repayment, typically offered by the lender, which allows borrowers to focus on their education and career pursuits without immediate financial burden. This period can vary in length, often ranging from six months to a year, depending on the loan type and lender policies. During this time, you are not required to make any payments, providing a financial cushion to help you get established in your career or complete your studies.

After the grace period, borrowers are required to start repaying the loan according to a repayment schedule. This schedule outlines the amount and frequency of payments, which can be monthly, bi-weekly, or even less frequent, depending on the loan agreement. The repayment term, or the period over which you repay the loan, can also vary. Some loans have a fixed term, typically lasting 10 to 20 years, while others may offer variable terms based on your income or employment status. It's crucial to review these terms carefully to ensure you understand the commitment and financial planning required.

The repayment schedule often includes a combination of principal and interest payments. Initially, a significant portion of your payment may go towards interest, with a smaller amount reducing the principal balance. As you continue to make payments, the proportion that goes towards the principal increases, gradually reducing the loan balance. This process can be adjusted based on your financial situation and preferences, with options to make additional principal payments to shorten the loan term and save on interest.

Understanding the grace period and repayment schedule is essential for managing your student loan effectively. It allows you to plan your finances, explore income-driven repayment plans if needed, and make informed decisions about loan consolidation or refinancing. By being proactive and well-informed, you can ensure that your student loan repayment journey is as smooth and manageable as possible, setting the stage for a secure financial future.

Scranton University's Nursing Program: Student Population Insights

You may want to see also

Eligibility Criteria: Income and Credit Checks

When considering a university student loan, understanding the eligibility criteria is crucial, especially when it comes to income and credit checks. These factors play a significant role in determining your ability to repay the loan and your overall financial health.

Income Checks: Lenders typically assess your income to gauge your capacity to manage loan repayments. This evaluation is particularly important for student loans, as it helps lenders understand your financial situation during and after your studies. Income checks can vary depending on the lender and the type of loan. Some lenders may require proof of income through pay stubs, tax returns, or employment letters. Others might consider your future earning potential, especially for graduate or professional programs. It's essential to provide accurate and up-to-date income information to ensure a fair assessment.

Credit Checks: Credit history is another critical aspect of eligibility. Lenders often perform credit checks to evaluate your creditworthiness and financial responsibility. This process involves reviewing your credit report, which includes information about your past borrowing, repayment history, and any outstanding debts. A good credit score can increase your chances of securing a student loan with favorable terms. Lenders may also consider your credit history to assess the risk associated with lending to you. If you have a limited credit history or a low credit score, you might need to provide additional documentation or explore alternative financing options.

The income and credit checks are designed to ensure that borrowers can afford the loan and have a reliable means of repayment. Lenders use these assessments to minimize the risk of default and to provide loans that are manageable for the borrower's financial situation. It's important to be transparent and accurate during this process to avoid any complications or rejections.

In summary, income and credit checks are essential steps in the loan application process for university students. They provide lenders with a comprehensive understanding of your financial capabilities and help determine the terms and conditions of the loan. By meeting these eligibility criteria, students can increase their chances of accessing the financial support they need for their education.

Ohio's Heidelberg University: Student Population and Campus Life

You may want to see also

Loan Limits: Maximum Borrowing Capacity

Understanding loan limits is crucial when considering a university student loan, as it directly impacts the amount of financial support you can access for your education. These limits are set by the lending institution and can vary significantly depending on the country, the type of loan, and the student's financial situation. When applying for a student loan, it's essential to be aware of the maximum borrowing capacity to ensure you receive the necessary funds without incurring excessive debt.

Loan limits are typically determined by a combination of factors. Firstly, the lending institution's policies play a significant role. Some lenders may have strict guidelines, offering lower loan amounts to students, while others might provide more generous limits, especially for those with exceptional academic credentials or a strong financial background. Additionally, the cost of attendance at the chosen university is a critical factor. Higher education institutions with more expensive tuition fees often result in higher loan limits to cover the increased expenses.

The maximum borrowing capacity can also be influenced by the student's financial status. Lenders often consider the borrower's income, credit history, and existing debts. Students with a stable income source or a co-signer with a good credit history may be eligible for higher loan limits. Conversely, those with limited financial resources or a poor credit score might face lower loan limits to mitigate potential risks. It is essential to assess your financial situation realistically and understand how it may impact your borrowing capacity.

Furthermore, different types of student loans may have distinct loan limits. For instance, federal student loans often have standardized loan limits, ensuring that students receive a fair amount of financial aid. These limits are regularly reviewed and adjusted to keep up with the rising costs of education. On the other hand, private student loans, offered by banks and financial institutions, may have more flexible loan limits, but they can also be more expensive and may require a stronger credit profile.

When applying for a university student loan, it is advisable to research and compare loan limits from various lenders. Understanding these limits will enable you to make informed decisions about your education funding. It is also beneficial to explore options for loan consolidation or refinancing, which can help manage and potentially lower the overall loan amount, especially if you have multiple loans with varying limits. Being aware of loan limits is a vital step in managing your student debt effectively and ensuring a sustainable financial future.

Pittsburgh Scholarships: International Students' Opportunities Explored

You may want to see also

Frequently asked questions

A university student loan is a financial aid option designed to help students cover the costs associated with pursuing higher education. These loans are typically offered by educational institutions, governments, or private financial institutions to assist students in funding their tuition fees, living expenses, and other educational-related costs. The primary purpose is to provide financial support to students who may not have the immediate funds to pay for their education.

Student loans work by providing a specified amount of money to the borrower, which they can use to cover their educational expenses. The borrower then repays the loan, usually with interest, over a predetermined period after completing their studies. There are different types of student loans, including federal loans, which are government-backed, and private loans, which are offered by financial institutions. Federal student loans often have more flexible repayment options and lower interest rates compared to private loans.

Taking out a student loan can offer several advantages. Firstly, it enables students to access higher education without the immediate burden of paying for it upfront, allowing them to focus on their studies. Student loans provide financial flexibility, ensuring that students can cover essential expenses like tuition, books, and accommodation. Additionally, many student loans offer grace periods after graduation, during which borrowers are not required to make payments, providing a financial cushion. This financial support can significantly contribute to a student's ability to achieve their educational goals and future career prospects.